Ensign Group (ENSG) Shares Up 2% Despite Q3 Earnings Miss

Shares of The Ensign Group, Inc. ENSG have gained 2.1% since it reported strong third-quarter 2022 results on Oct 26. Consistent improvement in occupancies, Medicare and managed care revenues contributed to the quarterly results. A raised 2022 earnings per share (EPS) guidance might have buoyed investors’ optimism on the stock.

Nevertheless, the upside was partly offset by a rising expense level resulting mainly from an elevated cost of services level.

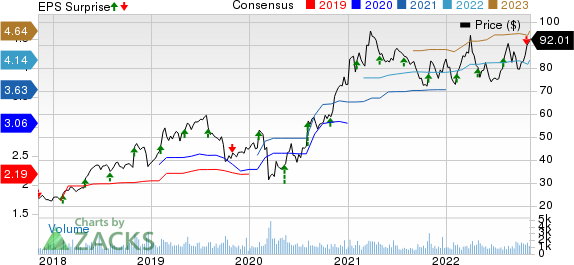

The Ensign Group, Inc. Price, Consensus and EPS Surprise

The Ensign Group, Inc. price-consensus-eps-surprise-chart | The Ensign Group, Inc. Quote

Q3 Update

Ensign Group reported third-quarter 2022 adjusted operating earnings of $1.04 per share, which missed the Zacks Consensus Estimate by a whisker. The bottom line climbed 14.3% year over year.

Operating revenues of $770 million grew 15.2% year over year on the back of improved skilled services and rental revenues. The top line beat the consensus mark by 2.7%.

Adjusted net income of $59.2 million rose 14.3% year over year in the quarter under review.

Same-store occupancy improved 2.4% year over year, while transitioning occupancy advanced 5.3% year over year. Same-store and transitioning managed care revenues climbed 9.7% and 25.9%, respectively, on a year-over-year basis.

Total expenses of $695.7 million escalated 15.5% year over year due to increased cost of services, rent-cost of services, general and administrative expenses, and depreciation and amortization.

Segmental Update

Skilled Services: Revenues logged $739.3 million, up 15.1% year over year in the third quarter but fell short of the Zacks Consensus Estimate of $752 million. Segmental income rose 7.8% year over year to $101.8 million.

Skilled nursing and campus operations of the segment totaled 222 and 26, respectively, at the third-quarter end.

Standard Bearer: Revenues climbed 29.8% year over year to $18.7 million. Segmental income of $6.9 million tumbled 12.6% year over year.

Funds from Operations (FFO) increased 1.4% year over year to $12.5 million in the third quarter.

Financial Update (as of Sep 30, 2022)

Ensign Group exited the third quarter with cash and cash equivalents of $308.9 million, which advanced 17.8% from the 2021-end level. ENSG had an available capacity of $593.3 million under its credit facility at the end of the quarter.

Total assets of $3,265.3 million increased 14.5% from the figure at 2021 end.

Long-term debt less current maturities dipped 1.8% from the figure as of Dec 31, 2021 to $150.2 million.

During the first nine months ended Sep 30, 2022, net cash provided by operating activities grew 8.7% from the prior-year comparable period’s level to $222.3 million.

Capital-Deployment Update

Ensign Group did not buy back shares in the third quarter as part of the share repurchase program authorized by management in July 2022.

ENSG paid out a quarterly cash dividend of 5.5 cents per share in the quarter under review.

2022 Guidance

On the basis of continued improvements in occupancies, skilled mix and reimbursement, management raised the full-year outlook for revenues and EPS.

Revenues are anticipated between $3.01 billion and $3.03 billion this year, up from the prior view of $2.96-$3 billion. The midpoint of the revised guidance suggests a rise of 16.2% from the reported figure of 2021.

EPS is currently predicted within $4.10-$4.18, higher than the previous guidance of $4.05-$4.15. The midpoint of the revised guidance indicates 14% growth from the 2021 reported figure.

Zacks Rank

Ensign Group currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the Medical sector players that have reported third-quarter results so far, the bottom-line results of Universal Health Services, Inc. UHS, Centene Corporation CNC and HCA Healthcare, Inc. HCA beat the respective Zacks Consensus Estimate.

Universal Health reported third-quarter 2022 adjusted earnings of $2.54 per share, beating the Zacks Consensus Estimate by 5.8%. However, the bottom line fell 4.9% year over year. Net revenues of $3.3 billion improved 5.7% year over year in the third quarter. The top line outpaced the consensus mark by a whisker. Adjusted admissions (adjusted for outpatient activity) rose 1.9% year over year on a same-facility basis at UHS’ acute care hospitals, while adjusted patient days declined 5% year over year.

Centene’s third-quarter 2022 adjusted earnings per share of $1.30 outpaced the Zacks Consensus Estimate by 6.6%. The bottom line grew 3.2% year over year. CNC’s revenues of $35.9 billion advanced 11% year over year in the quarter under review and also beat the consensus mark by 1.1%. Premiums of $31.8 billion rose 10.3% year over year in the quarter under review, while service revenues climbed 14.7% year over year to $1.9 billion.

HCA Healthcare reported third-quarter 2022 adjusted earnings of $3.93 per share, beating the Zacks Consensus Estimate by 1%. However, the bottom line dropped 14% year over year. Revenues of HCA dipped 2% year over year to $15 billion in the third quarter and missed the consensus mark by a whisker. Same-facility equivalent admissions inched up 2.3% year over year in the third quarter, while same-facility admissions slipped 1.5% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

The Ensign Group, Inc. (ENSG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research