Today’s top tech news, April 18: Lazada Philippines launches cardless instalment payment option with BillEase

Also, Waitrr raises more than target, OCBC Bank collaborates with Google, Funding Societies raised US$25M, and Twitter may be filled with bots

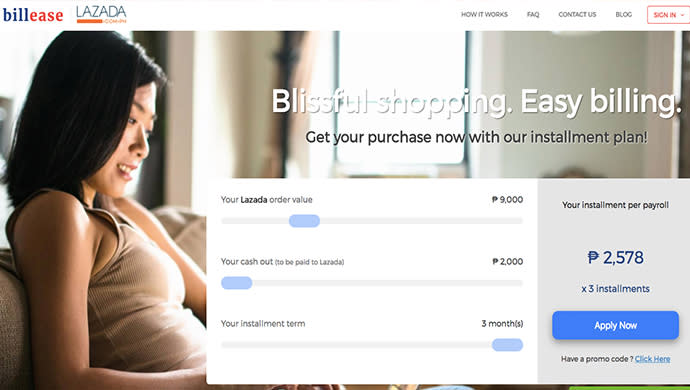

Lazada Philippines partners with First Digital Finance to launch cardless instalment payment option – [Press release]

Lazada has partnered with Philippine fintech company First Digital Finance to launch a cardless instalment payment option to the e-commerce platform.

The BillEase platform was launched by First Digital Finance in September 2017 to give eligible customers with the option to pay for their purchases in instalment without the need for a credit card. It has since received over 50,000 applications.

“BillEase is an exciting platform that provides an attractive payment solution. We’re offering Lazada customers a new way of financing their online purchases that is private and secure with flexible payment terms,” said First Digital Finance co-founder Georg Steiger in a press statement.

Also read: This Taiwanese startups helps creatives build content, nabs US$5M Series A

While Lazada has various payment methods on its website and app, this new payment feature is the first beyond traditional methods like credit cards or cash-on-delivery.

“We’re pleased that we’ve been able to respond to positive and constructive conversations we’ve had with our customers to provide this new payment service. Lazada is proud to be the only e-commerce company in Philippines to offer payment via instalments to customers with this partnership,” said Inanc Balci, CEO of Lazada Philippines.

BillEase is only one of the services by First Digital Finance, which also offers lending facilities for overseas Filipino workers and an online ending platform.

Waitrr surpasses initial target in FundedHere campaign – [Press release]

Singapore-based food and beverage mobile ordering payments app Waitrr has raised a significant amount of capital through crowdfunding platform FundedHere.

Amount raised exceeded the initial target and was funded by twelve registered FundedHere investors including reputable Singaporean investors Andy Lim, Founder and Chairman of private equity firm Tembusu Partners, and Steve Kek, CEO of OMG Venture.

Waitrr is an app that lets diners order food and make instant payments on their smartphone devices. It contains the full menu of its onboarded restaurants and orders on the app go directly to the kitchen. A favourite feature during lunch hours is it’s takeaway option, wherein users simply order and pay for their meal using the app before going to the restaurant and simply picking up their orders without the need to queue. Waitrr was launched in 2015 and now boasts a user base of 15,000 customer and 110 restaurants.

Also read: It’s gold baby! Malaysia investment startup raises Series A from 500 Startups

“We are thankful for the enthusiasm and support of the community at FundedHere, which both validates our business model and proves that we are on the right track with our product. We will put these investments to good use in our journey to improve restaurant service and create seamless dining experiences for all,” said Tim Wekezer, Waitrr Founder and CEO, in a press statement.

Waitrr’s campaign is the third oversubscribed campaign of FundedHere in recent months, following medtech startup AEvice Health and cleantech startup EcoWorth Tech. The crowdfunding platform is Singapore’s first equity and debt-based crowdfunding platform and has raised a cumulative S$8.1 million in funding for nineteen companies since it’s launch in 2015.

“Our team’s mission is to provide investors in Singapore with opportunities to grow disruptive start-ups in need of alternative funding. We are pleased to have provided Waitrr a platform to reach out to the investor community and very much look forward to its next chapter of growth,” said Daniel Lin, Co-Founder and Executive Director of FundedHere.

Waitrr will use the funds from the campaign to ramp up end-user acquisition, develop new features, and expand service beyond Singapore.

OCBC Bank first to launch AI-powered voice banking services in Singapore – [Press release]

In collaboration with Google, OCBC Bank is the first in Singapore to launch AI-powered voice banking services. With the launch of Google Home and Google Home Mini ins Singapore, OCBC Bank services like planning for retirement or saving for a child’s education or getting the latest financial updates can be accessed by voice using the Google Assistant either via smartphone of a Google Home device.

The Google Assistant will provide consumers with another self-service digital channel to interact with OCBC Bank wherein consumers can pose general banking questions to the Google Assistant at any time of the day to get instant responses. This complements other self-service digital channels such as AI-powered chatbot ‘Emma’, which OCBC Bank launched in 2017 to answer home and renovation loan queries on the OCBC Bank website.

Also read: Indonesian student printing platform Cetaku raises seed funding round led by IDN Media

“This is the new digital – conversational, smarter and simpler access to banking. For our customers to be able to interact with OCBC services by simply speaking to AI assistants on their smartphones and smart home devices is an exciting development, and an important one as we shape the bank of the future,” said Aditya Gupta, Head of E-Business Singapore of OCBC Bank.

OCBC Bank remains the only bank in Singapore to offer voice-based banking on digital voice assistants as a medium for customer interaction and engagement.

Funding Societies raises US$25M series B – [TechCrunch]

Peer-to-peer lending platform Funding Societies has announced today that it has raised US$25 million in a series B round led by Softbank Ventures Korea, according to a report by TechCrunch. Returning investors Sequoia India, Golden Gate Ventures, and Alpha JWC Ventures, as well as new investors Qualgro and LINE Ventures also participated in the round.

Funding Societies is a Singapore-based startup created to provide SMEs access to more means of financing.

Prominent southeast Asia Twitter users sprout possible fake followers – [Financial Times]

Journalists, academics, activists, entrepreneurs, and UN officials who tweet about or live in southeast Asian countries have seen an increase in their followers by hundreds – even thousands – of anonymous accounts according to this article by the Financial Times.

The anonymity of most accounts in the mass-following have fuelled unconfirmed theories that political or commercial entities are exploiting the site, as most accounts have the general indication of being bots designed to generate automatic posts – have no or few followers, do not have photos or biographical data, and follow the account of the same people.

While other parts of the world have already seen this mass-following phenomenon, this is the first time that southeast Asia have noticeably been affected.

The post Today’s top tech news, April 18: Lazada Philippines launches cardless instalment payment option with BillEase appeared first on e27.