Trump's barbs cast shadow over Fed meeting

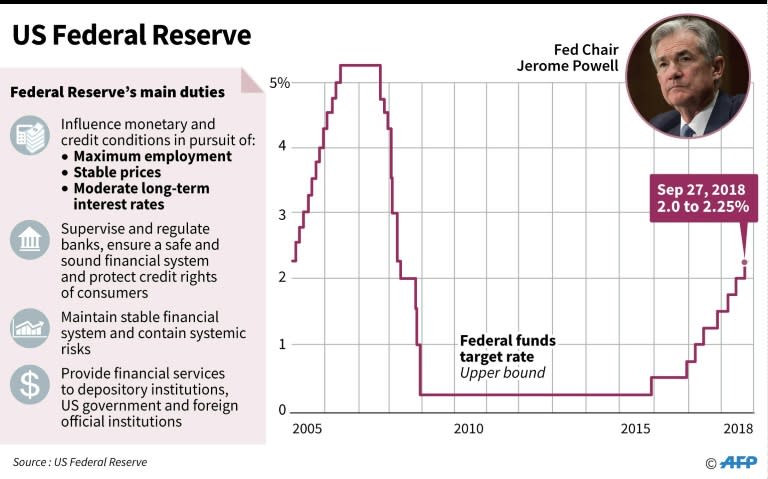

The US central bank is set to open its two-day policy meeting on Tuesday and despite renewed attacks from President Donald Trump is expected to announce the fourth interest rate increase of 2018. While the Federal Reserve may feel pressure to demonstrate its independence from political influence by raising the benchmark lending rate, there are legitimate concerns about the need for more moves amid signs the economy is slowing and no hint of runaway prices. Trump on Tuesday warned the Fed not to make "yet another mistake" by raising interest rates, the second consecutive day he has gone after the central bank on Twitter. A growing number of economists share Trump's basic argument -- albeit in more diplomatic language -- and have dramatically rolled back estimates for the number of increases in the benchmark lending rate they expect next year. At first glance the United States seems to have a Goldilocks economy: unemployment is flirting with a 50-year low at 3.7 percent, drawing people into the workforce who had been left on the sidelines; inflation is barely two percent; and business confidence is very high. But cracks have started to appear and elements fueling continued growth are fizzling out, while problems that had been ignored or overshadowed by good news are now garnering more attention. Many economists now say the economy may have peaked, especially since the housing market has been trending downwards in recent months. In addition, Trump's trade wars, signs China's economy is slowing and the impact of Brexit on an already sluggish European economy add to the sense of global uncertainty that has led stock markets in recent weeks to sell off, wiping out all their gains for the year. Economist Diane Swonk of Grant Thornton said "the Fed knows we are still in uncharted economic waters and doesn't want to risk overshooting on rates now that growth appears to be slowing." - Under pressure - In fact, Fed Chairman Jerome Powell in recent statements has indicated the central bank is considering suspending its rate increases while it takes time to view more economic data. Swonk and other economists expect the policy-setting Federal Open Markets Committee to send a strong signal of that planned pause in its statement Wednesday, when it raises the policy rate another 0.25 percentage points. The Fed has raised the key lending rate eight times since December 2015, bringing it from zero to 2.25 percent, but next year may make only one or two moves. Trump would rather the Fed stop now but his input complicates the situation. "I hope the people over at the Fed will read today's Wall Street Journal Editorial before they make yet another mistake," he tweeted. The Journal editorial called for the Fed to ignore political pressure and "follow the signals that suggest a prudent pause." Trump has repeatedly broken with the norm respected by US presidents in recent decades to refrain from criticizing the Fed, hammering the central bank this year. He called the central bank "crazy," "out of control" and a greater economic threat than China, which the president blames for hollowing out American industry through unfair trade. On Monday, in a tweet sent one hour before stock markets were due to open, Trump called it "incredible" that the Fed was "even considering yet another interest rate hike." But analysts and former Fed members say Trump's unprecedented vitriol could cause central bankers to try to prove their independence by raising rates even if they might otherwise have held off. Economist Chris Low said that would be a mistake. "True central bank independence is the freedom to do the right thing independent of the whims of the executive," Low said.