Virtu Financial (VIRT) Q2 Earnings Surpass, Increase Y/Y

Virtu Financial Inc's VIRT second-quarter 2020 earnings per share of $1.72 beat the Zacks Consensus Estimate by 9.6%. Moreover, the bottom line skyrocketed 975% year over year.

The company benefited from the market volatility amid the COVID-19 outbreak.

Revenues of $669 million soared 180% year over year on the back of heightened market volatility, bid-ask spreads, and trading volumes and asset classes. Moreover, the top line surpassed the consensus mark by 3.4%.

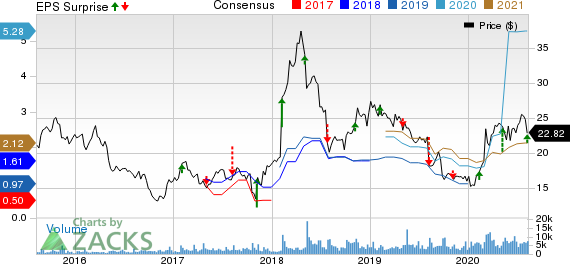

Virtu Financial, Inc. Price, Consensus and EPS Surprise

Virtu Financial, Inc. price-consensus-eps-surprise-chart | Virtu Financial, Inc. Quote

Quarterly Operational Update

Adjusted trading income of the company surged 179.9% to $668.7 million year over year.

In the quarter under review, adjusted EBITDA jumped 444.8% to $485.8 million.

Total operating expenses jumped 13.5% year over year to $501.4 million.

This upside was owing to higher brokerage, exchange and clearance fees, employee compensation and payroll taxes, etc.

Segmental Update

Adjusted net trading income from the Marketing Making segment ascended 262.3% year over year in the quarter under review. Under this segment, adjusted net trading income from Global Equities rose 305% year over year while the same from Global FICC, Options and Other climbed 105% year over year.

Adjusted net trading loss from Execution Services was $689 million against the prior-year quarter’s net trading income of $355 million.

Dividend Update

The company's board of directors declared a quarterly cash dividend of 24 cents per share, payable Sep 15, 2020 to its shareholders of record as of Sep 1.

Financial Update

As of Jun 30, 2020, the company had total assets worth $10.2 billion, up 7.1% from the level at 2019 end.

It exited the quarter with total equity of $1.7 billion, up 38.4% from the level on Dec 31, 2019.

The company exited the second quarter with $670.7 million of cash and cash equivalents, down 8.4% from the 2019-end level.

In the quarter under review, long-term borrowings dropped 9.7% from the level at 2019 end.

Zacks Rank and Performance of Other Players

Virtu Financial currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Of the other companies in the same space that already reported second-quarter earnings, the bottom-line results of American Express Company AXP, Visa Inc. V and Synchrony Financial SYF beat the respective Zacks Consensus Estimate.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Express Company (AXP) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

Synchrony Financial (SYF) : Free Stock Analysis Report

Virtu Financial, Inc. (VIRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research