UK grocers see stable gains amid growing COVID-19 fears

UK grocers are defying wider market trends by seeing stable gains on a day when the London Stock Exchange and other indices experience historic losses.

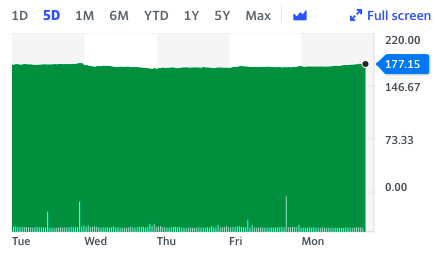

Shares in Tesco (TSCO.L) have been steadily gaining for the past week and were up 2.2% at around 3:30pm London on Monday.

Morrisons (MRW.L) has also seen an upswing all week, with shares trading higher on Monday at 1.7%.

Online demand has been surging for both grocers and will continue to do so as the COVID-19 threat looms.

On Monday, England’s chief medical officer warned the pandemic was a “six-month problem we have to deal with collectively,” as expectations grow stricter national restrictions will be announced later this week.

“If you take the view we’re heading into another lockdown and pubs and restaurants are in the firing line then supermarkets are likely to benefit from that in terms of higher weekly shop as people go out less, said Michael Hewson, chief market analyst at CMC Markets.

READ MORE: England's chief medical officer fuels fears of second lockdown for UK economy

Online sales has played a pivotal role in the surge in demand.

Tesco created 16,000 permanent jobs for its online grocery division just last month. It said online sales accounted for 16% of its total, up from 9% before the pandemic. This equates to almost 1.5 million people a week buying groceries through its website, in comparison to 600,000 at the start of the crisis.

The UK’s largest grocer also said it expects sales over the internet to jump two-thirds this year to £5.5bn ($7.15).

Similarly, Morrisons said like-for-like sales (excluding fuel) rose by 8.7% in the six months to the beginning of August. Yet, profit took a hit, falling by more than a quarter after costs rose by £155m to deal with the pandemic. This included hiring temporary workers and bonuses.

With the wider market in flux, investors are still piling into both stocks.

“Tesco and Morrisons are holding up well as providers of consumer staples – even if there is another lockdown, people will still need to eat, drink and keep their homes clean” said Russ Mould, investment director at AJ Bell. “The big grocers therefore seem like a less risky proposition than many other stocks in the UK market even if the overall benefit from their profits from spring’s stockpiling by customers and the lockdown was pretty muted, owing to the extra costs associated with the extra volumes.”

The news comes as the FTSE 100 suffered its worst plunge since June amid COVID-19 lockdown fears, falling more than 3%.