UK house prices rise at fastest pace in 18 years

UK property prices are rising at the fastest monthly pace in 18 years, according to new figures.

One estate agent said the property market was “exploding back to life,” after last month’s decisive general election result provided some short-term clarity over Brexit.

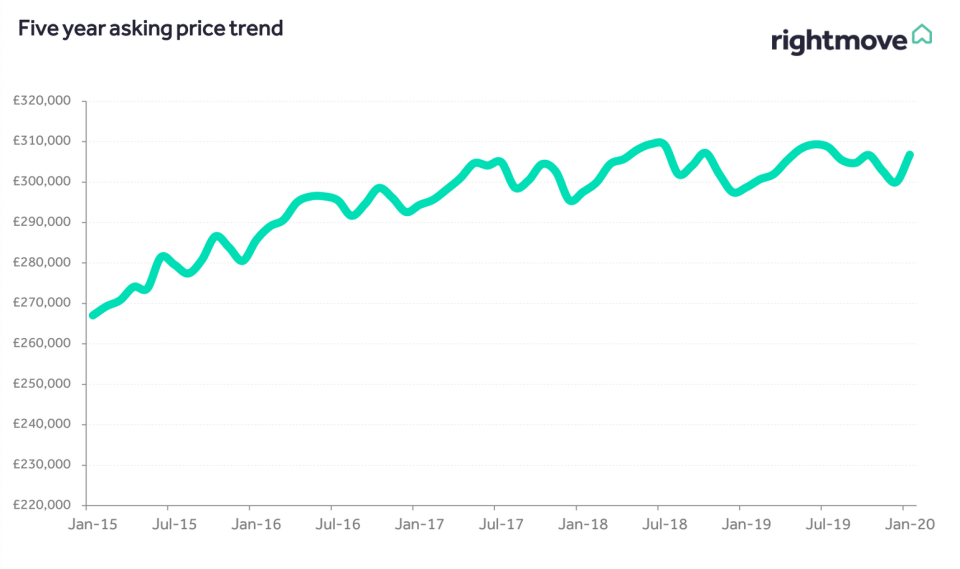

Rightmove’s house price index recorded its biggest ever monthly leap in asking prices at this time of year. The index, the largest monthly sample of residential sales, has been published since 2002.

Average asking prices in early January came in at £306,810 ($685,023), some £6,785 higher than one month earlier.

READ MORE: London rents rise at fastest pace in more than two years

It marked an increase of 2.3% month-on-month and a 2.7% rise on one year earlier, compared to a 0.9% decline between November and December.

The property listing site also said more than 1.3 million aspiring buyers had made enquiries to estate agents since the election on 12 December, 15% more than a year ago.

Price trends for different-sized properties

Rightmove released a breakdown of price trends for different sectors of the market, excluding inner London because of its exceptional trends.

Prices rose fastest for detached homes with at least four bedrooms and any property with more than five bedrooms.

Such larger property prices rose 3.1% over the month to an average of £528,221.

Studio, one- and two-bed properties saw the smallest gains, up 1.6%, but still hit a record high.

Miles Shipside, Rightmove director and housing market analyst, said it marked a “downside” for first-time buyers, who are most likely to try to buy such properties.

He said: “These statistics seem to indicate that many buyers and sellers feel that the election result gives a window of stability.”

“Whilst a substantial rise is the norm in January, buoyed by the start of a new year, this is the biggest new-year price surge that we have ever recorded.”

READ MORE: Persimmon sales slump after ‘poor workmanship’ on homes

But he said the market remained “price-sensitive” because of strained buyer affordability, and warned sellers not to get “carried away with their pricing.”

He said a shortage of properties coming to market in many areas amid the Brexit uncertainty of the past year had been partly behind the upwards price pressure.

Colby Short, founder and CEO of GetAgent.co.uk, said buyer and seller sentiment had been building “like a coiled spring” as political uncertainty curbed activity.

“The election has proven to be the release point for this built-up tension, with the market exploding back to life almost instantly and both buyers and sellers jumping back in at the deep end where enquiries and asking price increases are concerned,” he said.

Price trends for different nations and regions

Some areas saw prices fall over the past month, despite the leap in the UK average.

Prices dropped at a monthly rate by 0.9% in Wales to an average of £193,106, and slid by 0.8% in Scotland to £149,664.

In Yorkshire and the Humber, prices dropped 0.1% to £190,579.

The biggest jump came in the east of England, with a 2.7% rise to an average of £350,607. The West Midlands saw average prices rise 2.6% to £230,222.

London, where price growth has slowed or gone deeper into reverse than other areas in recent years, saw the third biggest jump. Asking prices hit an average of £612,645 in January, up 2.1%.