SI Research: Q&M Dental Group – When A Growth Stock Fails To Grow

The market tends to accord a high price-to-earnings (P/E) valuation for companies that exhibit greater potential for growth. However, when the performances of such companies fail to meet expectations, the drop in earnings per share resulting in a higher P/E valuation would act as a double-blow to the share price, often leading to a subsequent plunge that could sometimes be jaw-dropping.

At one time the historical P/E ratio of Q&M Dental Group (Singapore) (Q&M Dental) went as high as 67 times when its shares were trading at $0.98 back in May 2015. Nonetheless, the ensuing correction since then brought the share price back down to $0.505 as at 9 July 2018, which translated to a more reasonable P/E ratio at 16.9 times. Once a bright star of yesterday, we take a look at this leading private dental healthcare group that has fallen from grace.

Strong Momentum Of Growth

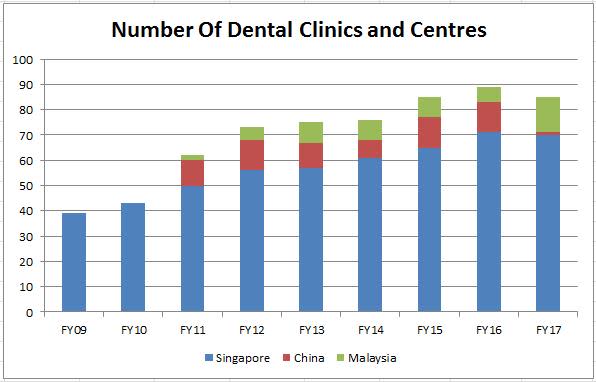

Q&M Dental’s pace of growth has been rather impressive. At time of listing in November 2009, the group only had 37 dental clinics and one dental centre located in Singapore. However within a short time span of eight years, Q&M Dental has almost doubled its network to over 70 dental outlets as at FY17. In addition, the group is also developing its presence geographically with one dental outlet in China as well as 14 clinics in Malaysia.

Source: Company’s Annual Reports

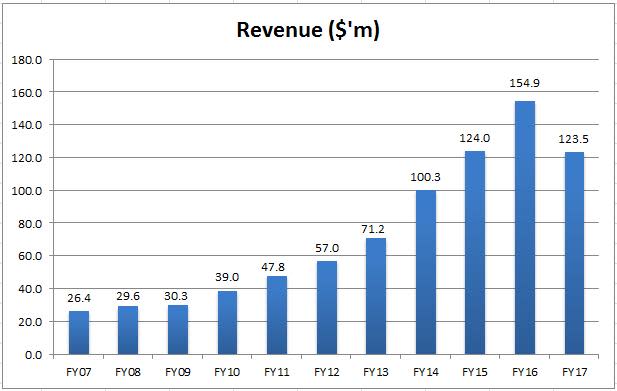

With contributions from an increasing number of outlets, the exponential growth seen in Q&M Dental’s revenue and net profits are equally spectacular over the last 10 years. Between FY07 to FY17, the group’s top-line has multiplied at a compounded annual growth rate (CAGR) of 16.7 percent from $26.4 million to $123.5 million. Correspondingly, net profit also magnified at a CAGR of 19.1 percent to $23.7 million over the same period.

Source: Company’s Annual Report

Stripped Of Growth Following Aoxin Spin-Off

Unfortunately, Q&M Dental failed to sustain its growth momentum following the spin-off of its China subsidiary, Aoxin Q&M Dental Group (Aoxin), through a listing on the Catalist Board of the SGX in April 2017 at a price of $0.20 per placement share. While Q&M Dental recognized a one-time gain of $17.1 million from the spin-off, its effective stake in Aoxin was reduced to around 45.9 percent.

The China market has always been a region of great opportunities and one of Q&M Dental’s main drivers for growth. In the absence of its businesses in China, the group’s speed of expansion has slowed tremendously. In fact, revenue and net profit in FY17 has declined by 20.3 percent and 29 percent respectively after the deconsolidation of Aoxin’s results from the group’s account. Hence, the high premium which investors used to factor into Q&M Dental’s share prices no longer seems justifiable now.

Strong Cash Flows To Support Expansion

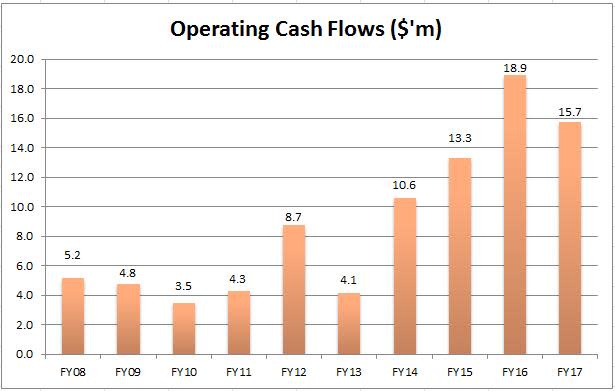

Underpinned by an expanding business and stable profit, Q&M Dental was able to derive consistent cash flows from its operating activities over the last few years. Cash flows from operations escalated at a CAGR of 13.2 percent from $5.2 million in FY08 to $15.7 million in FY17. On average, incoming cash flows generated from operations stood at around $8.9 million every year.

Source: Company’s Annual Reports

Q&M Dental’s cash flows allow the group to continue funding its plans of expansion through both organic growth and suitable acquisitions, without putting much strain on its balance sheet. According to the business plans revealed in its 1Q18 report, the group intends to add an additional 10 dental clinics in both Singapore and Malaysia each during 2018 subjected to market conditions and availability of opportunities.

Value Surfaced Amidst Pull-Back

No doubt Q&M Dental’s explosive momentum of growth has indeed halted momentarily with its growth pillar in China taken out of the picture, but business developments in Singapore and Malaysia are still very much in progress. Fundamentally, Q&M Dental’s cash generative operations will continue to lend support to the group’s aggressive expansionary strategy in the region.

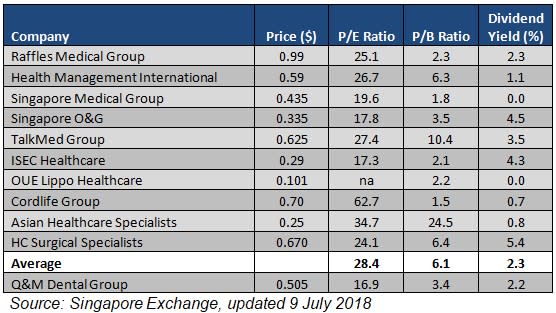

Furthermore, given Q&M Dental’s extensive network of outlets located at various easily accessible locations as well as the distinct brand and reputation which the group has built up over the years, we opine that it is a reasonable investment should one wish to gain an exposure to the defensive healthcare sector. In comparison to the average P/E ratios of other healthcare providers at 28.4 times, the current valuation of Q&M Dental following the recent correction does not seem very demanding.