Top 10 biggest private property losses of 2018

By Fiona Ho

Sentosa Cove condos dominate the list of greatest loss-making transactions of the year

Contrary to popular belief, not all property investments lead to profit. In this article, we take a look at the top 10 highest private property losses for the year 2018.

High-end properties located in Sentosa Cove dominate the list, with losses averaging at about 40%.

Top 10 biggest private property losses of 2018

Sentosa Cove condos dominate the list

Half of the 10 greatest loss-making transactions this year occurred at Turquoise, a leasehold project in Sentosa Cove. This includes the biggest loss of the year, which was incurred by the seller of a 4-bedroom unit at the development in September. The seller had purchased the sixth floor unit at Turquoise in November 2007 for over $9.53 million ($2,545 psf) when the development was still under construction.

It changed hands for $4.4 million ($1,175 psf) in September 5 this year, translating to an eye-watering loss of $5.13 million (53.8% overall loss), and an annualised loss of 6.9% over a holding period of 10.8 years. The sale also marked an all-time record loss for units transacted at Turquoise, which comprises 91 units and was completed in 2010.

Meanwhile, the second largest loss at the Turquoise was registered by a 2,777 sq ft, four-bedroom unit sold for $3.8 million ($1,368 psf), according to a caveat lodged in June 2016. The unit was first purchased at the peak of the market in November 2007 for $7.16 million ($2,580 psf). This translates to a loss of over $3.36 million or 47%, and it was a distressed sale.

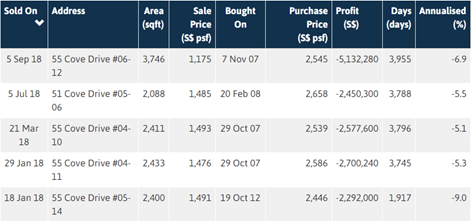

To date, there have been 16 unprofitable transactions and just one profitable transaction at the Turquoise. There were five transactions in 2018 and all five transactions were unprofitable, as shown in the table below:

Aside from the year’s biggest loss, transactions at the Turquoise in 2018 came up to an average loss of $2.5 million, with an average percentage loss of 42%.

Biggest losses in prime district 9

The sale of a four-bedroom unit on the 27th floor of The Tate Residences landed the second spot on the list of biggest loss-making properties of the year. The $3.3 million loss is the highest recorded loss within prime district 9 this year, and is also an all-time record loss for units transacted at the condo.

The seller had purchased the 3,229 sq ft unit in August 2007 for $11.3 million ($3,500 psf) when the development was still under construction, and so it for $8 million ($2,477 psf) on April 25. This translates into a 3% annualised loss for the owner over a holding period of 10.7 years.

The other district 9 condo on the list was Grange Infinite, at which the sale of a 2,217 sq ft three-bedroom unit at Grange Infinite on Grange Road saw a loss of $2.5 million. It made the number sixth spot of our list of the biggest loss-making properties this year.

The eighth-floor unit in the 36-storey tower at Grange Infinite was sold for $4.55 million ($2,052 psf). It was previously purchased for $7.05 million ($3,181 psf) in late 2007, when the project was first launched for sale. The seller therefore sustained a 35.5% loss after holding the unit for 11 years.

*This story is contributed by EdgeProp.sg

Related stories:

New launches sustain sales in November