Teledyne (TDY) Q3 Earnings Top Estimates, Sales Decline Y/Y

Teledyne Technologies Inc. TDY reported third-quarter 2020 adjusted earnings of $2.48 per share, which surpassed the Zacks Consensus Estimate of $2.40 by 3.3%.

The bottom line, however, declined 12.7% from the prior-year quarter’s earnings of $2.84 per share. The year-over-year downside can be attributed to decreasing sales figures.

However, the quarterly bottom line exceeded the earlier announced GAAP earnings guidance range of $2.25-$2.45.

Operational Highlights

Total sales in the third quarter amounted to $749 million, which missed the Zacks Consensus Estimate of $752.5 million by 0.5%. The top line also declined 6.6% from $802.2 million reported a year ago.

Segmental Performance

Instrumentation: Sales at this segment declined 6.9% year over year to $263.5 million in the third quarter. Lower sales of marine instrumentation, test and measurement instrumentation, and environmental instrumentation led to the downside.

The segment’s operating income declined 2.5% year over year to $50.7 million.

Digital Imaging: Quarterly sales at this division fell 1.8% year over year to $239.7 million.

The decline can be attributed to lower sales of X-ray products for dental and medical applications.

However, the segment’s operating income rose 10.4% year over year to $45.5 million due to a favorable product mix.

Aerospace and Defense Electronics: At this segment, sales of $144.8 million dropped 18.2% from the prior-year quarter due to reduced sales of aerospace electronics and defense and space electronics.

Operating income also plunged 32.4% year over year to $26.7 million on lower sales.

Engineered Systems: Sales at this division grew 2.9% year over year to $101 million in the third quarter on higher sales of engineered products and services, and turbine engines.

Operating income rose 17.9% to $12.5 million on account of higher sales and a greater mix of high-margin fixed-price manufacturing programs.

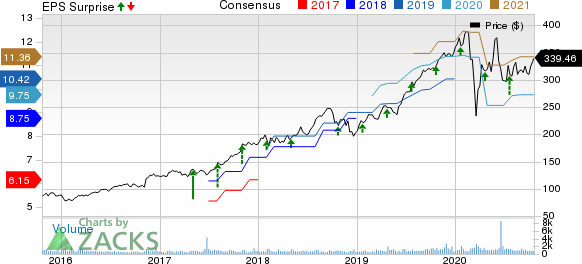

Teledyne Technologies Incorporated Price, Consensus and EPS Surprise

Teledyne Technologies Incorporated price-consensus-eps-surprise-chart | Teledyne Technologies Incorporated Quote

Financial Condition

Teledyne’s cash totaled $454.5 million as of Sep 27, 2020, compared with $199.5 million at the end of 2019. Total long-term debt summed $761.1 million compared with $750 million at 2019-end.

Cash provided by operating activities was $150.3 million for the third quarter of 2020 compared with $150.9 million for the third quarter of 2019.

In the reported quarter, capital expenditures amounted to $15.2 million compared with $25.1 million in the year-ago quarter.

Moreover, the company generated free cash flow of $135.1 million in the third quarter, reflecting a 7.4% annual growth.

Guidance

Teledyne expects to generate GAAP earnings per share of $2.56-$2.86 in the fourth quarter of 2020. Currently, the Zacks Consensus Estimate for third-quarter earnings is pegged at $2.70 per share, which lies near the midpoint of its bottom-line expectations.

For 2020, the company has raised the lower end of its earlier expected earnings guidance range. Notably, Teledyne currently anticipates generating earnings of $9.70-$10 compared with the earlier expectation of $9.45-$10.

Currently, the Zacks Consensus Estimate for Teledyne’s full-year earnings is pegged at $9.75 per share, which lies below the midpoint of its updated bottom-line expectations.

Zacks Rank

Teledyne currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Lockheed Martin LMT reported third-quarter 2020 earnings from continuing operations of $6.25 per share, which surpassed the Zacks Consensus Estimate of $6.07 by 3%.

Hexcel Corporation HXL reported third-quarter 2020 loss of 29 cents per share against the Zacks Consensus Estimate of earnings of 7 cents. The bottom line also declined from the prior-year quarter’s earnings per share of 90 cents.

An Upcoming Defense Release

Northrop Grumman NOC is set to release results on Oct 22.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research