Accenture (ACN) to Benefit From ARZ Acquisition: Here's How

Accenture plc ACN yesterday announced that it has inked a deal to acquire Allgemeines Rechenzentrum GmbH (“ARZ”), a technology service provider specialized in the Austrian banking sector. The deal closure is subject to customary closing conditions. Financial terms of the deal have been kept under wraps.

Volksbanken Group and Hypobanken Group are the majority owners of ARZ besides other private banks. ARZ has establishments in Vienna and Innsbruck.

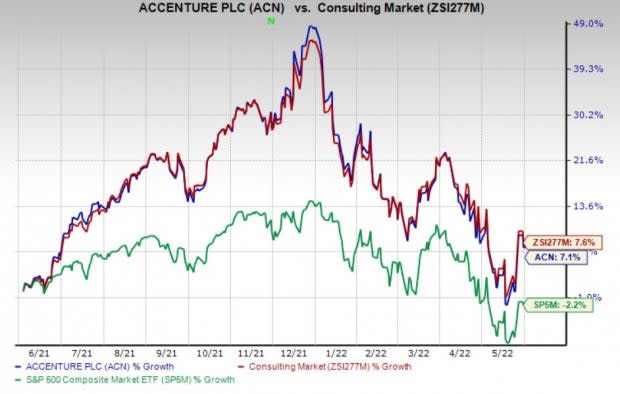

Over the past year, shares of Accenture have gained 7.1% compared with 7.6% growth of the industry it belongs to and 2.2% loss of the Zacks S&P 500 composite.

Image Source: Zacks Investment Research

Buyout to Strengthen Accenture’s Financial Services Industry Group

ARZ, with its team of almost 600 employees, will join Accenture. They will carry on their operations from their existing establishments in Vienna and Innsbruck. The buyout is expected to help Accenture widen its cloud-based banking platform-as-a-service offering, spanning from core banking services to online banking and regulatory services for banking clients across Europe.

According to Roland Smertnig, senior managing director in Accenture’s financial services practice in Europe, "By acquiring ARZ, we are expanding our digital transformation capabilities to help banks of the future as they look to move more of their core functions to the cloud, enable new business models, and reinvent the services and experiences they provide to customers."

Further, Michael Zettel, Accenture’s country managing director in Austria, added, "With this acquisition, we are expanding our team in Austria and will develop a comprehensive center of excellence at the Innsbruck location to serve our clients in Austria and across Europe. The ARZ team has the experience and talent to help us grow and meet our banking clients’ needs now and, in the future, and we look forward to welcoming them to Accenture."

Notably, ARZ complements Accenture’s prior initiatives in strengthening its position in the banking industry. A few of its latest investments include the acquisition of Exton Consulting, a provider of strategy and business management support to financial services firms across Europe, and a strategic investment through Accenture Venturesin Imburse, a cloud-based, payments-as-a-service enterprise platform. Both investments were done in June 2021.

Zacks Rank and Other Stocks to Consider

Accenture currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other stocks in the broader Business Services sector that investors can consider are Cross Country Healthcare CCRN, Gartner IT and Avis Budget CAR, each sporting a Zacks Rank #1 at present.

Cross Country Healthcare has an expected earnings growth rate of 54.2% for the current year. CCRN has a trailing four-quarter earnings surprise of 29.2%, on average.

Cross Country Healthcare has a long-term earnings growth rate of 6.9%.

Gartner’s shares have gained 10.6% in the past year. IT delivered a trailing four-quarter earnings surprise of 24.2%, on average.

The Zacks Consensus Estimate for Gartner's current-year earnings has moved up 13.6% in the past 90 days.

Avis Budget has an expected earnings growth rate of 59.8% for the current year. CAR delivered a trailing four-quarter earnings surprise of 102.1%, on average.

Avis Budget has a long-term earnings growth rate of 19.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accenture PLC (ACN) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research