SI Research: ST Engineering – A Defensive Stock In Uncertain Times

The Islamic State of Iraq and Syria (ISIS) recently suffered a major defeat in the old city of Mosul, Iraq. However, as it loses territories in the Middle East, cells of the terrorist group have announced their desire to create a “wilayah” or state in South East Asia. Specifically being targeted by the terrorist group, the Ministry of Home Affairs said in its “Singapore Terrorism Assessment Report 2017” that the country is under the highest terror threat in recent years.

Notwithstanding the global terror threats, tension in the Korean Peninsula is also escalating as the North Korean regime continues to blatantly conduct tests of Intercontinental Ballistic Missiles (ICBM). In return, the US has publicly announced that “the era of strategic patience” for the hermit state is over, further threatening the security in the region.

Meanwhile, amidst the current geopolitical uncertainty, global stock prices are trading at high valuations, with the sceptre of a “bubble” being suggested. The local Straits Times Index has also seen a splendid run by gaining about 13.7 percent since the beginning of the year. Given that, we look to a more defensive play in next half of 2017.

As such, we dig into local-listed blue chip Singapore Technologies Engineering (ST Engineering), given its investment moats and defensive yield. Its shares have made gains of about 13.1 percent to the current price of $3.71 since the start of 2017; will ST Engineering continue to provide investors a safe haven at the current valuation?

Huge Investment Moats

ST Engineering ranked 53, in 2015, amongst the largest military manufacturers in the world according to Stockholm International Peace Research Institute. It is also (perhaps) the largest military contractor for the Singapore Armed Forces (SAF) and hence also one of the biggest beneficiary to Singapore’s military budget from the private sector. In 2017, our city state has a whooping military budget of $14.2 billion!

As we all should know, national security and arm sales are highly sensitive businesses in addition to being capital intensive. These naturally high barriers of entry literally mean that ST Engineering is entitled to any contracts that SAF or the Ministry of Defence dish out to the private sector. Further adding to this point, it is good to note that our sovereign wealth fund Temasek Holdings have a majority interest of 50.7 percent in the group.

The second thing we like about ST Engineering is its Maintenance, Repair and Overhaul (MRO) business. The group specialises in aerospace, electronics, land systems and marine systems which make it a standout from SIA Engineering which the latter is primarily focused on the aviation industry.

Intricate and complex systems normally require routine maintenance to be operational which makes the MRO line a form of resilient recurrent income to the group. For instance, in the aerospace segment, aircrafts are required to undergo maintenance every interval to evaluate their airworthiness.

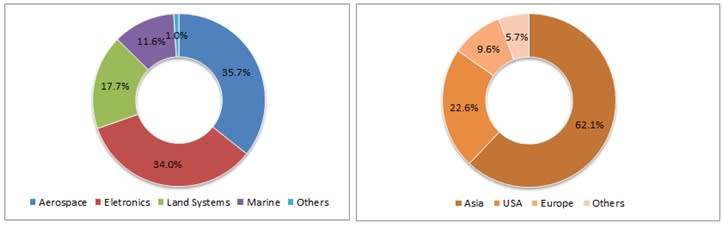

In ST Engineering’s case, the aerospace segment makes up about 35 percent of the group’s revenue. In the short-term, MRO margins could be dampened due to industry headwinds posed by longer maintenance intervals. But in the long-term, the group has partnered with Airbus for passenger-to-freighter conversion of A320/A321 and A330 models, expanding its conversion portfolio which should help to boost growth in the segment.

Apart from that, the shipbuilding industry which is facing protracted slowdown as a whole may have limited impact on the group’s marine arm ST Marine. This is due to the fact that ST Marine builds not only commercial ships but also military vessels. Tied-in to the sales, ST Marine also provides services such as training, maintenance and support which bring the group a stable source of income.

Smart City Theme

ST Engineering will benefit from additional tailwinds from the Government’s push to transform Singapore into a smart city. Under the “Smart Nation Initiative”, the government intends to hasten the adoption of data-driven innovations as well as autonomous technology.

For FY17, the Singapore Government revealed a technology budget of $2.4 billion for Smart Nation projects. About 22 percent or $528 million has been set aside for data analytics and digital citizen systems while another $528 million was allocated for development of cybersecurity applications. According to GovTech, the tender for the development of a Government Security Operations Centre under this framework will be issued in 1H18 and we think order wins momentum will increase going forward.

ST Engineering recognises that the potential of “Smart City” innovations are not limited to just the domestic market and thus present the group with tremendous long-term growth opportunities. In order to capture these new markets, ST Engineering has made headways on several fronts. Firstly, its land systems and specialty vehicles arm, ST Kinetics has taken the lead by partnering with the Land Transport Authority to develop autonomous buses to support Singapore’s car-light vision. The buses will also feature 4G and Wi-Fi connectivity, which may be linked to feed road data to the overall road management systems in the future.

The group’s electronics arm, ST Electronics, has also acquired a controlling stake in SP Telecommunications for $55 million in May 2017 which will pave the way for the group to access an extensive network of fibre optic backhaul infrastructure and expand its offerings of information and communication services.

Notwithstanding that, Siemens that recently launched its fully-integrated digitalisation hub, has partnered with SP Group, ST Electronics and Nanyang Technological University to co-create data-driven innovations for urban infrastructure such as driver-less mobility and advanced data analytics for optimising green buildings. Furthermore, ST Electronics and Siemens will also jointly develop applications for connectivity and cybersecurity.

Financial Performance

While the investment moats and long-term prospects of ST Engineering are indeed undeniable, financial performance in the past years have somewhat been deteriorating. For the past five financial years from FY12 to FY16, revenue fluctuated between $6.3 billion to $6.6 billion but net profit actually trended downwards. This phenomenon was a result of falling gross margins and higher operating expenses.

In the latest financial result 1Q17, financial performance is showing some positive signs of turnaround. Whilst revenue fell by 5.4 percent to $1.5 billion, gross profit increased 8.6 percent to $317.2 million which helped to lift operating profit by 20.1 percent to $116.7 million. Despite that though, the group’s bottom line decreased 6.1 percent to $103.4 million due to lower wage credit, lower shared profits from joint ventures and higher tax expenses incurred.

Balance-sheet wise, the group has cash assets worth $1.3 billion, against total debt that has been pared down from $1.4 billion in FY13 to $1 billion in 1Q17. Effectively ST Engineering boasts a net cash position of $241.8 million in the latest quarter. Owing to that, total debt-to-equity ratio has fallen from 60.9 percent in FY13 to a more conservative level of 41.1 percent, which we think is a healthy level in a rising-interest rate environment.

(Source: Shares Investment)

1Q17 Revenue Breakdown By Segment And Geography

Strong Earnings Visibility

At the meantime, investors may find some comfort in ST Engineering’s robust order book. As at 1Q17, commercial order book has been built up to a record level of $13.3 billion.

The group’s commercial sales constituted 68 percent of total revenue while defence sales accounted for the remainder in 1Q17. For the rest of FY17, ST Engineering expects another $3 billion of commercial orders to be fulfilled, bringing total commercial sales to about $4 billion. The management further guided that “total revenue is expected to be comparable, while profit before tax is expected to be higher than FY16”.

Source: Shares Investment

Valuation

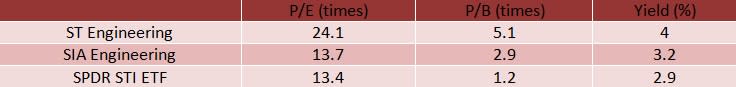

At the current share price of $3.71 (as at 17 July 2017), shares of ST Engineering are trading at a trailing 12-months price-to-earnings (P/E) multiple of 24.1 times, price-to-book (P/B) multiple of 5.1 times and offers a dividend yield of four percent.

Comparatively, partial-competitor SIA Engineering is trading at lower multiples at P/E of 13.7 times and P/B of 2.9 times. SIA Engineering’s annual dividend for FY17 was $0.013 per share (excluding special dividend of $0.005), which translates to a dividend yield of 3.2 percent. Meanwhile, the Straits Times Index exchange-traded fund SPDR STI ETF trades at 13.4 P/E, 1.2 P/B and offers a yield of only 2.9 percent.

Clearly, ST Engineering stands out as the more expensive counter and its stock is also trading at record-high P/E. However, given its investment moat due to its special position in our national defence and record-high order book, the high valuations of its shares may just be warranted. In addition to that, we opine that ST Engineering is one of the most fitting stocks to ride on the “Smart City” theme.

Coupled with its superior yield against the benchmark index ETF, we think investors may consider including ST Engineering into their portfolio in 2H17. Sharing our sentiments, DBS Research gives ST Engineering a target price of $4.12 per share, representing another 10 percent upside potential.

Source: Shares Investment, as at 17 July 2017