Rishi Sunak set to extend business loans schemes

The Chancellor is set to extend the loans schemes helping companies to weather the coronavirus storm, according to reports.

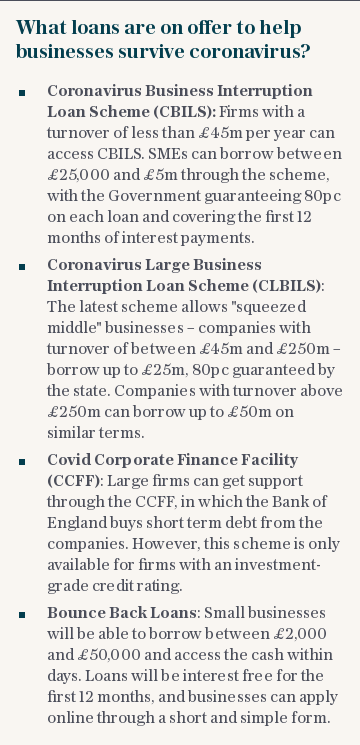

Rishi Sunak is this week expected to unveil plans to keep accepting applications for the Government's four loan schemes until the end of November, the Financial Times reported.

Banks will be permitted to keep processing loans until the end of the year.

The schemes have provided more than £50bn to firms through government guarantees.

So far the Treasury's flagship Coronavirus Business Interruption Loan Scheme has paid out close to £14bn. But only half of the 123,000 applications from businesses trying to survive the economic crisis have been approved.

A Treasury spokeswoman said its package of economic support was constantly under review.

“We have already provided unprecedented support worth £160bn to businesses impacted throughout this period. This includes government-backed loans, cutting VAT for the tourism and hospitality sectors, grants of £25,000 and the Coronavirus Job Retention Scheme, which has supported the wages of 9.6m people so far.”

The potential extension comes as ministers decide whether to impose new national lockdown restrictions in a bid to reduce the sharp increase in new coronavirus cases and hospitalisations.

Meanwhile, employers have voluntarily returned more than £215m to the Government in furlough payments they decided they did not want or need.

According to figures from HM Revenue and Customs, 80,433 employers have returned funds they were given to cover workers' salaries.

The companies and other bodies have returned £215.7m as of September 15, according to data obtained by the PA news agency through a freedom of information request.

Some of the money was returned, while other companies simply claimed smaller payouts the next time they were given furlough cash.

However, it is still only a tiny part of the overall £35.4bn claimed as part of the coronavirus job retention scheme, according to the latest statistics from August 16. New data is due to be published next Tuesday.

It is also only a fraction of the up to £3.5bn that officials believe may have been paid out in error or to fraudsters under the scheme.

HMRC said it welcomed employers’ decision to voluntarily return furlough funds because they no longer needed them or "have realised they've made errors and followed our guidance on putting things right".

The programme was set up in April this year in a bid to help support businesses which could not operate, or had to reduce staff levels, during lockdown.

Employees who stayed at home were paid 80pc of their salary, with the Government sending the money to businesses.

However, some firms that initially submitted a furlough claim later decided they did not need the money.

Housebuilders Redrow, Barratt and Taylor Wimpey have both said they returned all the furlough money they had claimed. They were joined by Bunzl, Ikea and many others.

Meanwhile retailer Primark has said it will refuse the £30m it could claim for bringing back staff under the Jobs Retention Bonus - a £1,000 per employee payment that companies get for bringing staff off furlough and keeping them employed until the end of January.

How will you and your business, big or small, be affected by today's economic announcement? Tell us in the comments section below or email yourstory@telegraph.co.uk