Weak economy, high oil prices fuel efficiency drive: IEA

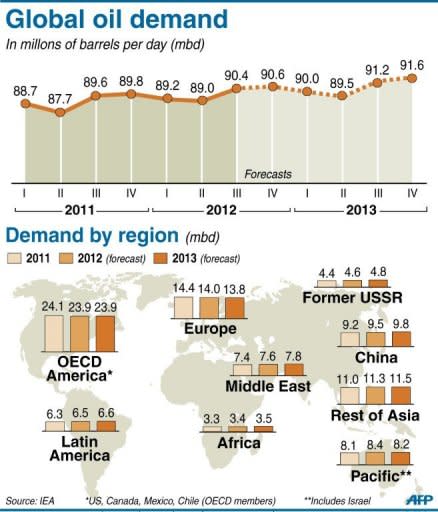

The strains of weak growth in the world economy and high oil prices are fuelling increased energy efficiency, the International Energy Agency said on Wednesday, forecasting a crimp on oil demand in 2012. These factors will also cap demand growth in 2013, the agency said. "The pace of oil demand growth is expected to remain relatively steady over the next 18 months, with annual gains of just 0.8 million barrels per day in both 2012 and 2013," the agency said in its latest Oil Market Report. "This modest growth rate reflects the combined effects of sluggish global economic activity, historically elevated oil prices and global improvements in energy efficiency," said IEA, an offshoot of the Paris-based Organisation for Economic Cooperation and Development. With Brent futures indicating that prices would remain above $100 in 2012 before dipping to just below $99 in 2013, the persistently high prices are giving consumers an incentive to cut consumption. "This is best encapsulated by the rapid decline in global oil intensity, which is forecast to fall by 2.3 percent in 2012 and 2.5 percent in 2013, a greater decline rate than the previous 15 year average of 2.2 percent," said the agency. Oil intensity is a measure of the role of oil in the overall mix of energy supplies. Prices soared on Wednesday, with Brent North Sea crude for October delivery hitting its highest level since May 3 of $116.67, up $1.27. New York's main contract, light sweet crude for delivery in October, was up 82 cents at $97.99 a barrel, its highest price since August 29. With the growth of the global economy expected to be merely 3.3 percent in 2012 and 3.6 percent in 2013, the weak macroeconomic backdrop is also expected to cap oil demand growth, the IEA said. The IEA was created as a result of the oil crises of the 1970s to monitor energy markets, advise OECD countries on energy policy and to oversee strategic oil reserves. It said that Europe showed the weakest growth trend while struggling with a public debt crisis, with demand for oil expected to decline by 2.6 percent in 2012, the IEA observed. Asian OECD countries are expected on the other hand to post oil demand growth of 3.3 percent on the back of Japanese nuclear outages. However a gradual recovery of nuclear capacity in Japan is expected to reduce demand for oil in Asia, leading to a decline of 1.9 percent in 2013, while a "more robust European economic outlook in 2013, with GDP (gross domestic product) growth of 0.8 percent", would result in a modest decline of 1.3 percent for the region. Oil output by Iran meanwhile continued to fall, declining by 50,000 barrels per day to 2.85 mbd in August, as Western sanctions over its controversial nuclear programme hurt demand. However, its exports emerged from a trough in July, and signs show that further gains may be made in September with China, South Korea and India among to boost imports during the month. In August, Turkey showed the biggest increase in appetite for Iranian imports in August which were up by about 150,000 barrels per day to 200,000 barrels. Malaysia's imports also rose by 100,000 barrels per day to 130,000. However, the IEA said the growth may be temporary as the West appeared set to tighten sanctions. "Both US and European officials look poised to tighten sanctions further given the lack of progress in negotiations over Iran's nuclear programme," it said. Overall, OPEC crude supply fell by 0.1 mbd month on month to 90.8 mbd in August, with Nigeria, Angola and Iraq posting the biggest increases, while non-OPEC supply dipped 0.2 mbd in August from a month ago. The Organization of Petroleum Exporting Countries predicted on Tuesday that world oil demand will reach 88.74 mbd in 2012, up from the previous estimate of 88.72 mbd, and higher than 87.89 mbd in 2011.