SI Research: Valuable Insights From Meeting Memories Group

After the successful reverse takeover (RTO) of SHC Capital Asia, Memories Group (Memories) became the first to debut as a new listco on Catalist of the Singapore Exchange in 2018. Commencing the first day of trading on 5 January 2018, shares of Memories soared 48 percent above its placement price, closing at the high of $0.37 per share.

Memories is a spin-off from Yoma Strategic Holdings’ (Yoma) tourism-centric businesses and the latter is one of the largest conglomerates in Myanmar listed on the Mainboard of Singapore Exchange.

Sensing strong investor interest, we met up with Myanmar’s tycoon Mr. Serge Pun – Executive Chairman of both groups – to get first hand insights into Memories’ businesses as well as how the group is positioning itself to capture the booming tourism industry of Myanmar.

Creating Memories In Myanmar

Memories provides an integrated tourism platform catering the whole range of tourism-related businesses, namely Experiences, Services and Hotels.

Thousands of tourists have floated over Myanmar’s historic Bagan cultural zone in hot-air balloons and more than likely, these tourists rode on one of Memories’ inflatables.

The experience dubbed “Balloons Over Bagan”, is often promoted in travel magazines’ top bucket lists and the experience allows tourists to explore and enjoy a breathtaking aerial view of the Bagan plains. The vast site of Bagan, which is covered with the remains of more than 2,200 historic pagodas, temples and monasteries that were constructed from the 11th to 13th centuries, is Myanmar’s cultural treasure and the premier travel destination in Myanmar. Balloons Over Bagan also operates in the Inle Lake in Shan State and in Pindaya.

Under the services segment, the group’s proprietary destination management company – Asia Holidays – helps tourists to design, organise and implement customised tours and unique excursions. To free the minds of travellers from hassles, that also entails the management of related travel logistics.

Last but not least, Memories’ hotel segment addresses one of the most fundamental needs of its customers – accommodation. The group currently owns and operates Hpa-An Lodge and will launch Pun Hlaing Lodge in the last quarter of the year.

Hpa-An Lodge is a 19-room upscale lodge nestled in the natural setting of the foothills of Mount Zwekabin. Meanwhile, Pun Hlaing Lodge is located in Yangon’s most prominent Pun Hlaing estate. The city resort is currently under construction and is expected to be completed by Q4 of this year.

Positive Tourism Trends

Myanmar’s tourism market makes for an obvious bet and the time is probably ripe for Memories to tap into Singapore’s capital market for expansion.

For one, Myanmar’s tourism industry is in its infancy when compared to other ASEAN countries. According to various industry sources, tourist arrivals in Myanmar ranked the lowest at just 2.9 million compared to Thailand’s 32.6 million, but the changing trend in terms of tourist profile is benefitting Myanmar.

The new generation of tourists are the increasingly affluent young people who are willing to spend more on experiences. In other words, tourists are now more likely to travel away from cities. Due to lower rate of industrialisation compared to other ASEAN countries, Myanmar offers the most rustic travel experience in Southeast Asia.

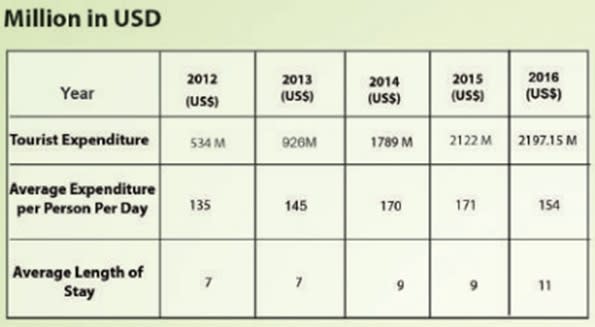

According to Myanmar’s Ministry Of Hotels And Tourism, the statistics is glaring: In 2012, tourists on average stayed in Myanmar for seven days. The average length of stay extended to 11 by 2016. Complementing that, tourists are also spending more and the average expenditure per person per day grew from US$135 to US$154 over the same period. On an aggregate basis, tourist expenditure ballooned more than four times from US$534 million in 2012 to US$2.1 billion by 2016.

Further cementing the notion that global investors are bullish about Myanmar’s tourism sector, world global travel body World Travel and Tourism Council ranked it second amongst 184 countries in terms of long-term growth. Based on their forecasts, the contribution of the tourism sector to Myanmar’s gross domestic product is expected to hit a whopping US$12.6 billion.

Source: Ministry of Hotels and Tourism, Myanmar

Charming Tourists

The ballooning segment is seeing the highest growth numbers for tourist transportation and Memories is well-established to attract the rising visitorship. In 2012, about 8,000 people took balloon flights in Myanmar. By 2016, the number jumped to about 28,400.

With some 22,000 visitors having rode on the group’s balloons, Memories is the market leader in the hot air balloon business in Bagan, operating 12 of the 21 balloons in the region. Currently, there are only three licenced operators – including Memories – in the region.

Despite the low costs of capital for operating hot air balloons the regulatory body is unlikely to issue more licences. As a matter of fact, the licence issued to Memories is in fact similar to an airline operating licence.

Further elaborating, the management explained that despite the vast size of Bagan plains, the number of hot air balloons in the air space is restricted to ensure flight safety and more importantly preserve the beauty of the site.

Nonetheless, the balloon business in Myanmar is seasonal and Memories (like other operators) can only fly from October to April. However, the remaining months of operations more than made up for the shortfall. Tourists pay US$340 per person for a one-hour premium balloon flight.

In its latest FY17, the experiences segment contributed US$6 million in revenue to Memories. Noting a higher demand for luxury experiences, Memories introduced a premium balloon service at US$450 per person during the current season, contributing to the group’s healthy cash-flow.

Of course, the experiences segment is not just bound within the Bagan region. For Memories, it also has two more balloons flying over Inle lake in the Shan State. For a start, the attraction is to draw more tourists arrival to Inle before the group increases the number of flights including complementary experiences and services in the country.

(Ballooning Over Inle Lake)

Promoting Myanmar

Through Asia Holidays, Memories can tie up all its services to design and customise a unique holiday for tourists to experience Myanmar to the fullest. Currently, the management is expanding its clientele to Asian tourists on top of European travelers. More importantly though, Memories sees significant growth opportunities in the outbound destination management space for the growing affluent Burmese.

For inbound customers, Asia Holidays intends to offer its customers an end-to-end service encompassing hotel accommodation, experiences and all ancillary services normally sought by a traveller. Currently, the operating Hpa-An Lodge averages an occupancy of about 65 percent. In addition, the management has also guided that domestic tourists are also coming in during low seasons when room rates are lower. On average, revenue-per-room is about US$80 during the low season and could rise to as high as US$150 during peak season This has provided a marked improvement to occupancy rates for this property.

On the other hand, upcoming Pun Hlaing Lodge will likely be well-received. Located within the premium estate of Yangon, the lodge is about 16 km from downtown and 13 km from the airport. Memories is positioning Pun Hlaing Lodge to be an urban resort, with a fully furnished 200-seat ballroom. The lodge is ideal for company offsite retreats, meetings or functions and guests also have priority access to Pun Hlaing 18-hole golf course designed by South African golfer Gary Player.

Adding a long-term catalysts to Memories, the group holds a plot of land in Bagan – a 4.3-acre piece of land. As at now, the group has yet to formalise plans to develop the piece of land, which sits along the Irrawaddy River and over the front of Nyaung U Township where travelers often visit for its restaurants and traditional markets.

Citing reasons for the holdback, the management highlighted that Bagan is actually making headways for a UNESCO listing as a world heritage site. As such, Memories do not want to make any developments prematurely which could potentially be at odds with Bagan’s potential listing. Nonetheless, instead of just building a hotel, the management will probably be developing the large piece of land into a mixed-use commercial and hospitality property.

According to Mr. Pun, “As of now, Bagan’s connectivity is still underdeveloped and there is still no jetty. We see huge potential in developing Bagan Land into a mixed-use attraction instead of just planting a hotel atop. That may include building a jetty for river cruise boats and restaurants along the river. While there is still no exact formulas due to the pending UNESCO listing, one thing is for sure – the land price will appreciate.”

(Hpa-An Lodge)

Focus On The Long-Term Prospect

In all, Memories’ revenue has grown from US$10.3 million in FY15 to US$11.6 million in FY17. Prior to the RTO, Memories was still generating net profit of about US$1 million over the same periods. The enlarged group, however, generated a small net loss of US$0.5 million in FY17. This was mainly due to adjustments and one-time provisions made in accordance to the stringent requirements of the listing.

Ascribing a value to Memories seem a little premature as the earnings momentum has yet to kick in. Only at its infancy stage, we prefer not to talk about numbers but more about the growth potential of Myanmar’s economic growth and explosive tourism growth.

That said, with its long-term growth prospects, coupled with the backing of Yoma and business expertise of Mr. Pun, it is hard not to be captivated by Myanmar’s potential as a tourist destination and the investment merits of Memories.