TreeHouse Foods (THS) Perks Up Guidance on Q2 Earnings Beat

TreeHouse Foods, Inc. THS released strong second-quarter 2020 results, wherein both top and bottom lines advanced year over year and the latter beat the Zacks Consensus Estimate. The company’s retail business catered well to the unexpected rise in demand amid the coronavirus pandemic, which compensated for softness in the food-away-from-home business and distribution losses. Encouraged by a solid performance, the Zacks Rank #2 (Buy) company raised its financial guidance for 2020.

Quarter in Detail

Adjusted earnings from continuing operations amounted to 58 cents per share that surpassed the Zacks Consensus Estimate of 47 cents. Further, the bottom line grew 45% year over year on the back of better operational performance, as the company continued to cater to the burgeoning demand amid the pandemic.

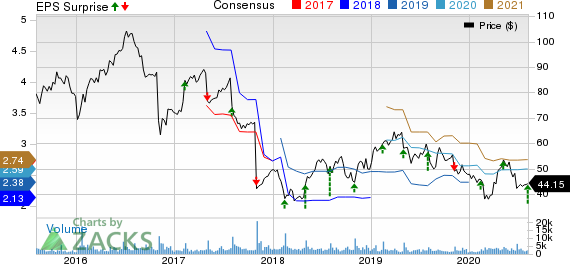

TreeHouse Foods, Inc. Price, Consensus and EPS Surprise

TreeHouse Foods, Inc. price-consensus-eps-surprise-chart | TreeHouse Foods, Inc. Quote

Net sales of $1,041.9 million came below the consensus mark of $1,069 million, while it advanced 1.6% year over year. Organic sales grew 3.7% owing to higher volume/mix, backed by elevated retail demand due to the pandemic, which countered distribution loss impacts and weak demand in the food-away-from-home channel. Also, adverse pricing, divestiture of two in-store Bakery facilities and currency woes partly hurt organic sales. Notably, organic sales improved in both Meal Preparation and Snacking & Beverages segments.

Gross margin came in at 18.4%, down 10 basis points (bps) from the year-ago quarter’s figure. This was accountable to higher costs incurred in connection with the pandemic, like higher production shifts, increased sanitization measures, supplemental payments and protective equipment. This was partly compensated by improved channel mix of greater retail business along with elevated throughput at the company’s production and distribution centers. In fact, adjusted gross margin expanded 120 bps to 20.1%, thanks to productivity gains across manufacturing and distribution facilities.

Total operating expenses, as a percentage of sales, dropped 3.3 percentage points to 15.9%, courtesy of reduced restructuring costs and SG&A control measures, somewhat negated by elevated employee costs. However, adjusted EBITDA from continuing operations rose 13.1% to $119.2 million on productivity gains and improved channel mix, partially countered by higher employee costs.

Segment Details

As notified earlier, the company has reorganized itself from three segments (on the basis of product categories) to two segments (on the basis of market dynamics).

Meal Preparation: During the quarter, sales in the segment climbed 1.6% year over year to $657.5 million. The upside was backed by improved volumes/mix, primarily stemming from the coronavirus-led increase in retail demand, which compensated for distribution losses and lower food-away-from-home demand. This was partially mitigated by currency woes. Direct operating income (DOI) margin in the segment rose 1.6 percentage points on better channel mix and a decline in SG&A expenses.

Snacking & Beverages: Net sales rose 1.7% to $367.8 million on improved volumes/mix, courtesy of the coronavirus-led increase in retail demand, which compensated for distribution losses and adverse mix associated with divestitures. Also, adverse pricing and currency woes were deterrents. DOI margin rose 1.5 percentage points due to productivity gains led by pandemic-induced demand.

Other Financial Updates & Guidance

The company concluded the quarter with cash and cash equivalents of $293.9 million, long-term debt (excluding operating lease liabilities) of $2,086.6 million and total shareholders’ equity of $1,803.7 million. In the first six months of 2020, cash provided by operating activities of continuing operations amounted to $123.3 million.

Management remains encouraged with its operations amid the pandemic-led burgeoning demand. Also, the company is impressed with its restructuring and reorganization actions, which helped it perform well even amid the crisis. The company remains optimistic about its prospects for the private label space and expects revenues to remain strong in the remainder of 2020. It also expects high costs associated with COVID-19-related safety measures.

All said, the company raised its guidance for 2020. Revenues are now expected to be toward the upper end of its previously guided range of $4.10-$4.40 billion. The company delivered net sales of $4288.9 million (nearly $4.29 billion) in 2019. For 2020, management now expects adjusted earnings from continuing operations of $2.55-$2.75 per share compared with $2.40-$2.65 forecasted earlier. The company recorded EPS of $2.39 in 2019. The Zacks Consensus Estimate for sales and earnings in 2020 is currently pegged at $4.35 billion and $2.59 per share, respectively.

Net sales for the third quarter of 2020 are expected in a band of $1.04-$1.08 billion, nearly flat (on a year-over-year basis) at the midpoint. Organic sales are likely to rise 2%. Adjusted EBITDA from continuing operations is anticipated in a band of $112-$127 million, suggesting almost a 6% increase at the midpoint. Further, management expects adjusted earnings from continuing operations of 55-65 cents, suggesting a roughly 9% increase at the midpoint. The Zacks Consensus Estimate for third-quarter sales and earnings is pegged at $1.06 billion and 61 cents per share, respectively.

Shares of the company have declined 17.5% in the past three months against the industry’s growth of 8.5%.

Looking for More Solid Food Stocks? Check These

Kraft Heinz KHC, which currently carries a Zacks Rank #2, has a long-term earnings growth rate of 6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Campbell Soup CPB, with a Zacks Rank #2, has a long-term earnings growth rate of 8.3%.

B&G Foods BGS, with a Zacks Rank #2, has an impressive earnings surprise record.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.3% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Campbell Soup Company (CPB) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

BG Foods, Inc. (BGS) : Free Stock Analysis Report

The Kraft Heinz Company (KHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research