What's in Store for The Children's Place's (PLCE) Q1 Earnings?

The Children's Place, Inc. PLCE is likely to witness a decline in the top line when it reports first-quarter fiscal 2022 numbers on May 19, before the market opens. The Zacks Consensus Estimate for revenues is pegged at $406 million, suggesting a decline of 6.8% from the prior-year reported figure.

The Zacks Consensus Estimate for quarterly earnings per share has been stable at $1.66 over the past 30 days. It suggests a sharp decline from earnings of $3.25 reported in the year-ago period. This children's specialty apparel retailer’s bottom line has outperformed the Zacks Consensus Estimate in the trailing four quarters.

Key Factors to Note

On its last earnings call, management had guided mid-single to high single-digit decline in first-quarter fiscal 2022 net sales. This is due to lapping record government stimulus year ago, the uncertainty surrounding soaring inflation, the impact of the permanent store closures since the first quarter of last year, supply chain bottlenecks, and the impact of the Omicron variant.

Management had also cautioned about decade-high cotton price. It expects gross margin to be lower in the first half of fiscal 2022. It had projected first-quarter SG&A expenses in the range of $112 million, higher than last year, primarily due to incremental investments in brand marketing and the impact of lapping the temporary store closures in Canada last year. Cumulatively, these are likely to have weighed on the to-be-reported quarter's bottom line.

Despite aforementioned headwinds, we cannot ignore the company’s effort to mitigate these challenges. The company has been accelerating fleet optimization initiative, directing resources toward digital platforms, and taking pricing actions to offset higher raw material costs. It has been focusing on “Superior Product” strategy to resonate well with millennial customers and advancing omni-channel capabilities.

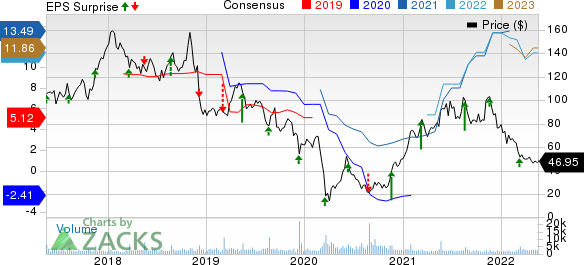

The Children's Place, Inc. Price, Consensus and EPS Surprise

The Children's Place, Inc. price-consensus-eps-surprise-chart | The Children's Place, Inc. Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for The Children's Place this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Children's Place has an Earnings ESP of 0.00% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

3 Stocks With Favorable Combination

Here are a few companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Costco COST currently has an Earnings ESP of +1.90% and a Zacks Rank #2. The company is likely to register bottom-line improvement when it reports third-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $3.04 suggests an increase of 10.6% from the year-ago quarter’s reported figure.

Costco's top line is expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $51.76 billion, which indicates an improvement of 14.3% from the figure reported in the prior-year quarter. COST has a trailing four-quarter earnings surprise of 13.3%, on average.

Ross Stores ROST currently has an Earnings ESP of +1.24% and a Zacks Rank #2. The company is likely to register bottom-line decline when it reports first-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 99 cents suggests a decline from $1.34 reported in the year-ago quarter.

Ross Stores’ top line is expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $4.54 billion, which indicates a marginal improvement of 0.5% from the figure reported in the prior-year quarter. ROST has a trailing four-quarter earnings surprise of 33.3%, on average.

Casey's General Stores CASY currently has an Earnings ESP of +3.73% and a Zacks Rank #3. The company is likely to register an increase in the bottom line when it reports fourth-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $1.48 suggests an increase of 32.1% from the year-ago reported number.

Casey's top line is expected to increase year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $3.34 billion, which suggests an increase of 40.4% from the prior-year quarter. CASY has a trailing four-quarter earnings surprise of 21.6%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

The Children's Place, Inc. (PLCE) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research