World Cup, Brexit and Open Banking among weapons for fraudsters to 'try to take advantage'

Fake World Cup tickets and dubious Brexit investments could be the weapon of choice for scammers this year alongside a radical overhaul of Britain's banking sector, warned security experts at NatWest.

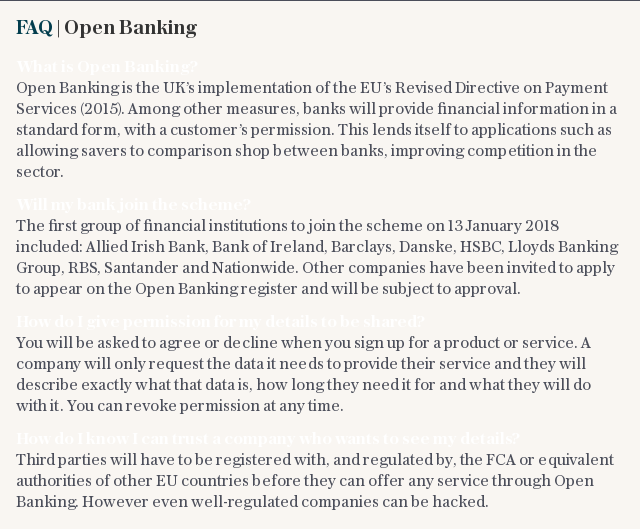

Open Banking was launched in January, though few British banks are yet on board, and will allow consumers to securely share their banking data with third parties, such as price comparison and budgeting apps.

Advocates say this will make it easier for customers to find better deals and will contribute £1bn to the British economy, but some security experts have warned it could create new avenues for fraudsters to exploit the vulnerable.

Research by consumer group Which? suggested as many as nine in 10 consumers were unaware of the change, months before its January implementation.

Julie McArdle, NatWest’s security manager, warned that fraudsters will try to take advantage. “We know criminals try to use any new tools at their disposal,” she said. “Open banking is secure and will be strictly regulated, but as with any new technology, criminals will take hold of the opportunities it represents.”

She said scammers could attempt to create “copycat” firms which appear to be compliant with open banking but in reality are fraudulent attempts to steal your money.

All providers taking part in open banking must be properly regulated by the Financial Conduct Authority or a European equivalent, and Ms McArdle said caution was needed to ensure the app, or company, you share your data with satisfies those requirements.

A spokesman for Open Banking said its security procedures had been “rigorously tested” and that consumers retained complete control of their own data.

She added: “Open Banking takes the risk of fraud very seriously and has worked with banks and building societies, consumer advocacy groups and specialist organisations to build a set of specifications that have security at their centre.”

Customers will never be asked to give banking passwords to other companies, as is the case with so-called "screen scrapers" which provide a similar service, and will instead authorise third parties directly with their bank.

Open Banking will this week launch a list of all providers registered with its directory so consumers can easily check the status of a service they wish to use.

Digital bank Monzo has accused the High Street banks of "scaremongering" around Open Banking, saying it will increase competition.

Other events taking place in 2018 which NatWest warned scammers may take advantage of included the World Cup in Russia, Brexit and the Royal Wedding. Ms McArdle warned consumers to be aware of buying football tickets which turn out to be forgeries or entering into questionable investments marketed around Brexit.

Malware, malicious software which allows fraudsters to influence a device, targeting mobile phones is also likely to increase throughout the year, according to Ms McArdle. “People are using smartphones more, and moving away from traditional online devices. More people are banking on their phones and that leaves them vulnerable if they aren’t properly protected,” she explained.

NatWest advises customers to be vigilant, always follow their bank’s security advice and keep their smartphones operating system up to date.