UK jobs boom roared in late 2019, despite election jitters

By William Schomberg and David Milliken

LONDON (Reuters) - The number of people in work in Britain jumped again at the end of last year, according to data which underscores how the labour market has defied a broader economic slowdown in the run-up to December's election.

The number of people in work jumped by 180,000 in the October-December period to 32.934 million, at the top end of forecasts in a Reuters poll of economists.

Full-time employment accounted for most of the growth, while self-employment also rose strongly, the Office for National Statistics data showed.

Signs of weakness in the labour market in the autumn - when Britain faced deep uncertainty about Brexit and the outcome of a polarising national election - prompted two Bank of England interest-rate setters to vote for a cut to borrowing costs.

But the BoE's other seven rate-setters backed keeping borrowing costs on hold amid signs that the economy has picked up following Prime Minister Boris Johnson's election triumph on Dec. 12.

The number of people out of work dropped by 16,000 to 1.290 million, the ONS data showed.

The unemployment rate of 3.8% remained at its joint lowest level since early 1975.

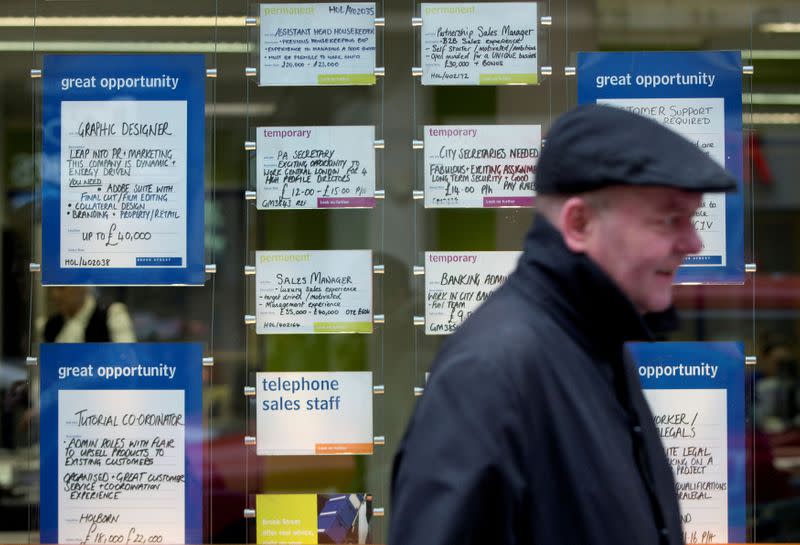

In another sign of confidence among employers about their hiring intentions, vacancies in the three months to January rose to 810,000, their highest since the three months to September.

"The jobs market remains remarkably robust, with employment levels rising despite the UK economy stalling at the end of last year," said Suren Thiru, head of economics at the British Chambers of Commerce.

PRODUCTIVITY CONCERNS

"However, the strong headline figures mask underlying problems. Lingering economic uncertainty can mean companies hire staff to fill orders rather than investing for the long-term, weakening productivity."

Tuesday's data showed Britain's productivity growth - the flipside of strong increases in jobs - remains a problem.

Output per hour in the fourth quarter rose by 0.3% in quarterly and annual terms. While the year-on-year growth rate was the strongest since the second quarter of 2018, the ONS said the numbers did not represent a breakthrough.

Many employers fear that Brexit-related uncertainty will return in 2020 as Johnson has ruled out extending a transition period with the European Union beyond the end of the year, saying he will clinch a free trade deal with the bloc by then.

Growth in pay has also slowed steadily in recent months.

Total earnings growth including bonuses rose by an annual 2.9%, the weakest gain since the three months to August 2018.

Excluding bonuses, pay growth also slowed to 3.2%, its slowest increase since the third quarter of 2018.

Economists had expected total pay to grow by 3.0% and regular pay to grow by 3.3%.

"In real terms, regular earnings have finally risen above the level seen in early 2008, but pay including bonuses is still below its pre-downturn peak," ONS statistician Myrto Miltiadou said.

The data also showed workers born in the EU's 27 countries rose by nearly 6% in annual terms in the fourth quarter of 2019, ahead of Britain's departure from the bloc on Jan. 31 this year. That was the biggest such increase since the start of 2017.

(Writing by William Schomberg; Editing by Andy Bruce and Gareth Jones)