SI Research: Singapore ANG BAO Series – 3 Income Stocks For Your Retirement

Happy Lunar New Year folks! Wish you “huat” in this New Year! Did you retired uncles and aunties receive many ang bao from your children and grandchildren? But don’t lose control and use all their monies on “ban-luck” ok?

A productive (less risky too) way to use the ang bao monies you received is to INVEST them. In this third and final installation of the Singapore ANG BAO series, Shares Investment will highlight 3 stocks that we think retirees can put their money to work and generate more income for them in their retirement.

In fact, the market correction that preceded the Chinese New Year holidays gives a golden opportunity for investors to accumulate on the cheap. So, again, HUAT ar!

First REIT

First REIT is always my go-to-REIT whenever my own uncles and aunties ask me for “tips”. After all, the healthcare REIT is a solid income-generating counter and the REIT‘s managers have done little to no wrong. I dare say, First REIT is one of the darlings amongst all S-REITs.

A look at the financials and investors know why: Gross revenue rose at a compound annual growth rate (CAGR) of 14.7 percent over the decade, from $28.1 million in FY07 to $111 million in FY2017. Net property income grew at the same CAGR from $27.8 million to $109.5 million in the same period. Correspondingly, distributable income rose at CAGR 13.2 percent to $66.7 million in FY17. The improvements in financial performance were consistently positive over the years.

Of course, all this was only possible because First REIT has a strong sponsor – PT Lippo Karawaci Tbk. The sponsor is the largest listed property developer in Indonesia under the behemoth conglomerate, Lippo Group. The REIT’s Indonesian properties operate under the brand of Siloam Hospitals Group. The sponsor has been injecting a pipeline of yield-accretive properties into First REIT which drove asset-under-management to grow at CAGR of 15.3 percent from $325.6 million in FY07 to $1.3 billion in FY17.

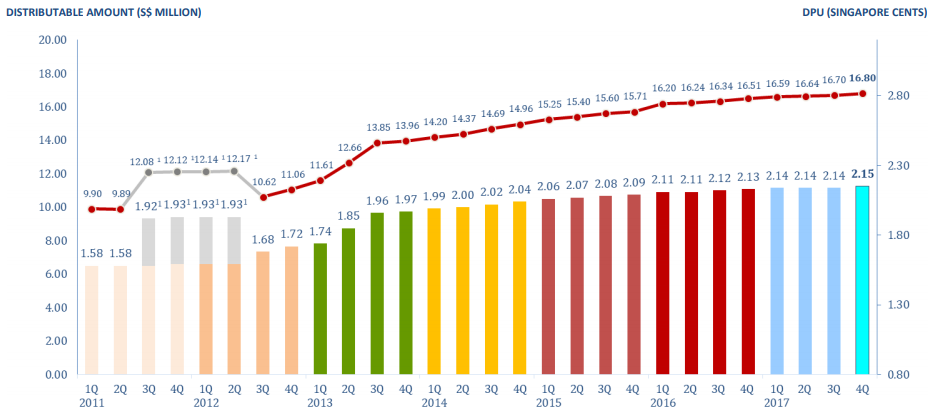

While FY17 distribution per unit (DPU) of 8.57 Singapore cents implies a yield of 6.3 percent is lower than the 8.8 percent yield from highest-yielding Lippo Malls trust, First REIT’s consistency in raising DPU is the hallmark of its quality.

Source: First REIT 4Q17 investors’ presentation

Singapore Telecommunications

The largest constituent of the Straits Times Index, Singapore Telecommunications (Singtel) plunged from $3.60 to $3.33 during the correction. The decline in Singtel’s share price is even more significant when its current share price at $3.38 is compared to $4 a year ago.

Much of the poor performance of its share price stems from Singtel’s poorer-than-expected 3Q17 results, as net profit fell 8.5 percent to $890.2 million due to weaker contributions from its regional mobile phone associate companies. That said, With Bharti Airtel (Indian associate) merging with Tata Teleservices, contributions from Bharti Airtel should improve as price war between the two companies reduces.

Notwithstanding that, Singtel is trading at one of its lowest valuations in years, at about 9.8 times its earnings. In addition, it also has been paying an average of 17 Singapore cents (inclusive of special dividends) as dividends annually since 2007. This implicitly means that investors can expect a yield of at least 5 percent at the current share price. Most brokerage houses have a Buy call on Singtel with TP above $4. As a strategy, investors can consider buying more of Singtel whenever it drops by more than its dividend payout.

Straco Corporation

It is not always about high yield. Studies have shown that dividend growth stocks often outperform high-yield stocks in the long run.

Owner and operator of tourism-related assets Straco Corporation is one such example. The company owns the Singapore Flyer as well as other landmark attractions in China. Owning these attractions is equivalent to owning catchments for the boom in China’s inbound and outbound tourism.

Although a significant portion of its revenue is derived from China, Straco Corporation is incorporated in Singapore (no fear of S-chips). In addition, the financial performance of Straco Corporation has been on the uptrend, along with its dividends. From 2007 to 2017, dividend per share rose from $0.0025 to $0.025, representing an increase of 900 percent. The payout ratio remains low at some 46 percent of FY16 net profit. As of 9M17, Straco Corporation’s cash position stood at a record high of $189.1 million compared to $163.2 million in FY16. Meanwhile, the company has been positive free cash flow since 2003. Straco Corporation remains in net cash of $136.2 million.

Owing to strong cash generating abilities and record cash position, investors can expect continued dividend growth going forward. In the event that the company finds any attractive tourism acquisition targets, inorganic growth could also spur more dividend hikes! Whatever the case, while its current dividend yield of 3 percent based on current share price of $0.83 seems less compelling, investors can expect their yield-to-costs to rise.