TFS Financial's (TFSL) Shares Up 3.2% on Q3 Earnings Beat

Shares of TFS Financial Corp. TFSL rallied 3.2% following the release of third-quarter fiscal 2020 results (ended Jun 30). Earnings per share of 10 cents surpassed the Zacks Consensus Estimate of 6 cents. However, the bottom line compares unfavorably with the year-ago figure of 21 cents.

Results reflect higher non-interest income, lower operating expenses and no provisioning. However, lower net interest income and declining margins were headwinds.

Net income in the quarter plummeted 54.3% year over year to $26.8 million.

Quarter in Detail

Total revenues came in at $78.2 million, down 65.1% from $223.8 million in the prior-year quarter. However, it outpaced the Zacks Consensus Estimate of $73 million.

Shrinking margins and lower yield on interest-bearing assets during the quarter resulted in the net interest income to decrease to $62.9 million from the year-earlier quarter’s $209.1 million. This was partially offset by lower interest expense. Net interest margin (NIM) shrunk 16 basis points (bps) year over year to 1.74% during the reported quarter.

Nevertheless, non-interest income increased 4.5% year over year to $15.3 million. This upswing resulted mainly from higher net gain on the sale of loans, and fees and service charges, net of amortization. However, these were partially negated by a fall in death benefits from bank-owned life insurance contracts and other income.

Non-interest expenses came in at $44.8 million, slumping 70% from the year-ago quarter. This fall primarily resulted from lower salaries and employee benefit costs, office and equipment expenses and marketing related expenses. This was muted to some extent by the rise in federal insurance premium and assessment costs.

TFS Financial’s capital ratios were well above the regulatory requirement. As of Jun 30, 2020, Tier 1 risk-based capital ratio was 11.82%. Total risk-based capital came in at 19.29%.

Credit Quality

In the second quarter, TFS Financial reported no provision for loan losses compared with the credit of $2 million from the year-ago quarter. However, net loan recoveries came in at $1.2 million, up 20% from the prior-year quarter figure.

Our Viewpoint

TFS Financial’s solid revenues and lower expenses bode well for the company. Nevertheless, contracting margins amid the low-rate environment and the pandemic-induced induced uncertainties are concerns.

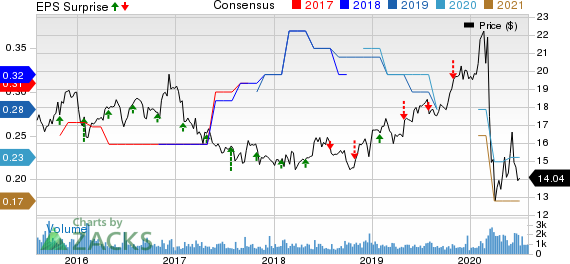

TFS Financial Corporation Price, Consensus and EPS Surprise

TFS Financial Corporation price-consensus-eps-surprise-chart | TFS Financial Corporation Quote

At present, TFS Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Associated Banc-Corp’s ASB second-quarter adjusted earnings of 26 cents per share came in line with the Zacks Consensus Estimate. The figure reflected a year-over-year plunge of 49%.

Zions Bancorporation’s ZION net earnings of 34 cents per share missed the Zacks Consensus Estimate of 37 cents in the June-end quarter. Moreover, the bottom line compared unfavorably with the year-ago quarter’s 99 cents.

BancorpSouth Bank BXS delivered an earnings surprise of a whopping 90.3% in the second quarter on higher interest income. Net operating earnings of 59 cents per share outpaced the Zacks Consensus Estimate of 31 cents. Yet, the bottom line compared unfavorably with the year-ago quarter’s 61 cents.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report

BancorpSouth Bank (BXS) : Free Stock Analysis Report

TFS Financial Corporation (TFSL) : Free Stock Analysis Report

Associated BancCorp (ASB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research