Huge losses for European and US stocks as lockdowns loom

WATCH: European stock indexes fall sharply

Global stock markets suffered heavy selling on Wednesday, as anxieties around the worsening COVID-19 second wave and the upcoming US election continued.

COVID-19 cases and deaths continue to rise across Europe and the US. New restrictions now look set to ramp up across France and Germany, continental Europe’s two biggest economies. Analysts said the UK could follow suit.

Stock markets across Europe and the US suffered heavy losses, falling to levels not seen since the depth of the first COVID-19 wave.

“We have seen a return to the unrelenting selling of Monday’s session, only this time it is arguably even more dramatic,” said Chris Beauchamp, chief market analyst at IG.

The “avalanche” of selling, as Beauchamp termed it, was prompted by renewed fears about strict lockdowns of European economies.

French president Emmanuel Macron is set to hold a televised address on Wednesday evening, local media reported, and France24 said Macron was likely to announce new restrictions that could include a full lockdown on weekends or full lockdowns in the worst hit areas.

In Germany, Angela Merkel is set to meet with regional leaders to discuss tighter restrictions. Reports suggest she favours a “light lockdown,” but one that would still require widespread closure of non-essential businesses.

READ MORE: Germany braces for 'lockdown light' as coronavirus cases keep climbing

“France and Germany look set to move towards some form of ‘lockdown lite’ over the next 24-48 hours with more info likely today and tomorrow,” Jim Reid, a senior strategist at Deutsche Bank, wrote in a note to clients on Wednesday morning.

Heavy selling began as soon as trade started in Europe and gathered momentum as the day went on.

The DAX (^GDAXI) closed down 4.1% in Frankfurt and the CAC 40 (^FCHI) lost 3.3% in Paris. In Milan, the FTSE MIB (FTSEMIB.MI) fell by 4%. The IBEX 35 (^IBEX) lost 2.9% in Madrid. All indexes were at levels not seen since May.

IG’s Beauchamp said the UK could move towards a second lockdown “given the current direction of travel across the continent.”

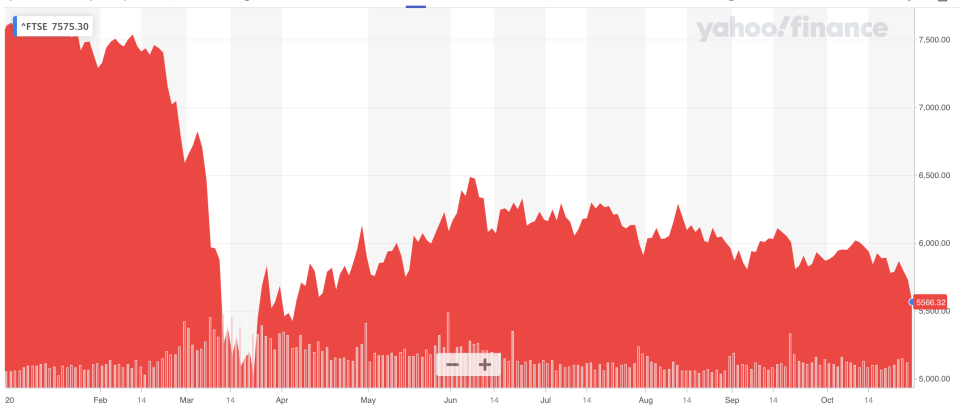

The FTSE 100 (^FTSE) closed down 2.8% in London, hitting its lowest point since April.

Shares in retailers, restaurants, and travel stocks fell across the board.

“Companies which just about scraped through in the spring may not survive another period without any business despite the generous state support which has been announced,” said Russ Mould, investment director at stockbroker AJ Bell.

Digital businesses like online supermarket Ocado (OCDO.L), meal kit delivery service Hello Fresh (HFG.DE), and takeaway app Delivery Hero (DHER.DE) were among the few winners.

Wall Street joined the global sell-off when trading got under way in New York. The S&P 500 (^GSPC) and Dow Jones index (^DJI) were both down 3% by the time Europe closed and the Nasdaq (^IXIC) was 3.2% lower.

COVID-19 cases continue to rise rapidly in the US. Over 74,000 new cases were recorded on Tuesday, according to the New York Times, taking the total confirmed cases across the US to over 8.8 million.

“The trend in the national positivity rate began to rise in the first week of this month, and it shows no sign of stopping,” said Ian Shepherdson, chief US economist at Pantheon Macroeconomics.

Shepherdson said record numbers of hospitalisation were likely by Thanksgiving.

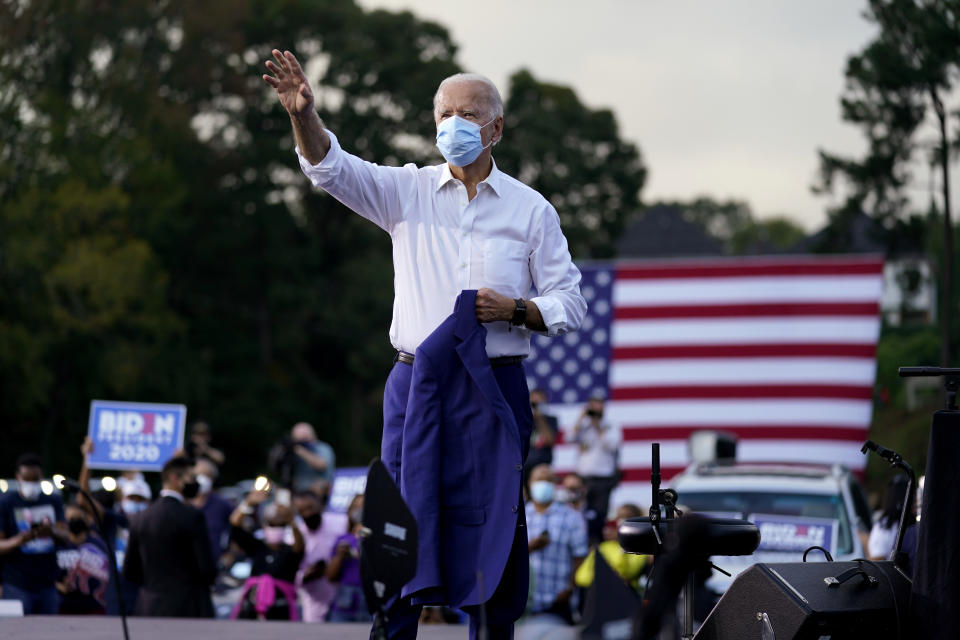

Away from the pandemic, investors remain cautious ahead of next week’s US election.

“No one wants to take too much risk ahead of this event,” said Naeem Aslam, chief market analyst at Avatrade. “Traders have learned their mistakes and do not want to rely on polls as they tend to be terribly wrong.”

Stock had been mixed during the Asian trading session overnight into Wednesday. Japan’s Nikkei (^N255) and the Hong Kong Hang Seng (^HSI) both lost 0.3%, but mainland Chinese markets rose. The Shanghai Composite (000001.SS) closed half a percent higher and the Shenzen Component (399001.SZ) rallied 0.9%.

China has largely avoided the COVID-19 second wave that has blighted the US and Europe, with recent data pointing to a continued strong recovery for the world’s biggest economy.

Watch: What is a V-shaped economic recovery?