World stocks rally fizzles, but oil offers support

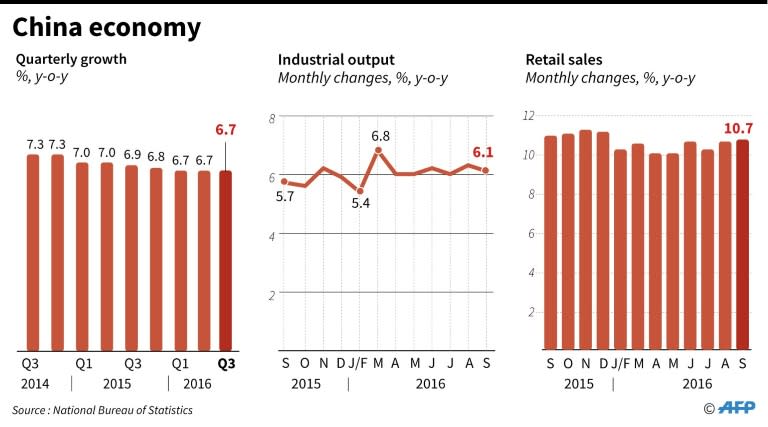

A global stocks rally stuttered Wednesday as dealers mulled Chinese growth numbers, ahead of the final US presidential debate and on the eve of a eurozone interest rate decision. But rising oil prices -- which hit their highest point this year, following a surprise drawdown in US crude stockpiles -- kept equities in mildly positive territory, dealers said. London, Frankfurt and Paris all showed small gains at the close after pulling back from early weakness. US stocks also finished narrowly positive, boosted by energy and banking shares after strong earnings reports from oil services giant Halliburton and investment bank Morgan Stanley. After strong gains Tuesday, European equity markets were handed an underwhelming session from Asia, where Shanghai finished flat and Hong Kong dipped, while Tokyo, Sydney and Singapore found higher ground. New data showed Wednesday that China's economy grew 6.7 percent in the third quarter from July-September, compared with a year earlier. That matched the annual clip from both the first and second quarters, and chimed with expectations. But some China watchers warned that authorities have relied too much on easy credit, which has in turn increased financial risks. Some analysts also expressed skepticism at what Mike van Dulken, research boss at traders Accendo Markets called "suspiciously stable China GDP growth." Markets are watching closely as Democrat Hillary Clinton and her Republican rival Donald Trump wade into their last presidential debate later Wednesday, with the latter sliding in opinion polls amid allegations of sexual misconduct and wild charges of a "rigged" US election. Dealers will also be keenly following an ECB meeting on Thursday after speculation it is considering tapering its vast quantitative easing (QE) stimulus. Despite the chatter, many analysts expect it to maintain its easing programme and possibly flag fresh measures in December. - Oil prices surge - US oil prices finished at their highest level since July 2015 after the Department of Energy reported that American petroleum stockpiles fell 5.2 million barrels last week. Among individual stocks, Dow member Intel slumped 5.9 percent as it projected fourth-quarter sales of $15.7 billion, below the $15.9 billion analysts expected. That outlook renewed worries about the chipmaker's prospects as more consumers turn away from personal computers in favor of smartphones. In Tokyo, Mitsubishi Motors surged 7.9 percent following a report by the Nikkei business daily that Nissan chief Carlos Ghosn will become chairman of the embattled carmaker. In May, Nissan threw Mitsubishi a lifeline as it announced plans to buy a one-third stake in the crisis-hit automaker for about $2.2 billion, forging an alliance that will challenge some of the world's biggest auto groups. The purchase came after Mitsubishi was hit by a mileage-cheating scandal that slammed the brakes on sales. - Key figures at 2100 GMT - New York - Dow: UP 0.2 percent at 18,202.62 (close) New York - S&P 500: UP 0.2 percent at 2,144.29 (close) New York - Nasdaq Composite: UP 0.1 percent at 5,246.41 (close) London - FTSE 100: UP 0.3 percent at 7,021.92 points (close) Frankfurt - DAX 30: UP 0.1 percent at 10,645.68 (close) Paris - CAC 40: UP 0.3 percent at 4,520.30 (close) EURO STOXX 50: UP 0.3 percent at 3,057.47 Tokyo - Nikkei 225: UP 0.2 percent at 16,998.91 (close) Hong Kong - Hang Seng: DOWN 0.4 percent at 23,304.97 (close) Shanghai - Composite: UP less 0.1 percent at 3,084.72 (close) Euro/dollar: DOWN at $1.0973 from $1.0979 Tuesday Dollar/yen: DOWN at 103.42 yen from 103.87 yen Pound/dollar: DOWN at $1.2283 from $1.2295 Euro/pound: UP at 89.34 pence from 89.29 pence Oil - West Texas Intermediate: UP $1.31 at $51.60 per barrel Oil - Brent North Sea: UP $0.99 at $52.67