Singapore SMEs Saw Sharp Business Turnaround In 2Q2021

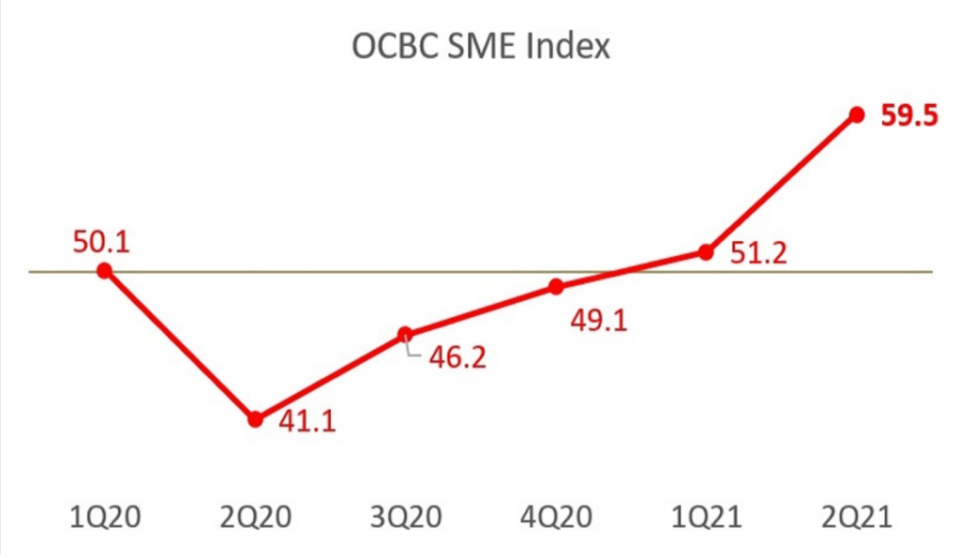

The OCBC SME Index reported that Singapore’s small and medium enterprises turned in an improved quarter-on-quarter performance in in 2Q 2021. Despite COVID-19 disruptions, the OCBC SME Index for 2Q 2021 rose sharply by 8.3 points to 59.5.

For reference, a figure that’s above 50 points indicates an improvement in business health and performance of Singapore SMEs. 2Q 2021 also marks the second time that the OCBC SME Index has turned expasionary since the COVID-19 outbreak.

One of the reasons cited in the OCBC press release was Singapore’s improving cross-border trade especially with Greater China and ASEAN. Crucially, this offset the lower collections from F&B and other domestic services.

Read Also: OCBC SME Index: How Small Businesses Can Use Data To Forecast Their Industry Direction

Broad-Based Business Recovery Witnessed In 2Q 2021

The base effect was low due to COVID-19 – which had resulted in the worst ever economic contraction on record in Singapore – hence why we may see relatively high growth rates. Nevertheless, the recovery posted in 2Q 2021 was generally broad-based.

Growth Industries | OCBC SME Index | 2Q21 Q-o-Q |

Retail | 62.4 | 22.1 |

Business Services | 56.7 | 15.5 |

Building & Construction | 57.9 | 13.8 |

Education | 58.1 | 13.5 |

Transport & Logistics | 58.6 | 13.3 |

Manufacturing | 57.9 | 13.1 |

Wholesale Trade | 56.0 | 10.5 |

ICT | 54.9 | 8.3 |

Healthcare | 55.0 | 7.6 |

F&B | 55.1 | 7.4 |

Resources | 55.0 | 7.4 |

Shipping and Marine | 55.1 | 2.4 |

The better performing sectors included retail, which is recovering after being one of the biggest losers of COVID-19 pandemic. Even Business Services, which include travel-related events and services, turned positive in 2Q 2021.

Even though F&B was one of the hardest-hit because of the prohibition of dine-in customers, the sector continued to register an expansionary readings of 55.1.

Overall SMEs seemed to be coping better even though they were grappling with Phase 2 (Heightened Alert) and Phase 3 (Heightened Alert) during the period. This is evidence by significantly less severe impacts on business sentiments compared to 2020.

One example highlighted in the OCBC press release was of a business that had learned a great deal since the Circuit Breaker in 2020. Since then, it had already pivoted to adopt greater digitalisation in its workflow.

Read Also: 5 Things You Should Know About MOM’s Labour Market Report 1Q2021

Resilience In Healthcare Manufacturing And ICT Services Sub-Industries

Healthcare continued to perform well due to sustained demand for medical equipment and the rollout of vaccines. ICT Services such as Data Processing and Software Development, and Web Portals and Hosting, showed resilience on the back of continued demand to support digitalisation efforts.

However, Shipping and Marine was understandably lagging as it continues to be plagued by manpower constraints. While Building and Construction face similar labour constraints, the OCBC press release highlighted an example of a business that had pivoted to EV infrastructure projects, and was looking to hire more locals and providing more training to boost their capacity.

Next Quarter May Be A Better Indication Of How Well Singapore Is Coping

When Phase Three (Heightened Alert) began on 14 June 2021, the social gathering limit was raised from two pax to five pax. Facials and other personal care services were allowed, even with masks off. Gyms and fitness studios could resume indoor mask-off sports/ exercise activities in group sizes of up to 2 persons, and in classes of up to 30 persons including the instructor. From 21 June 2021 onward, dining-in in groups of up to two pax was allowed.

Of course, we all know that Singapore was plunged back into Phase 2 (Heightened Alert) from 22 July to 18 August 2021.

While the OCBC SME Index depicts an expansionary business sentiment, which broadly mimicks the 14.3% GDP growth in 2Q 2021 announced by the Ministry of Trade and Industry (MTI), it doesn’t consider the setbacks in 3Q 2021.

Seeing tighter safe management measures manifest and then reverting into Phase 2 (Heightened Alert) in 3Q 2021 would have dented business sentiments. Moreover, the uncertainties with the stop-start nature of re-opening Singapore may also take a toll on businesses – especially as they had finally see the light at the end of the tunnel.

In fact, while sentiments may have been improving, 2Q 2021 had already seen the Singapore economy contracting 2.0%. With tightened safe management measures in 3Q 2021, business sentiments may start to wane along with the economic contraction.

The post Singapore SMEs Saw Sharp Business Turnaround In 2Q2021 appeared first on DollarsAndSense Business.