Tech Stocks' Earnings Roster for Jan 29: FB, NOW, MSFT, PYPL

Technology stocks are anticipated to see a sluggish fourth-quarter 2019 earnings season, primarily due to continued softness in the semiconductor space.

Softness in NAND pricing and higher tariffs on electronics, thanks to the U.S.-China trade tussle are anticipated to be reflected in the industry players’ financial results this time around.

Nonetheless, the technology sector’s fourth-quarter 2019 results are expected to bring the period of sequential earnings decline to an end.

Per the Earnings Preview, technology sector fourth-quarter earnings are estimated to decline 2.8% year over year on revenue growth of 4.2%. This would follow 7% decline in the sector’s earnings in the preceding quarter on 2.4% higher revenues.

Improving trend in PC shipments, strengthening data center market, increasing proliferation of IoT and growing clout of cloud-based applications are likely to have benefited the companies’ in the quarter under review.

Moreover, the accelerated deployment of 5G technology — the next-generation of wireless connectivity — is also likely to have spurred growth.

Q4 Performance of Tech Stocks so Far

So far, Intel INTC and International Business Machines Corporation IBM delivered earnings beat, which buoyed optimism.

Intel’s fourth-quarter performance benefited from growth in the data-centric businesses, driven by robust adoption of high-performance products, including Xeon Scalable processors.

Further, IBM’s fourth-quarter results reflected improved position in the hosted cloud, security and analytics. Moreover, IBM provided promising bottom-line guidance for 2020.

Meanwhile, Texas Instruments TXN fourth-quarter 2019 results reflected persistent weakness in the company's Analog and Embedded Processing segments.

Sneak Peek Into Upcoming Tech Releases

Given the mixed backdrop, investors interested in the technology sector will keenly await upcoming earnings releases from notable players, including Facebook FB, ServiceNow NOW, Microsoft MSFT and PayPal Holdings PYPL, due to report on Jan 29.

Facebook’s fourth-quarter 2019 results are likely to reflect continued subscriber growth, driven by rapid adoption of Stories and Gaming endeavors. The company has also bolstered its streaming and live video unit, given its push into augmented reality and more.

Moreover, the Menlo Park, CA-based company has a Zacks Rank #3 and an Earnings ESP of +2.62%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Notably, per the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

The Zacks Consensus Estimate for fourth-quarter earnings is pegged at $2.51 per share, up a penny in the past 30 days. (Read more: Facebook to Report Q4 Earnings: What's in the Cards?)

Facebook, Inc. Price and EPS Surprise

Facebook, Inc. price-eps-surprise | Facebook, Inc. Quote

ServiceNow’s fourth-quarter 2019 results are likely to benefit from expansion in global footprint and clientele, both private and public. Additionally, robust adoption of Now Platform’s digital workflow solutions, driven by strong demand for digital transformation and cloud-based solutions among large companies is expected to have driven top-line growth.

Moreover, the Santa Clara, CA-based company has a Zacks Rank #3 and an Earnings ESP of +0.57%.

Notably, the consensus mark for fourth-quarter earnings has been steady at 88 cents over the past 30 days. (Read more: ServiceNow to Report Q4 Earnings: What's in the Cards?)

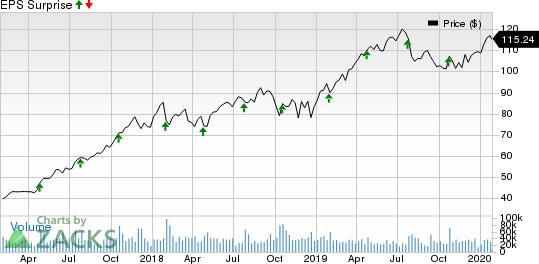

ServiceNow, Inc. Price and EPS Surprise

ServiceNow, Inc. price-eps-surprise | ServiceNow, Inc. Quote

Momentum in Redmond, WA-based Microsoft’s cloud computing service — Azure — is likely to have contributed to its fiscal second-quarter 2020 performance. Moreover, second-quarter revenues are likely to have benefited from growing user base of its different applications like Office 365 commercial, Dynamics, Outlook mobile and Teams.

Microsoft has an Earnings ESP of -0.70% and a Zacks Rank #3, which makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank stocks here.

Notably, the consensus mark for earnings has been stable over the past 30 days at $1.32. (Read more: Factors Setting the Tone for Microsoft's Q2 Results)

Microsoft Corporation Price and EPS Surprise

Microsoft Corporation price-eps-surprise | Microsoft Corporation Quote

Further, San Jose, CA-based PayPal Holdings’ strength in product portfolio comprising One Touch, Xoom and Venmo, among others, is anticipated to get reflected in fourth-quarter 2019 results. Moreover, improving user engagements on the company’s platform, and expanding merchant base are likely to have contributed to the top line.

PayPal has a Zacks Rank #4 (Sell) and an Earnings ESP of +1.26%.

Notably, the consensus mark for fourth-quarter earnings has been steady at 83 cents over the past 30 days. (Read more: PayPal to Report Q4 Earnings: What's in the Offing?)

PayPal Holdings, Inc. Price and EPS Surprise

PayPal Holdings, Inc. price-eps-surprise | PayPal Holdings, Inc. Quote

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Facebook, Inc. (FB) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research