New Zealand: Attracting the rich and famous

View of Auckland, New Zealand’s biggest city.

A strong economy, political stability, better real estate returns, and an abundance of magnificent natural beauty make New Zealand one of the world’s most attractive property markets for overseas buyers.

By Michelle Yee

Amid the growing political instability in the US, and terror attacks in several European destinations, more foreign investors are looking Down Under, particularly New Zealand, for attractive buying opportunities, as well as for migration for a better life.

News reports have revealed that New Zealand’s government granted approval for the purchase of 465,863ha by foreigners last year, an almost six-fold rise on the previous year. Net migration also hit a record 70,588 last year, with 1,286 US citizens granted permanent residence.

According to a report by the Financial Times, Silicon Valley’s rich and famous are among those who have bought homes in New Zealand, notably Peter Thiel, PayPal co-founder and Facebook board member, who was reported to have bought a £4.5 million (S$8.2 million) lakeside property near the town of Wanaka in 2015.

Other reputable figures who have acquired New Zealand properties include renowned film director James Cameron, hedge fund guru Julian Robertson, and Matthew and Brian Monahan, co-founders of Inflection, a big data company in Silicon Valley.

Clearly, the country of 4.69 million people – as of June 2016 – is experiencing a foreign investment and migration boom.

Layne Harwood, Country Head of Knight Frank New Zealand, shared that investment by the ultra-rich in New Zealand had always been reasonably strong, but interest levels had substantially increased in the last two years.

“High profile investors like Peter Thiel have been very supportive of New Zealand as an investment and lifestyle destination,” he said.

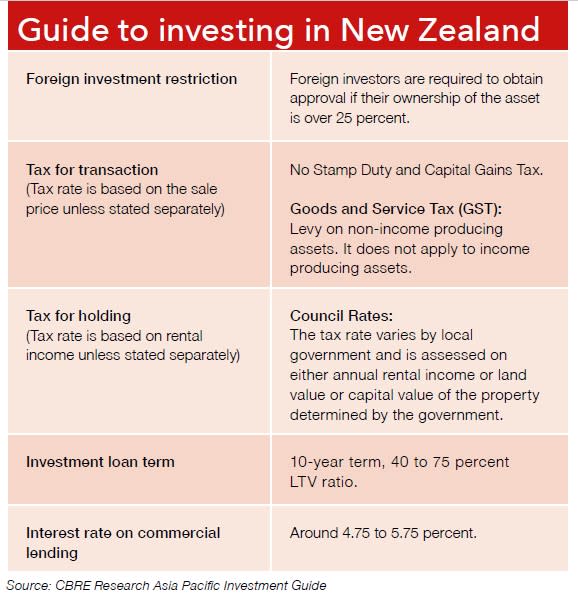

Sharing some of the factors that are drawing investors to New Zealand, a representative from Christie’s International Real Estate said, “A strong economy, magnificent natural beauty and a friendly image are key selling points for New Zealand’s foreign realestate buyers. Add to that the country’s property laws – which do not include stamp duty, capital gains tax or visa requirements – and the result is one of the world’s most attractive property markets for overseas buyers.”

Why invest in New Zealand

A nature haven

For those who have never visited New Zealand, they might recall catching a glimpse of this stunning country in two blockbuster movies: The Lord of the Rings and The Hobbit, which were both filmed there.

Truly, the sights and wonders of both the North and South Islands must be seen to be believed – think majestic mountain vistas, geothermal pools, spectacular lakes, hidden beaches and rustic buildings. It’s no wonder many call New Zealand a paradise on earth.

Another allure of living in New Zealand is the lack of congestion and pollution, which one will find in most countries. Imagine a land the size of the UK or Japan, but with just a fraction of the number of people.

In the country’s largest city – Auckland, the population is only about 1.5 million people, and in the country’s capital of Wellington, the population currently stands at 0.4 million.

Strong economy

According to reports, New Zealand’s economy is growing at an annual rate of 3.5 percent, while house prices surged an average of 52 percent from January 2013 to August 2016.

And experts say the country’s economy is set to continue growing at a healthy pace of around three percent plus this year, on the back of solid domestic demand supported by accommodative monetary policy and strong net migration.

The Bank of New Zealand (BNZ) expects GDP growth of 3.1 percent, and BNZ economist Doug Steel said ongoing strength in migration would put upward pressure on that forecast.

Strong growth in tourist and migrant arrivals

According to recent data released by Statistics NZ (SNZ), a record number of migrants entered New Zealand in 2016 on work visas, and more tourists chose the country as a holiday destination. And economists expect migrant in-flows to keep rising.

“Annual net migration hit 70,600 in December 2016, with the biggest net migrant gains from China, India, the UK and the Philippines. Migrant arrivals rose four percent to 127,300, while short-term visitor arrivals, which includes tourists, people visiting family and friends, and people travelling for work, reached 3.5 million last year, up 12 percent from the year earlier,” SNZ said.

Looking ahead, analysts believe the strong growth in the number of migrants and overseas visitors is set to continue to stimulate the country’s economy and property sector.

“Strong growth in the number of overseas visitors, up 11 percent over the last year to 3.5 million visitors is supporting growth across the country. Tourism is one of our largest earners of overseas income,” stated a Savills report.

The report added that stronger population growth, particularly in Auckland because of increased positive overseas net migration, is expected to continue to support growth.

Potential for capital appreciation

Property website QV.co.nz reported that in December 2016, the average home value around the nation’s biggest city, Auckland, was about NZ$730,000 (S$704,547), up 12.2 percent from the year earlier, while values near Queenstown, a South Island outdoor adventure mecca, soared 31.6 percent to roughly NZ$725,000 (S$699,542).

And analysts say that prices are likely to continue an upward trend.

“House prices are expected to remain elevated in many parts of the country, particularly Auckland, after strong growth in 2016 and 2017, reflecting limits in the housing supply response to growth in housing demand. High house prices continue to underpin strong residential investment growth in the second half of 2017 and in 2018,” said a New Zealand Treasury report.

Road toward Mount Cook, New Zealand.

Buying guide

Overseas property restrictions

Overseas ownership restrictions include the requirement for Overseas Investment Commission approval for an overseas national to acquire or take more than a 25 percent stake in:

• Properties or businesses worth more than NZ$100 million (S$96.5 million)

• Land over five hectares and / or worth more than NZ$10 million (S$9.65 million)

• Land deemed sensitive

• Land on most offshore islands

Transaction costs / legal fees

Fees typically range between 0.8 percent and 1.2 percent of the value and are negotiable.

Stamp duty

There is no stamp duty.

Agency fees

Agency fees vary with the size of the assignment. Typically, agent fees range from two percent to four percent for residential properties, and one percent to 2.5 percent for commercial / industrial properties depending on the size of the transaction. The vendor typically pays agency fees, however, in certain circumstances the agency fee is paid by the purchaser.

For more information, visit www.linz.govt.nz.

INTERNATIONAL HIGHLIGHTS

New Zealand has emerged as an up-and-coming investment destination due to its high standard of living, favourable climate and stunning scenery. We check out two projects in Auckland that are drawing keen interest from foreign buyers.

NEW PROJECTS

The Pacifica

Commerce Street, Auckland, New Zealand

Type: Apartment

Developer: Hengyi Pacific (NZ) Ltd

Facilities: Lap pool, sauna, steam room, spa, gymnasium, yoga studio, library, resident’s lounge, barbecue terrace

Nearby Key Amenities: Britomart, Silo Park, Viaduct precincts

Nearest Transport: Bus stops

Starting Price: NZ$640,000 (S$621,731)

Situated in downtown Auckland, The Pacifica, which is a luxury apartment tower developed by Hengyi Pacific (NZ) Ltd and designed by Plus Architecture, is without a doubt the perfect epitome of city living at its best. Overlooking Waitemata Harbour, the 295-unit development is set to become the tallest residential tower in the country.

It is centrally located close to a slew of attractions and conveniences including Britomart, Silo Park and the Viaduct precincts. Beach lovers will just be a short drive away from some of the region’s most beautiful beaches and island getaways.

Prices range from NZ$640,000 (S$621,731) for apartments to NZ$1,100,000 (S$1,068,368) for “Skyhomes” and penthouses. The Pacifica is slated to be completed by September 2020.

Wynyard Central

Wynyard Quarter, Auckland, New Zealand

Type: Mixed-use development

Developer: Willis Bond & Co.

Facilities: Gymnasium, swimming pools, carpark

Nearby Key Amenities: Britomart, Viaduct Harbour, North Wharf, Saint Mary’s Bay, Queens Wharf

Nearest Transport: Bus stops

Starting Price: NZ$1,150,000 (S$1,117,173)

Despite its proximity to Auckland’s bustling Central Business District, Wynyard Central, which is located within the prime and regenerated Wynyard Quarter, feels like a private hideaway. It offers magnificent views of one of the world’s most beautiful harbours.

The largest marina in the southern hemisphere – Westhaven – is also within walking distance from the development. A collaboration between Willis Bond & Co. and one of New Zealand’s leading architecural firms, Architectus, this exclusive development will offer three different styles of residences: pavilions, townhouses and apartments.

Prices start from NZ$1,150,000 (S$1,117,173) for a two-bedroom apartment with carpark, and NZ$1,495,000 (S$1,452,009) for a three-bedroom apartment with carpark.

This article was first published in the print version PropertyGuru News & Views. Download PDFs of full print issues or read more stories now! | |||