Why Did Koda Slump 43 Percent From High Of $1.095?

Koda has dropped 43 percent from the high of $1.095 on 31 October 2017, to close $0.625 on 16 March 2018. Has Koda’s fundamentals deteriorate since October 2017 to warrant such a massive price decline?

I have the privilege of meeting Mr Joshua Koh, CEO of Commune Lifestyle Pte Ltd (Commune Lifestyle) for a 1 on 1 discussion over Koda / Commune’s operations and prospects.

Company Background

Koda was established in 1972 by Mr Koh Teng Kwee. It started off producing wooden TV and speaker cabinets. Since its inception, Koda has progressed from being an Original Equipment Manufacturer (OEM) to an Original Design Manufacturer (ODM). Its forte is in home furniture and it is possibly the largest dining room furniture exporter in Southeast Asia.

Besides its ODM business, Koda established Commune Lifestyle in 2011. This is their in-house brand, managed by the 3rd generation of the founding Koh family. Commune Lifestyle has presence in Singapore, Malaysia, China and Australia and is currently their largest growth driver. Readers can refer to the respective websites for more information on Koda (click HERE) and Commune (click HERE).

Koda has been listed on SGX since 18 January 2002.

Investment merits

Attractive Valuations

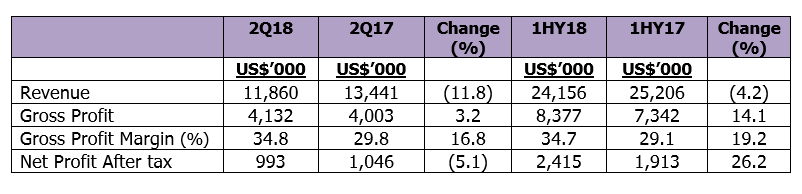

Based on Table 1 below and on an annualised basis, Koda trades at 8.2 times FY18F price-to-earnings (PE) at the current price of $0.625.

Table 1: Koda’s 1H18 results at a glance

Source: Company

The above is noteworthy on two fronts:

2Q18 results were impacted by timing differences. Shipments to key export markets ordered in December were mostly shipped in early January. Thus, 2Q18 results should have been stronger;

Based on its 2Q18 results, Koda is sitting on a net cash amounting to US$7.4 million. On an ex-cash basis, Koda trades at 6.7 times FY18F PE.

Just for illustration purposes with some companies in the furniture space, in HTL International’s take-over offer in early 2016, it was offered 11 times based on their profit guarantee in Year 1 (click HERE). Man Wah which delisted in Singapore in Sep 2009 and subsequently listed on Hong Kong Stock Exchange in April 2010 is trading at 16.1 times estimated earnings based on Bloomberg’s figures.

Notwithstanding the above, both HTL International and Man Wah are larger than Koda and are not exactly “apples-to-apples” comparisons.

China Growth Story

From the current 43 distributor-retail stores in China, Commune Lifestyle is set to more than double its presence by expanding to 100 stores by June 2020. Koda believes that China holds great potential as it is common knowledge that the Chinese government is shifting from export-led growth to an economy focused on domestic consumption. In addition, Koda believes that its Commune Lifestyle brand is perceived by the Chinese consumers as avant-garde. This is because their stores are distinctively black, yet they offer a range of contemporary furniture that suits a wide audience of consumers.

In addition, to deepen and expedite its expansion into China, Koda may have possible strategic collaboration with other local industry players.

But not ignoring the rest of Asia

In a joint announcement with IE Singapore on 13 February 2018, it was reported that IE Singapore will work with Commune Lifestyle to expand into Taiwan, Indonesia and Thailand. Besides having expansion plans for Taiwan, Indonesia and Thailand, Koda may plan to expand their brand into Philippines too. Based on Koda’s 2Q18 results, it was reported that Koda may start to have Commune Lifestyle presence in new markets within Asia over the course of 2018.

Besides helping Commune to expand, IE Singapore will also support the development of a digital platform to complement Commune’s physical presence.

Net Cash Company With Dividends

Koda has only US$0.88m in debt as of December 2017. It has cash and cash equivalents amounting to US$8.26 million. For the past three years, it has also been giving out dividends (See Table 2 below). However, it is noteworthy that although Koda distributed $0.035 in FY17, this dividend per share is slated to drop as Koda has done two bonus issues in 2017.

Table 2: Dividend Record For Past Three Years

Source: Shareinvestor

ODM Business Is Not Going Away

According to management, Koda’s ODM business is still growing. US, Koda’s largest export market continues to be buoyed by good GDP data, job creation and wage growth. US housing sector continues to be resilient too which should bode well for Koda’s ODM business.

Expansion With Limited Capex

Inclusive of their recent acquisition of land buildings in Vietnam in October 2017, average utilisation rate is around 70 to 80 percent. (Optimal utilisation rate is around 85-90 percent). However, management emphasises that its utilisation rate is based on one shift alone. If they expand to 1.5 to 2 shifts, they can have a significant increase in their capacity without much capex.

Furthermore, Koda is buying new equipment (i.e. CNC machines) with the aim of improving productivity and managing the rising cost of labour. Such investments in new equipment are unlikely to exceed US$1 million per year.

1st Share Buyback Since September 2016

Koda started its first share buyback since September 2016 by buying 2,000 shares at $0.640 on 12 March 2018. Although this is a small quantity limited by Koda’s lack of liquidity, this is still a positive signal that management feels the company is undervalued. It is noted that share buyback on the market transaction is limited to 105 percent of the average closing price over the last five trading days. Let’s monitor and see whether the buybacks will continue.

Succession Planning

Several SGX listed family-owned listed companies do not have a clear succession plan. It is assuring that the 3rd generation of Koh family has the passion and willing to continue the older Kohs’ business.

Transformation Bears Fruit

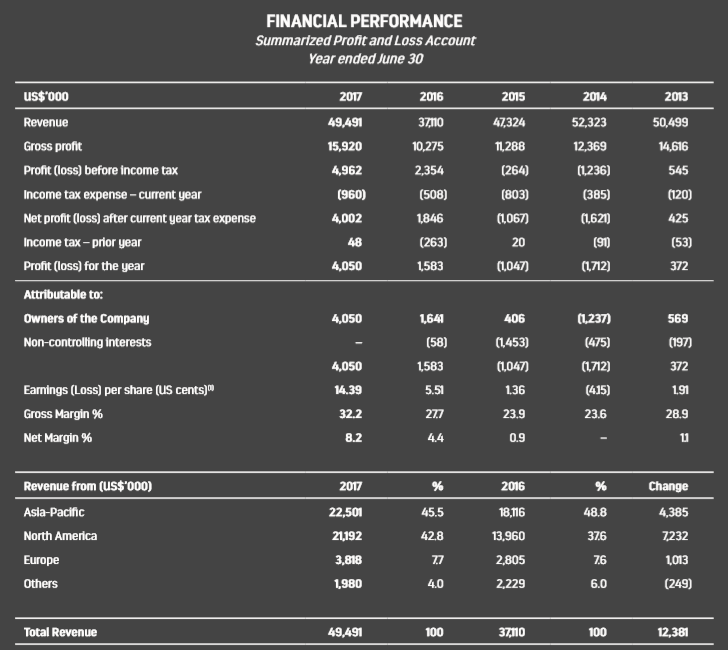

Since Commune Lifestyle started in 2011, it has streamlined its operations (such as consolidating production facilities in Vietnam and relocating factories out of China) and disposing loss making retail business (Rossano) in Vietnam. Koda has posted more encouraging results in recent financial years. Table 3 below shows the rising net profit and margins since FY15. In fact, FY17 net profit of US$4.1 million was the best performance in the past eight years. If Koda can replicate its 1H18 net profit of US$2.4 million in 2H18F, it will be another record year in the past nine years.

Table 3: Financial Results

Source: Company

Investment risks

Some noteworthy investment risks are as follows:

Demise of the retail channel

There have been concerns that e-commerce platforms will / have rendered brick and mortar shops obsolete. Management is aware of such challenges and have put in some interesting and useful retail technologies such as virtual reality simulation, coupled with 3D floor planner at their Commune Lifestyle stores. This even caught the attention of Sim Ann, Senior Minister of State at the ministries of Culture, Community and Youth and Trade and Industry who quoted Commune Lifestyle in her speech at the Retail Center of Excellence on 10 October 2017 (Click HERE for her speech).

Illiquid with daily average 30D volume amounting to 37K shares

Notwithstanding the two bonus shares issuance last year, Koda’s shares are thinly traded. Average 30D and 100D volume amount to 37,000 shares and 76,000 shares respectively. This is not a liquid company where investors with meaningful positions can enter or exit quickly.

Lease Expiry End Of This Year?

Based on Koda’s FY17 annual report, Koda’s head office and warehouse at 28 Defu Lane 4 has a lease expiry at end 2018. Management clarified that they still have 1-2 years after to negotiate the lease and to assess their options.

No Rated Coverage

During 2007 – 2008, Koda was covered by a few brokerage houses, namely OCBC, Maybank and RHB. However, Koda’s results weakened after the global financial crisis and analysts gradually dropped coverage. As of now, there is still no rated analyst coverage on Koda. Notwithstanding Koda’s long operating history, it is likely that some investors and fund managers are still not familiar with Koda’s business and prospects, thus it may take some time for the market to get to know this company.

Possible Execution Risks In Overseas

Koda currently has 43 distribution-retail stores in China spanning Beijing, Shanghai, Nanjing, Tianjin etc. They have plans to expand to 100 stores in China and at least eight stores in other parts of Asia by June 2020. In view of their aggressive expansion, there may be possible execution risks. However, management seems confident that they should be able to execute their carefully planned expansion targets without significant hiccups.

Small Cap

Koda is a small company with an approximate market capitalisation of $51 million. With its small market capitalisation and illiquid nature, it may be difficult to attract analysts and fund managers’ attention.

Trade Tariffs

If the global countries engage in destructive and stiff trade tariffs, Koda will be affected too, together with its other peers.

P.S: Do note the above list of risks is not exhaustive

Chart analysis

Based on Chart 1 below, Koda has slumped 43 percent after hitting a high of $1.095 on 31 October 2017. This may be attributed partly to the two rounds of bonus issues in less than a year. Koda is entrenched in a downtrend with all the exponential moving averages (EMAs) moving lower, coupled with death cross formations. Amid negatively placed directional indicators, ADX has risen from 18.8 on 5 February 2018 to close 48.7 on 16 March 2018. This indicates that the downtrend is quite strong. Notwithstanding the bearish chart, it is assuring that the breakdown at its 200D EMA of around $0.655 is not accompanied with larger than expected volume. In fact, volume has largely decreased since 1 March 2018. In addition, indicators such as RSI are exhibiting bullish divergences. This may indicate that the downtrend is weakening in momentum but may not mean that an impending rebound is on the way. It is noteworthy that a sustained breach above $0.655 would alleviate the strong bearish trend. Only a sustained breach above $0.765 would completely negate the bearish trend of the chart.

Near term supports: $0.615 / 0.600 – 0.605 / 0.570

Near term resistances: $0.655 / 0.700 / 0.725

Chart 1:

Source: Chartnexus 16 March 2018

P.S: Chart reading is subjective especially for illiquid stocks.

In A Nutshell

Koda has slumped 43 percent from an intraday high of $1.095 on 31 October 2017 to close $0.625 on 16 March 2018. If the company can continue to execute its plan in expanding to China and other parts of Asia, and delivers on its results, the current (low) price may be an opportunity for investors, who believe in Koda’s management and prospects.

Notwithstanding the above, readers should be aware of some of the potential risks in Koda (the list of risks is by no means exhaustive). It is important to do your due diligence before making any trading or investment decision. Readers who have questions on Koda can contact their investor relation firm WeR1 (contacts on Koda’s press release) for more information. Readers can also consider visiting Commune Lifestyle’s stores (click HERE for the stores’ location)

P.S: I am currently vested. However, please note that as I am a full time remisier, I can change my position fast to capitalize on the markets’ movements.

Disclaimer

Please refer to the disclaimer HERE