Sluggish US economy points to more jobless misery

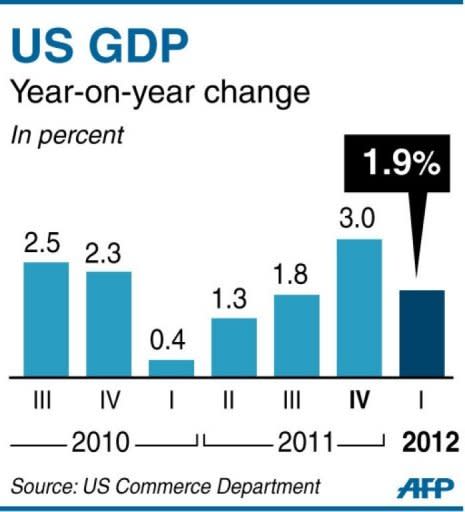

The US economy grew more slowly than thought in the first three months of the year, new estimates showed Thursday ahead of the government's May jobs and unemployment report. The Commerce Department said the world's largest economy expanded at an annual rate of 1.9 percent in the first quarter, instead of the 2.2 percent pace initially estimated last month. The slowdown followed a 3.0 percent growth rate in the final quarter of 2011 and offered fresh evidence of the economy's struggle to gain traction almost three years after the Great Recession. Fresh jobs indicators for May on Thursday suggested that second-quarter economic conditions would do little to spur recovery in the sick labor market. Payrolls firm ADP reported private-sector employment rose by a modest 133,000 jobs in May, well below expectations, from April's 113,000 number. And new claims for US unemployment benefits -- indicating the pace of layoffs -- rose by 10,000 to 383,000 in the week ending May 26, the Labor Department said. The four-week moving average also increased, for the first time in four weeks. The lackluster data came just five months ahead of the November presidential election in a race dominated by high unemployment concerns. President Barack Obama argues that his Democratic administration has kept the economy out of depression after the Wall Street financial meltdown. His Republican foe Mitt Romney insists his business-friendly, less-regulation approach will rev up growth and the jobs machine. The first-quarter slowdown was due in part to declines in private inventory investment and a pick-up in imports, the Commerce Department said. "Leaner inventories are a plus for second-quarter growth, but incoming evidence suggests that second-quarter growth will be uninspiring like the first quarter -- around 2.0 percent," said Nigel Gault, chief US economist at IHS Global Insight. Chris Low at FTN Financial agreed. "Momentum in the economy has stalled with growth at about 2.0 percent, a level consistent with slower job growth ahead," Low said. Joel Naroff of Naroff Economic Advisors noted the ADP data showed hiring activities by small and midsized companies had softened significantly. "Since they create just about all the jobs, that is not good news," he said. "Firms are no longer swiftly cutting positions as during the height of the recession, but because of uncertainty surrounding domestic fiscal policy and global economic health," said Sara Kline at Moody's Analytics. But, she said, "they have not yet switched gears" to consistently expand their work forces. Meanwhile global outplacement firm Challenger, Gray & Christmas warned that a surge in layoffs is in the pipeline. Challenger said that the nation's employers announced plans in May to cut 61,887 workers from their payrolls, the most since last September and up 53 percent from April's figure. The data came ahead of the Labor Department's May employment report Friday. Analysts expected 150,000 jobs were added, better than April's meager 115,000 jobs, but still just barely keeping up with the growth in the labor force. The national unemployment rate was anticipated to remain unchanged at 8.1 percent. In April, the jobless rate fell to 8.1 percent from 8.2 percent the previous month, mainly due to more than 300,000 workers dropping out of the labor force. Steven Ricchiuto, chief economist at Mizuho Financial Group, said the May job numbers could spur the Federal Reserve to unleash more economic stimulus, such as another round of asset purchases, or quantitative easing. "Should the payroll number come in below 100,000 tomorrow then the policy risk will shift from extension of Twist to outright QE," he said.