A Smart Guide to Investing: An Introduction to REITs Part 1

If you are an income-seeking investor, don’t miss out on our dividend investing guide.

Dividends are paid out from a wide variety of companies in different industries.

One of the more reliable sources of dividend income comes from owning real estate investment trusts, or REITs for short.

Singapore is well-known for being a hub for REITs.

Since 2002, many REIT sponsors and property developers have chosen Singapore as their REIT listing destination.

As such, there is much to learn about the industry.

So, let’s take a mine tour to understand more about REITs and how they can help you to grow both your wealth and passive income flow.

This is the first of a three-part series on REIT investing, where we explain what REITs are and why you should invest in them.

What are REITs?

A REIT is a financial vehicle that allows you to own a portfolio of investment properties.

These properties generate rental income for the REIT and are professionally managed by a REIT manager.

Investors can buy shares (also known as “units”) of the REIT on the stock exchange.

Hence, REIT shareholders are called “unitholders”.

A REIT usually has a sponsor that provides financial support to the REIT and also has a ready pipeline of properties that can be injected into the REIT in the future.

Why invest in REITs?

1. Capital outlay and diversification

So, you may ask, why should I want to invest in a REIT?

After all, I can simply go out there and buy a property myself and earn rental income from it.

First off, REITs offer exposure to a portfolio of properties, allowing the unitholder to be adequately diversified.

The pie chart above shows that 85% of Singapore REITs own properties outside Singapore, allowing unitholders to gain exposure to overseas real estate.

When you purchase property on your own, the capital outlay is also significant and will require you to take a bank loan.

Most people can only afford just one, or at most two, properties before they are leveraged to the hilt.

Not only does buying physical property involve tying up significant funds and a chunk of debt, but it also means you cannot diversify your property exposure.

REITs solve this problem by allowing unitholders to buy as little as 100 shares, spending just a few hundred to several thousand dollars to own a portfolio of professionally-managed properties.

2. A dependable yield vehicle

The law mandates that a REIT has to pay out at least 90% of its taxable income as distributions to qualify for tax exemption.

Because of this rule, REITs are known to be a dependable and consistent source of dividends for income-seeking investors.

3. Professionally-managed properties

If you buy a physical property, it would be costly and impractical to appoint someone to manage it to ensure the property is in good condition and that the tenant pays up on time.

In the case of REITs, they are professionally managed by an experienced manager that has a team of staff to help out.

The REIT manager not only maintains the properties but also collects rental from tenants promptly and helps to renovate or enhance the property to improve both its yield and attractiveness.

4. Non-taxable income

Dividends received from REITs are also not taxable in the hands of the unitholder.

This is unlike rental income from physical property that needs to be included in your tax computation.

An attractive asset class

The graph above shows the total returns (i.e. capital gains + reinvested dividends) for REITs versus the Straits Times Index (SGX: ^STI).

In 10 years, an investment of S$100 in a portfolio of REITs would have more than doubled your money to around S$240.

By contrast, investing in Singapore’s bellwether index over the same period yielded a total return of just around 40%.

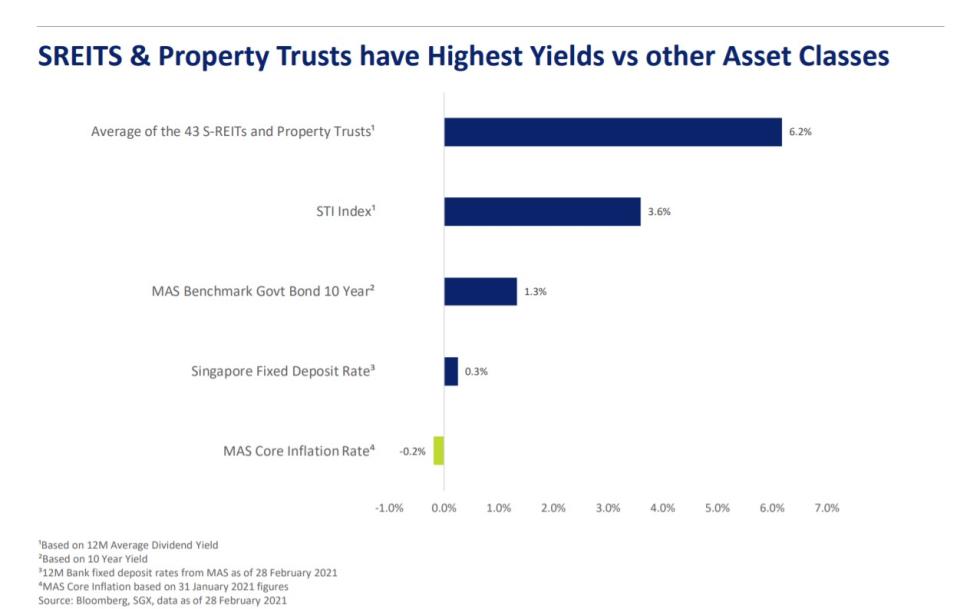

REITs have a higher overall dividend yield compared with other asset classes, making them great candidates for generating a stream of growing passive income.

The chart above shows that Singapore REITs have an average yield of 6.2%, significantly higher than the Straits Times Index’s yield of 3.6%.

Investing in REITs also provides a vastly superior yield to other asset classes such as Singapore 10-year government bonds (1.3%) and a bank fixed deposit (0.3%).

Get Smart: Choosing a good REIT

We hope that this quick summary on REITs and what makes them desirable investments has got you curious about this attractive asset class.

In the next part of this series, we will talk about the various types of REITs in the stock market and the factors involved in choosing a good REIT.

In our latest special FREE report, we cover eight stocks, consisting of a mix of blue-chips and mid-cap companies, that we believe can ride the recovery and offer investors a great mix of both growth and income. Click HERE to download the report, 8 Singapore Stocks for Your Retirement Portfolio, for FREE now!

Don’t forget to follow us on Facebook and Telegram for some of our latest free content!

Disclaimer: Royston Yang does not own shares in any of the companies mentioned.

The post A Smart Guide to Investing: An Introduction to REITs Part 1 appeared first on The Smart Investor.