3 Considerations Before Considering Cromwell Europe REIT’s IPO

As suggested by its name, Cromwell Europe REIT is a REIT investing in a mix of office, light industrial/logistics and retail properties in Europe.

It is the first and only European-focused REIT that is listed on SGX.

Amended on 18 September, the issuer has reduced its offering from the initial 1,583,955,000 units to the current 1,296,105,000 units. The offer pricing range will be between €0.55 and €0.57 ($0.93) per unit.

The offering will close on 26 September and officially list on 28 September.

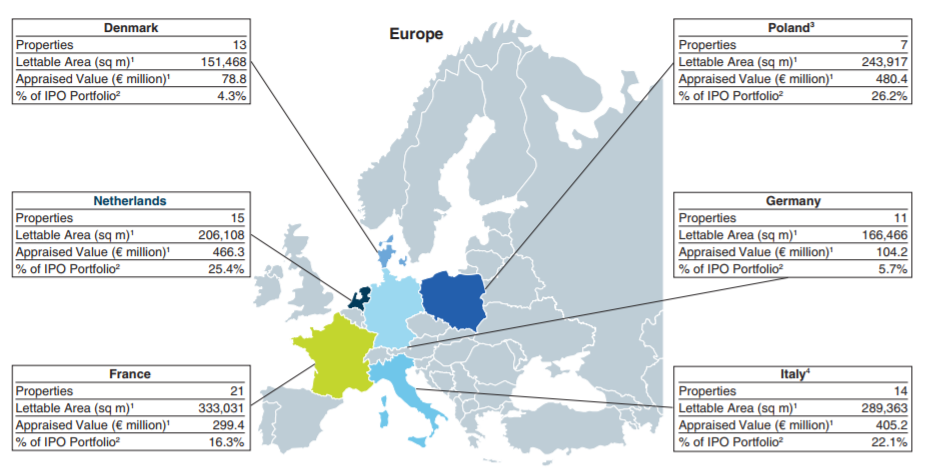

Source: Initial Portfolio, Cromwell Europe REIT’s Prospectus

Its initial portfolio consists of 81 properties across six countries and various asset classes.

Based on the difference between the appraised price and agreed purchase price, there is a 1.7% discount to the appraised value of the IPO portfolio.

It offers investors a decent yield of 7.5% to 7.7%. Yield is expected to be stable given its long weighted average lease expiry of 5.1 years.

Sounds attractive enough? Here are three key factors to consider before taking the plunge, though.

1. Alignment of interest

After amending the prospectus, the sponsor’s interest is more aligned to investors when compared to before the amendment.

However, it is clear from the previous version of the prospectus that the sponsor wants to cash out using this IPO. Based on media reports, Cromwell charges above market rate for its management fees.

The main turnoff is the high-performance fee of which the manager will receive 25% of the increase in distribution per unit (DPU).

Currently, there are lots of room for improvement in terms of performance of the portfolio. The overall occupancy rate of the portfolio stands at 89.3%.

It begs the question: Why should investors pay such a high fee for the manager to do what’s in their job scope?

In addition, it creates an agency theory whereby the manager would choose to expand quickly as it will increase his or her performance fee rather than work in the interest of investors.

2. Eurozone and FX concerns

Unless you are extremely bullish and positive about the developments that are ongoing in Europe, Cromwell might prove to be a poor investment.

The recent attack on the London Underground has well reflected the geopolitical risk of the region.

Coupled with the rising populist movement around the world, there are more factors working against Angela Merkel and her bid for a fourth term in office.

As Germany is one of the leaders of the European Union, it poses a threat to regional political stability. For example, an immediate risk for investors will be the foreign exchange risk.

From valuations to dividends, Cromwell uses Euros as the principal currency rather than the Singapore Dollar. Performance of the REIT might be adversely affected by a potentially poorer exchange rate.

3. Value of the REIT

A key factor in asset pricing will be the prevailing interest rates, which has an inverse relationship with asset prices especially when we’re looking at property and REITs.

On the backdrop of rising interest rates, asset prices are expected to decrease unless driven by other factors. As a REIT, Cromwell will undoubtedly need to hold a significant amount of debt.

When interest rate starts to rise, the cost of borrowing will go up, resulting in a tighter spread. Investors who plan to hold the REIT post-IPO will need to take this into serious consideration.

Moreover, given the large float rate, it is highly unlikely that the REIT will see a strong debut. That will also mean that Cromwell will not be suitable for investors looking to “hit and run” on the first trading day.