SI Research: Wilmar International – Accumulate On Dips

Wilmar International’s (Wilmar) latest 2Q19 quarterly results were kind of disappointing. Affected by lower crush margins attributable to the impact of African swine fever on soybean meal demand and recognized losses due to the consolidation of Shree Renuka Sugars, the group’s net profit for the quarter sank 52.3 percent to US$150.9 million. The less-than-satisfactory results, coupled with negative investors’ sentiments around the protests in Hong Kong, escalating US-China trades conflicts and the inversion of yield curve in the US, have caused Wilmar’s share price to tank more than 8.8 percent after reaching a historical high of $4.08 on 30 July 2019.

The weakness in the share price got us interested in this counter. We are tempted to jump into this stock but let us take a deeper look before we take the plunge.

More Than Just A Plantation Operator

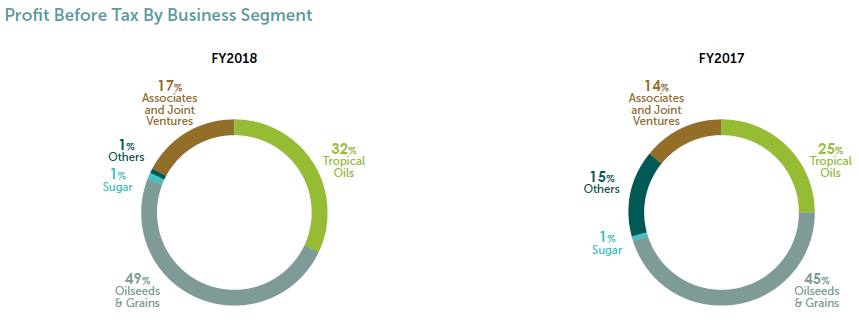

Wilmar is one of the world’s largest oil palm plantation owners with 230,409 hectares of total planted area in Indonesia, East Malaysia and Africa as at 31 December 2018. With a market capitalisation of $23.8 billion, Wilmar dwarfed its peers among listed palm oil plantation operators the likes of Golden Agri-Resources, First Resources and Bumitama Agri. In FY18, the group’s Tropical Oils segment achieved pre-tax profit of US$546.1 million driven by better performance in the manufacturing and merchandising businesses despite lower commodity prices in that year. This segment stood as Wilmar’s second largest earnings contributor accounting for around 32 percent of the group’s FY18 profit before tax.

In spite of that, Wilmar is much more than just a palm plantation operator. The group also processes and distributes a wide range of other agricultural products including non-palm and lauric edible oils, oilseeds such as soybean and rapeseed, rice, wheat and flour. It is the leading soybean crusher and one of the largest wheat and rice millers in China, with extensive presence in various parts of the world. Wilmar’s oilseeds and grains segment constituted 49 percent of the group’ pre-tax profit generating US$875 million of income in FY18, and it is the group’s largest earnings contributor by business segment.

Apart from that, Wilmar also operates an integrated sugar business from sugarcane cultivation to sugar milling and refining. The group produces around 60 percent of Australia’s raw sugar and supplies about 75 percent of Australia’s and New Zealand’s refined sugar requirements. Wilmar’s sugar division did not report strong contributions in FY18 because of non-cash impairment charges relating to the group’s milling operations in Australia along with the decline in sugar prices.

Source: Company’s Annual Reports

Financial Performances

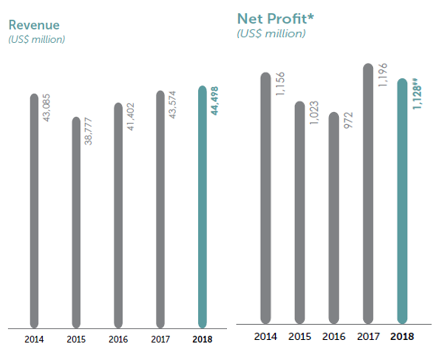

Although Wilmar’s 1H19 results did not manage to meet analysts’ expectations, we would find that it has displayed remarkable stability and consistency in an industry distinctively saddled with great volatility if we were to look at the group’s performances over a longer perspective.

Over a five-year period from FY14 to FY18, Wilmar attained a slow but gradual expansion of its top-line at a compounded annual growth rate of 0.8 percent to US$44.5 billion last year. Meanwhile, net profit held steady dipping 0.6 percent per annum to US$1.1 billion in FY18.

Source: Company’s Annual Reports

Subsidiary To List In China

On 12 July 2019, it was announced that the proposed listing of Wilmar’s China operations, Yihan Kerry Arawana (YKA), on the Shenzhen Stock Exchange has been accepted by the China Securities Regulatory Commission. While the listing date has yet to be determined, this could happen as early as 4Q19 or early next year.

The listing of Wilmar’s subsidiary has been very much in focus by investors and was probably one of the key reasons behind the group’s strong rally to chart new heights seen in the last few months. The news was viewed favorably as the listing served as an opportunity to unlock the value of Wilmar’s China operations and shareholders’ value. Given YKA’s strong market positioning and branding in China, a strong share price performance upon listing could give Wilmar another boost.

In addition, Wilmar could potentially declare a special dividend post-listing of YKA with the offering proceeds it received. This resonates well with income investors who are looking for higher payouts.

Riding On Plam Oil Recovery

Crude palm oil prices have been on a general downtrend for the last two years due to higher production output and weaker demand. However, we are of the opinion that this is a trend that could not go on forever. The price of a commodity is simply determined by only two attributing factors alone – its demand and supply, and the cure to a depressed price in the price itself. As cultivators find it unprofitable to produce owing to a low market price, they would either be forced out of the market or be unmotivated to continue, leading to a lower supply which would eventually bring the price to a more sustainable and equilibrium level. This is classic economics for cyclical instruments, and what comes down has to go up.

Furthermore, commodities which possess physical real values, are good hedges against depreciating paper currencies and inflation amidst times when major central banks around the world are implementing loose monetary policies and printing money. While we cannot say for sure when a recovery for palm oil prices would occur, but to state that they would eventually rebound – that, without a doubt, is almost always a certainty.