Singapore’s Current Economy In 4 Charts

Economists and the Singapore government are optimistic about Singapore’s economy in 2017, forecasting a higher growth than last year’s two percent. Their primary cause for the positive outlook is global growth recovery.

But is that the case? Consumers might not be feeling it, at least. Below is one of the four charts from Bloomberg that tell us a different story than the tune our economists and government are singing.

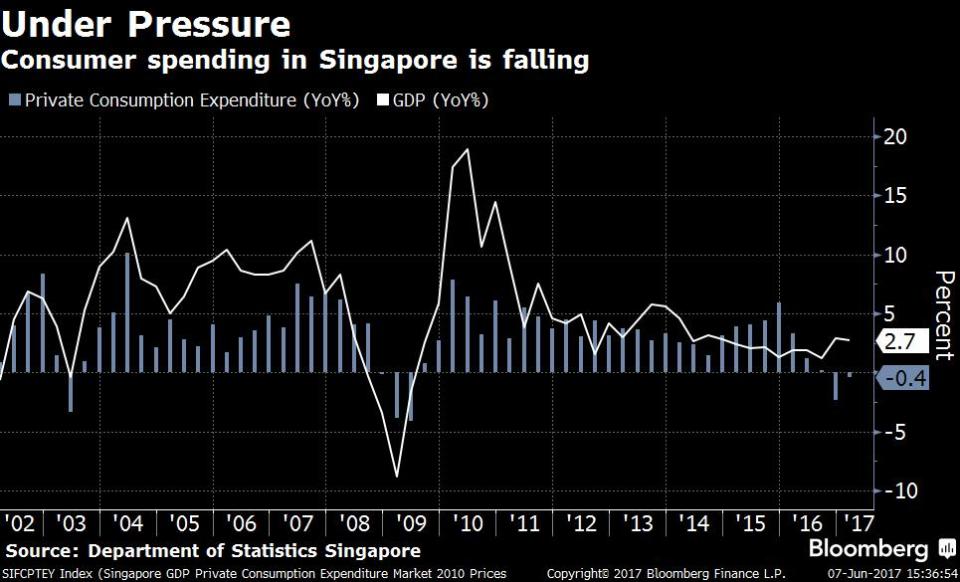

1. Consumer spending

Consumer spending contracted for two consecutive quarters. It isn’t a good sign because it makes up a third of the Singapore economy. In fact, out of the many optimistic economists, Australia & New Zealand Banking Group’s (ANZ) economist, Ng Weiwen seems not too hopeful.

Ng thinks the recovery in global growth doesn’t look resilient in the medium term. Electronic exports will “fizzle” out in the second half of 2017, which will steer Singapore’s growth away from the consensus expectations.

It might be weird to say this but having too few people spending instead of saving is not great for the markets.

2. Unemployment

Just looking at how Singapore’s unemployment rate and job vacancies diverge on the chart would make one’s heart drop. It is a clear indication companies everywhere are not hiring, and more people are left jobless on the streets.

Of course, we shouldn’t forget the freelancing industry is growing all over the world. But we must also remember companies can hire cheaper freelancers outside of Singapore to work remotely.

It isn’t an encouraging sign to also note that unemployment is the highest since the Global Financial Crisis.

3. Wages

As if rising unemployment rates aren’t enough, wages growth is beginning to slow, moving towards Global Financial Crisis levels. Worse, productivity growth is anaemic. There are slight improvements as compared to the past few years but still negligible.

Given that, wages are growing faster than productivity. But what does that mean for Singapore? We turn to Singapore Management University (SMU) Professor of Economics Hoon Hian Teck.

Professor Hoon says, “Wage growth that outstrips labour productivity growth translates into declining profit margins, business closures, and layoff of workers.”

Also, if the Singapore Dollar is persistently strong, “the increase in unit labour costs also implies a loss of international competitiveness.” Overall, it’s bad news for Singapore’s long-term outlook if productivity doesn’t improve.

4. Household debt

It shouldn’t come as a surprise debt slowly ballooned as unemployment rises and wages growth softens. That is despite the fact that the Singapore Residential Property Price Index (PPI) has been dipping since late 2013.

More importantly, bigger debts mean pressure on consumer spending (refer to chart 1) and economic growth as a whole.

So is everything as “rosy” as the government and economists say? It’s hard to tell now, but we shouldn’t be overly optimistic yet.

Have an emergency fund of preferably cash or liquid assets, always be ready to protect ourselves and our family.