Trading Activity in Technology Stocks Soars

The 19 June trading session saw Venture as the fifth most actively traded company with S$91M in turnover. AEM Holdings, Hi-P International, UMS Holdings, Creative Technology & Valuetronics also ranked in the top 40 companies by turnover.

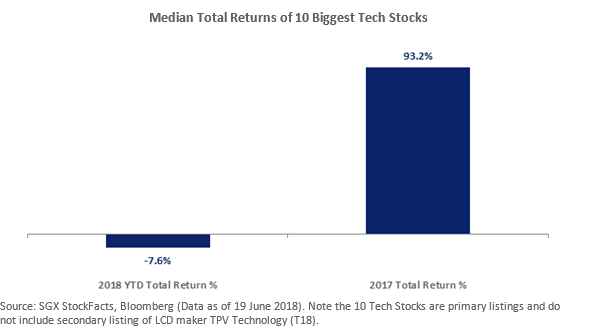

These stocks make up six of the 10 largest capitalised Technology stocks listed on SGX that generated a median decline of 8% in the 2018 YTD, following median gains of 93% over 2017. The SIPMM Electronics Cluster PMI is now at 52.3, down 0.9 from the end of 2017.

Technology is earmarked as a key driver of U.S. growth. The Trump Administration estimates 5G will potentially create up to 3 million new American jobs and generate US$500 billion a year in economic growth. This is akin to a 2.5 percentage point increase in U.S. GDP.

Singapore’s Technology stocks are diverse and highlight the City-state’s strength in technology hardware manufacturing. This has provided for a continued track record of competitive dividend distributions in addition to creating foundations for the formation of disruptive technologies.

The 10 largest capitalised primary listed technology stocks include companies focused on technology assembly, products and distribution, semiconductor and electronic components in addition to application software and services.

Last year these 10 stocks generated a median total return of 93.2% and have followed up in the 2018 year through to 19 June with a median decline of 7.6%. The 10 stocks have also been comparatively volatile with median 12 month volatility at 43.9%.

Marginal Declines in SIPMM Electronics Cluster in 5M18

The Singapore Institute of Purchasing and Materials Management (“SIPMM”) Electronics Sector PMI is currently at 52.3 after finishing 2017 at 53.2. Although declining 0.9 points over the first five months of 2018, the gauge has recorded 22 months of continuous expansion. Throughout the 2017 year the gauge advanced 2.0 points from 51.2 at the end of 2016.

SIPMM noted on 4 June that anecdotal evidence suggested that despite concerns amongst electronics manufacturers about a possible global trade war, several firms were developing their digital capabilities for high-value manufacturing.

10 Biggest Singapore Tech Plays

As illustrated above, the 10 stocks have generated a median decline of 7.5% in the 2018 year through to 19 June. Note the median is used in place of average due to Creative Technology’s outlier performance of 428.0% after unveiling its new Super X-Fi 3D audio product earlier in the 2018 year. The stocks also continue to maintain an indicative dividend yield of 3.4% on both a median and simple average basis. For more details on the stocks below in SGX StockFacts click on the stock name.

Name | SGX Code | Market Cap (S$M) | 19 Jun Closing Price | CCY | YTD Total Return % | 2017 Total Return % | 12M Div. Yield % | 12M Volatility % |

V03 | 5,311 | 18.490 | SGD | -7.1 | 115.4 | 3.2 | 39.6 | |

5CP | 1,381 | 0.520 | SGD | -8.1 | 18.8 | 2.3 | 22.3 | |

H17 | 934 | 1.160 | SGD | -36.2 | 326.5 | 3.5 | 50.2 | |

C76 | 425 | 5.650 | SGD | 428.0 | 10.9 | N/A | 130.5 | |

558 | 424 | 0.790 | SGD | -20.4 | 122.3 | 6.1 | 40.6 | |

T18 | 361 | 0.154 | SGD | -32.3 | -6.1 | 1.1 | 144.7 | |

E16 | 360 | 1.928 | USD | -3.9 | 83.0 | 5.6 | 32.3 | |

BN2 | 298 | 0.695 | SGD | -23.6 | 103.5 | 3.7 | 47.3 | |

AWX | 286 | 1.060 | SGD | 27.9 | 498.6 | 1.5 | 58.2 | |

C33 | 269 | 0.290 | SGD | -1.7 | 37.5 | 3.4 | 29.3 | |

Average | 32.3 | 131.0 | 3.4 | 59.5 | ||||

Median | -7.6 | 93.2 | 3.4 | 43.9 |

Singapore’s largest Technology Assembly, Products & Distribution stock, Venture Corp has declined 7.1% in the 2018 year through 19 June. This followed on from its 115.4% total return in 2017. At the same time Singapore’s largest capitalised Semiconductor & Electronics Component play, UMS Holdings, has declined 20.4% in the year thus far, after generating a 122.3% total return in 2017.

Beyond the 10 stocks tabled above, the next five largest capitalised stocks with a technology business Sunningdale Tech, CSE Global, Frencken Group, Tai Sin Electric and Memtech International generated a similar median decline of 8.0% in the year thus far, followed by 75.1% median total returns in 2017.Source: SGX StockFacts, Bloomberg (Data as of 19 June 2018). Note stocks tabled above are primary listings and do not include secondary listing of LCD maker TPV Technology (T18). * Elec & Eltek International returns in SGD terms.

Technology a Key Variable in Global Trade and Global Growth

As the two largest economies engage in an open trade dispute, GDP growth remains a mutual objective. As relayed by U.S. Commerce Secretary Wilbur Ross last week, technology is expected to be a key driver of U.S. growth in future years. Secretary Ross estimated that 5G will potentially create up to 3 million new American jobs, and generating US$500 billion a year in economic growth, is akin to a 2.5 percentage point increase in U.S. GDP.

Secretary Ross also noted that the U.S. leads the world in the application of 4G wireless technology while China and South Korea are trying hard to position themselves to dominate the next generation of 5G, with China shaping to be the biggest 5G market by 2022.

The potential reductions in latency and power requirements for 5G networks are expected to benefit the ongoing evolution of disruptive technologies.

Electronics also continues to be a key growth sector for Singapore’s economy. As highlighted in March by Senior Minister of State for Trade and Industry, Dr Koh Poh Koon, the output of the Singapore’s electronics cluster grew by more than 30% in 2017, supported by strong growth in the semiconductors segment which made up close to two-thirds of the electronics manufacturing GDP.

Singapore currently maintains second ranking to the U.S. amongst a group of 63 countries in the Swiss IMD World Digital Competitiveness Ranking.

This article was originally published on SGX.