11 Budget 2023 Incentives You Should Know About

The revised Budget 2023, themed Membangun Malaysia Madani or Developing a Civil Malaysia, was tabled by Malaysian Prime Minister and Finance Minister, Datuk Seri Anwar Ibrahim on the 24th of February 2023.

With an allocation of RM386.14 billion, Malaysia Madani is focused on addressing the high cost of living, strengthening the social safety net and enhancing the micro, small and medium enterprises (MSMEs) eco-system.

Let’s take a look at the main financial incentives announced for Budget 2023!

1. Income tax rate is reduced by 2% for the M40

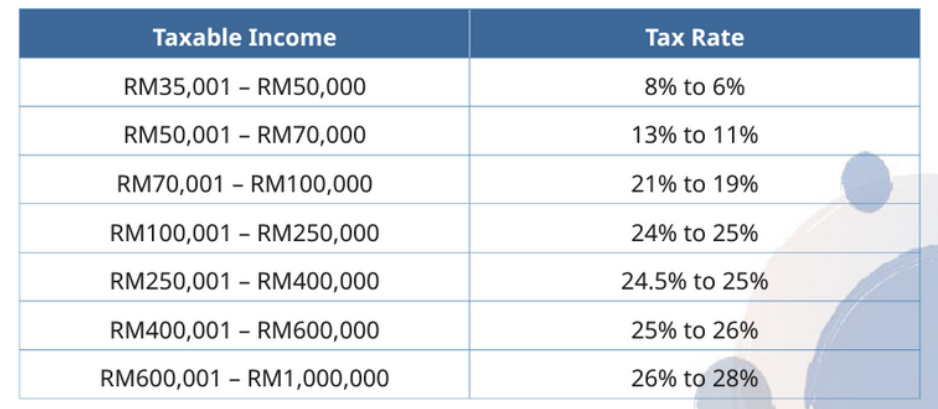

Individual’s income tax rate will be reduced by 2 percentage points for the chargeable income band between RM35,000 to RM100,000.

These reductions are expected to benefit approximately 2.4 million taxpayers with excess disposable income of up to RM1,300 annually.

Tax rates for higher income groups between RM100,000 to RM1 million will see an increase in income tax rates between 0.5% and 2%. The Ministry of Finance expects fewer than 150,000 taxpayers will be affected by the increased tax.

Check out the new tax rates in 2023 below:

Do take note that chargeable income refers to your total annual income minus all the tax exemptions, deductions and reliefs you are entitled to.

2. Stamp duty exemptions for first-time homebuyers

Full stamp duty exemption until the end of 2025 for first-time homebuyers who purchase a home valued at RM500,000 and below.

First-homebuyers who purchase residential properties worth between RM500,001 to RM1 million will enjoy a 75% stamp duty exemption up to 31 December 2023.

This stamp duty holiday was increased from the 50% exemption announced in July 2022, under the Keluarga Malaysia Home Ownership Initiative or i-MILIKI.

Example of stamp duty calculation for a house that costs RM750,000

Under normal circumstances, the stamp duties payable for a RM750,000 house will amount to RM19,885 – {(First RM100,000 X 1%) + (Next RM400,000 X 2%) + (Remaining RM250,000 X 3%) } + 0.5% of loan amount (90% of RM750,000) + RM10 for stamp duty on SPA.

With a 75% exemption, you will only have to fork out RM4,971.25, thus enjoying savings of roughly RM15,000.

Nevertheless, the government has not clarified whether this stamp duty exemption extends to the subsale housing market or not. We certainly hope so as this would provide more options to aspiring home seekers – this section will be updated accordingly once the PU(A) is passed by the Parliament and published in the government gazette.

Read all about stamp duty and RPGT now!

3. PTPTN repayment discounts

PTPTN borrowers earning less than RM1,800 will be granted a six-month moratorium in payments, with applications starting in March 2023.

A 20% discount on PTPTN repayments will be given for three months, beginning March 2023.

4. Stamp duty exemption for property transfer between family members

From 1st April 2023, real estate transfers based on love and affection between parents and children as well as grandparents and grandchildren will enjoy full stamp duty exemption on the instruments of transfer – limited to the first RM1 million of the property’s value.

The remaining balance of the property’s value is subject to an ad valorem stamp duty rate. However, a 50% remission or discount will be given on the stamp duty imposed.

These stamp duty exemption applies only to property recipients who are Malaysian citizens.

Example stamp duty exemption calculation

For example, say you transfer a property worth RM1.5 million to your son – you will have to pay a stamp duty on the RM500,000 (the first RM1 million is exempted).

The existing stamp duty rate is based on a tier system where the property value of RM100,001 to RM500,000 will be subjected to a 2% stamp duty:

0.02 X RM500,000 = RM10,000

Since there is a 50% remission on the remaining balance of the property value, you will only have to pay RM5,000 in stamp duty fees for the transfer of your RM1.5 million property (0.5 X RM10,000).

Currently, only transfers between spouses are exempted from stamp duty, whereas between parent and child, there is a 50% exemption. Meanwhile, property transfer between siblings and from grandparents to grandchildren is subjected to 100% stamp duty. These categories will stand to benefit the most.

5. Housing Credit Guarantee Scheme (HCGS) for those with irregular incomes

The Housing Credit Guarantee Scheme (HCGS) will guarantee home financing up to RM5 billion in 2023 for applicants who have irregular incomes. This housing loan scheme is expected to benefit 20,000 borrowers in need.

Established as a company wholly owned by the Minister of Finance in 2007, the HCGS aims to help first-home buyers who do not have a fixed income such as gig words and freelancers, independent business owners, and small traders such as fishermen and farmers.

6. My50 monthly pass for public transportation users

The Government will continue the My50 monthly pass initiative – where an RM50 pass will provide unlimited rides in that month for most public transportation services including the LRT, MRT, BRT KL Monorail and the Rapid KL buses.

Finance Minister Anwar Ibrahim says that the initiative is set to benefit 180,000 users. MOF has previously shared an estimate that the average Klang Valley resident who utilises bus and rail services spends RM200 each month. If you haven’t secured your My50 pass yet, you can secure one at a Rapid KL Customer Service Counter.

Travel Pass in Johor Bahru

Prasarana will also launch a MyBAS50 Unlimited Travel Pass in Johor Baru, benefiting those who commute using the domestic bus services under the Stage Bus Service Transformation (SBST) programme.

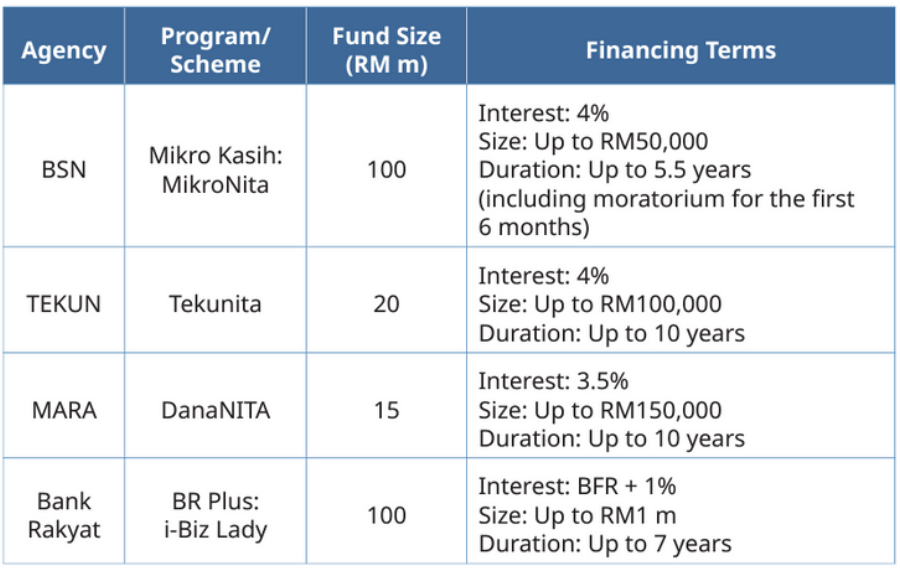

7. Loan facilities/micro-financing to encourage more female entrepreneurs

A total of RM235 million of financing will be provided specifically for women under BSN Semarak-Nita, Tekunita TEKUN, DanaNITA MARA and Biz Lady Bank

Rakyat schemes – these are aimed to encourage more women entrepreneurs to grow their (existing) businesses and to provide funds to help enhance their marketing strategies.

Depending on the scheme, women who currently have their own registered businesses (including professionals such as doctors, lawyers and accountants), can apply for these loan facilities. More details below:

8. Rahmah Cash Assistance for B40 households

Households with a combined income of less than RM2,500 will obtain up to RM2,500 under the Rahmah cash aid initiative, which is set to benefit almost 9 million recipients through an allocation of almost RM8 billion

The cash amount provided will depend on the number of children in a household:

Households earning less than RM2,500 per month with 5 children or more will receive a cash aid of RM2,500 (this is a new category)

Households earning less than RM2,500 with up to 4 children are eligible to receive cash aid of between RM1,000 to RM2,000.

Single senior citizens and single adults will continue to receive cash aid of RM600 and RM350 respectively.

Family classified as the hardcore poor are eligible to receive assistance up to a maximum of RM3,100.

Bonus for youth: A RM200 e-Tunai Belia Rahmah credit will be provided to 2 million youth aged between 18 to 20 years old.

9. Help for rakyat with financial issues

The government will amend the Insolvency Act 1967 so that bankruptcy cases can be released automatically in a short time. The government aims to release 130,000 people from bankruptcy with the passing of the amendment.

Small bankruptcy cases that owe less than RM50,000 and meet the conditions will be released immediately starting March 1, 2023.

To help the underprivileged in obtaining fair and impartial representation, the Legal Aid Department will raise the eligibility limit for total legal aid from RM30,000 to RM50,000.

To curb online scams, BNM will introduce a “kill-switch” policy for all banking institutions. Account holders can immediately freeze their accounts and ATM cards if they detect suspicious activity.

10. SOCSO discount for self-employed workers

To encourage better social protection and help alleviate the burden of SOCSO payments by self-employed individuals (full-time and part-time workers), the Government will continue to bear 80% of the contribution value in 2023 (this initiative was first introduced in Budget 2022).

This would mean self-employed individuals such as food delivery drivers, farmers, FINAS artists, gig workers and hawkers will only have to pay 20% of their SOCSO contributions.

A total of RM100 million will be allocated and extended to those who are self-employed. If you fall in this category, you can apply at PERKESO’s Matrix Portal or do it in person at the nearest SOCSO office.

Bonus for Women: To support women to return to work after childbirth, SOCSO will amend its Act to allow for a financial grant equal to 80% of the insured employee’s monthly salary. It is estimated that over 130,000 women will benefit from this grant, involving an allocation of RM290 million.

11. Tax exemption for all parents who send their kids to nursery and kindergarten extended until YA 2024

To ease the financial burden for parents who provide early education for their children, the Government has agreed to extend the tax relief of up to RM3,000 on fees paid for TASKA and TADIKA registered with the Government – up until December 2023 or for the Year of Assessment 2024.

If you are wondering what is the difference between the two, TASKA caters for children from birth to 4 years of age while TADIKA is for children between 4 to 6 years of age.

Check out the full list of allocations announced under Budget 2023: Key highlights and list of incentives.

*This article is reworked from Budget 2023: Income tax deduction, PTPTN discount, stamp duty exemption and 8 more financial incentives