SI Research: Spindex Industries – Intrinsic Value Waiting To Be Realised

Spindex Industries (Spindex), one of the small-cap counters with a market capitalisation of only $128.1 million, is thinly traded on the local bourse with an average three-month volume of 100,000 shares changing hands. Nevertheless, its share price has outperformed the general market by delivering an impressive 54.2 percent year-to-date (YTD) return whereas the Straits Times Index (STI) YTD return stood at 11.8 percent. Should we stretch the time frame back over the last five years, Spindex’s last close of $1.11 as at 11 September 2017 has surged more than five times from its low of $0.19 in January 2012. This dwarfed the STI’s 21.4 percent absolute return over the same period which seems rather insignificant in comparison. Does this multi-bagger have what it takes to continue to beat the market?

About The Company

Spindex is a manufacturer of precision machined components and assemblies, with its history dated as far back as its founding in 1981. The group has manufacturing facilities in Singapore, Malaysia, China and Vietnam, serving a customer base consisting of MNCs worldwide. Spindex’s products and machined parts are predominantly needed in the imaging and printing industry, automotive and machinery industry as well as the consumer and lifestyle sector in everyday products ranging from bicycles, fishing rods to washers and irons.

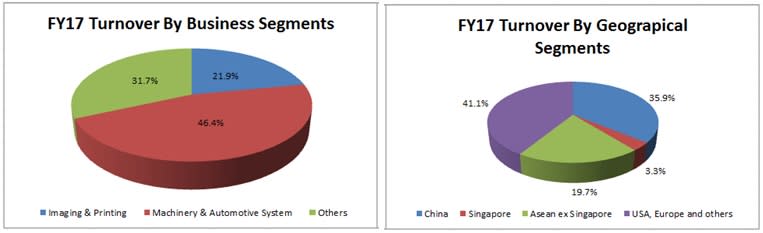

As at 30 June 2017, income from the machinery and automotive segment made up 46.4 percent of the group’s FY17 revenue, imaging and printing segment constitute 21.9 percent while the others category (comprising domestic appliances, consumer electronics, data storage and telecommunication instruments) accounted for the remaining 31.7 percent. Geographically, FY17 revenue that were derived from USA and Europe, China, Asean region excluding Singapore and Singapore came in at 41.1 percent, 35.9 percent, 19.7 percent and 3.3 percent respectively.

Source: Company Annual Reports

Growing From Strength To Strength

The fundamentals of Spindex’s business have been improving with increasing success. Over the last five years, we saw the group’s revenue growing at a compounded annual growth rate (CAGR) of 11.2 percent to reach $141.8 million in FY17. Likewise, net profit almost doubled from $7 million to $14 million rising at a CAGR of 18.9 percent.

Underpinned by the strong performances of its top and bottom lines, Spindex consistently generate positive and increasing cash flows from its operations year after year. Without the need for high capital expenditure, the stable streams of free cash flow play a critical role in helping the group to amass a sizeable cash hoard in its balance sheet.

As at 30 June 2017, Spindex’s fixed deposits and cash equivalents stood at $39.8 million, which was accumulated at a CAGR of 11.9 percent from $25.4 million five years ago. With bank loans of merely $3.2 million, the group was in a net cash position of $36.6 million.

Spindex’s net cash alone made up more than one-third of its net assets of $97.5 million at 37.5 percent, and around 28.3 percent of its total market capitalisation. In view of its strong financial muscles, not only is Spindex being put in a favourable position to capitalise on potential business opportunities, but the group is also more than capable to reward its shareholders by maintaining healthy dividend payouts.

Source: Company Annual Reports

Heated Offers Bid Up Share Price

On 9 February this year, Spindex received a cash offer from Hong Wei Holdings, a private vehicle owned by Spindex chairman Tan Choo Pie, to acquire all the shares of the group at $0.85 a share under a scheme of arrangement. The offer price represents a 21.4 percent premium from the last transacted price of $0.70. Within three weeks, the arrangement was quickly escalated into a mandatory unconditional offer after the Tan family has secured a majority stake in the firm.

Excitement was stirred and things started to heat up when Star Engineering, a subsidiary of investment fund Northstar Equity Partners, had on 3 March 2017 announced that it is considering all options, including potentially making a conditional offer for the shares of Spindex at higher price offered by Hong Wei. This lifted Spindex’s shares to an intraday high of $0.94 before closing at $0.89 at the end of the day.

The series of events eventually ended with the offer drawn to a close on 26 April 2017 with the offeror’s resultant shareholding standing at approximately 72.4 percent of the total number of issued shares of the company. Spindex’s share closed at $0.855 at the end of the day just slightly above its offer price. Apparently, minority shareholders deemed the offer price as not attractive enough for them to let go of their shares. As things turned out, the general offer was unsuccessful and Spindex will remain listed.

Intrinsic Value Yet To Be Realised

Trading at a share price of $1.11 as at 11 September 2017 and with its FY17 earnings-per-share (EPS) of $0.1217, Spindex is currently being valued at a price-to-earnings (P/E) ratio of just 9.1 times. Current market price is also at a premium of 30.6 percent to its offer price of $0.85.

Comparing that with another counter which also experienced an unsuccessful general offer, semiconductor equipment provider Ellipsiz would immediately came to mind. Investment holding company Bevrian has launched a conditional cash offer for Ellipsiz’s shares back in July last year at an offer price of $0.38 per share. Unfortunately, the offer closed in September with the offeror holding an aggregate 59.5 percent of total shares. Today trading at $0.75, Ellipsiz is now changing hands at a premium of 97.4 percent over the offer price last year, and is valued at a P/E ratio of 14.7 times. In that light, it seems like Spindex still have some room to play catch-up in order to match the appreciation that of Ellipsiz’s.

If we were to look at Spindex’s counterparts in the precision engineering sector, Innovalues and Fischer Tech could be more relevant examples for comparisons. Innovalues, a manufacturer of customized precision machine parts and components, received an acquisition offer from private equity firm Northstar Advisors at $1.01 per share in October last year. The group was subsequently delisted in March 2017. Judging from its offer price and FY16 EPS of $0.073, Innovalues was valued at a P/E multiple of 13.8 times just before it was delisted. On the other hand, precision engineering plastic components manufacturer Fischer Tech recently received a takeover offer by Platinum Equity at $3.02 per share in July this year, resulting in a 11.1 percent jump of its share price upon the announcement. Based on Fischer Tech’s FY16 EPS of $0.2349, the offer price implies a P/E multiple of 12.9 times.

At the moment, Spindex’s valuation seems relatively low in comparison with its peers. Even if we were to be conservative and take just a P/E ratio of 12 times, this would still translate to a price target of $1.46 and would suggest a potential further upside of approximately 31.5 percent from its current price. The good news is, investors who are holding the stocks while waiting for Spindex’s intrinsic value to be realised would still be paid a dividend yield of 2.7 percent, based on its FY16 payout of $0.03 per share.