Alberta pension engagement on hold until Ottawa provides CPP asset transfer amount

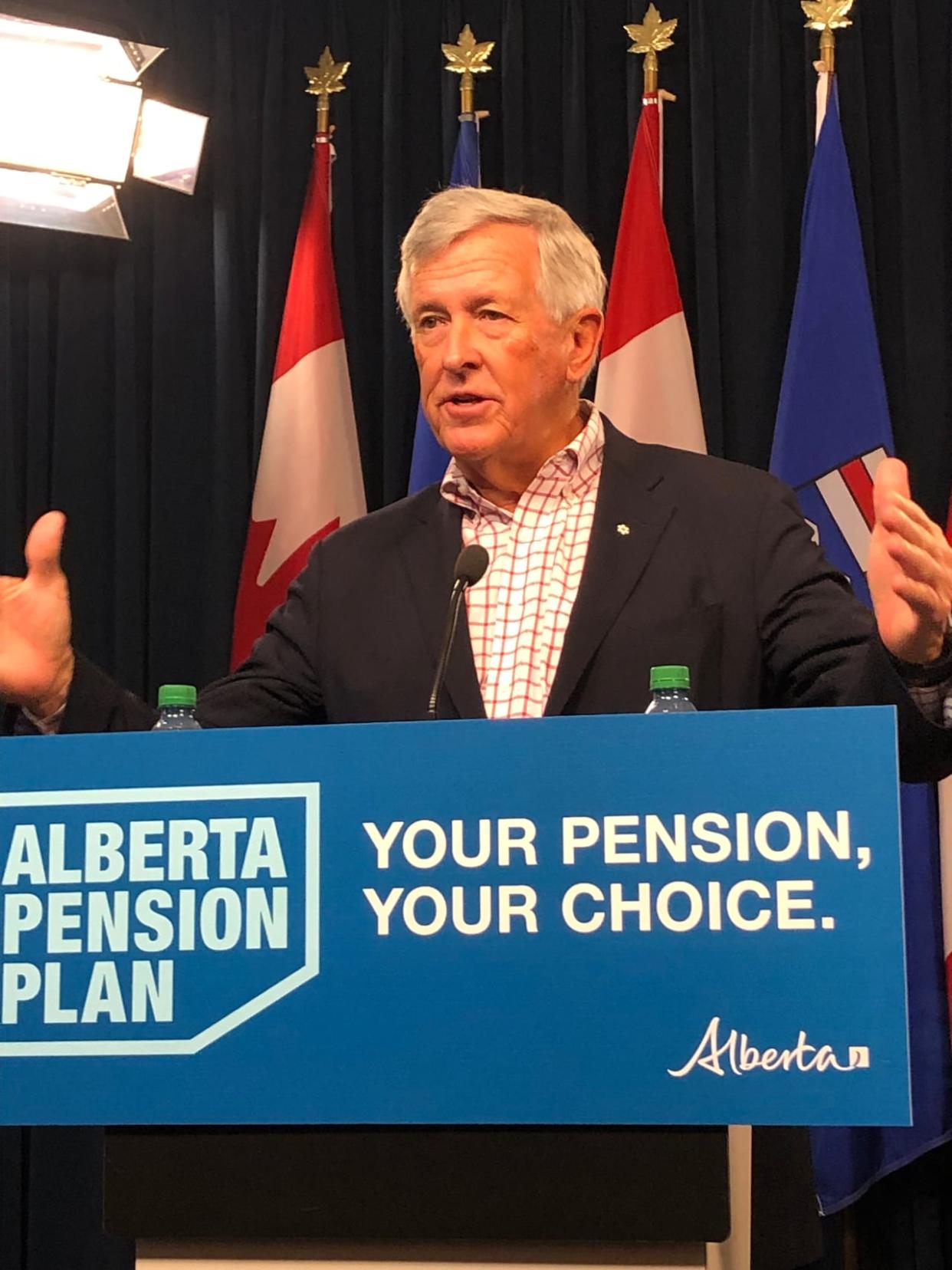

Consultations on a proposed Alberta Pension Plan are on hold until the province gets asset transfer figures from the Office of the Chief Actuary of Canada, pension engagement panel chair Jim Dinning said Friday.

"It is hard for Albertans to provide concrete perspectives when many variables concerning an Alberta plan depend upon the size of that asset transfer," Dinning said at a news conference in Edmonton with Finance Minister Nate Horner.

Dinning said uncertainty around the asset transfer amount has become a barrier to productive discussions so the panel wants to put additional consultation on hold.

Horner said he is pleased the engagement panel is giving the Office of the Chief Actuary time to release its own findings on the asset transfer amount.

The asset transfer number in the government-commissioned LifeWorks report has been a source of controversy since it was released to the public in September.

The report claims Alberta would be entitled to $334 billion — 53 per cent of the CPP's net assets — if it decided to leave the plan.

Dinning said Friday the LifeWorks figure initially struck him as a "gobsmacking number."

Economists, other provincial premiers and the CPP Investment Board are also skeptical. Experts have put the figure much lower.

Horner has gone back and forth on whether an APP would follow the investment model used in Quebec, where a portion of contributions are reinvested in the provincial economy. Critics worry some of that money could go toward politically-motivated projects if Alberta adopted that model.

Horner and Premier Danielle Smith have said they are open to hearing what the CPP thinks would be a more reasonable figure.

Federal Finance Minister Chrystia Freeland has asked the chief actuary to perform the analysis.

Horner said he wrote to Freeland this week asking what will be asked of the chief actuary, and for details on the terms of reference.

"We know the chief actuary has better data than the publicly available data LifeWorks had to use," Horner said. "But as far as timeline, I think any speculation would be kind of challenging at this point."

Alberta pension not a priority, NDP says

Dinning's panel held five telephone town halls where they took 142 live questions and logged about 3,800 comments and questions.

This is in addition to a survey that was criticized for not asking whether Albertans wanted to leave the CPP.

Dinning said the panel had planned to hold to in-person meetings in December and early 2024 but decided it would be better to hold off and wait for more information.

He estimated 50 per cent of respondents were opposed to an Albertan plan, another 25 per cent were in favour and the rest needed more data before making a decision.

The Opposition NDP has called on the government to drop the idea of a APP. NDP MLAs have held in-person town halls and put out a survey in a campaign to prove Albertans don't want one.

Edmonton-South West MLA Nathan Ip said about 90 per cent of respondents say they opposed the switch to provincial plan.

He said the province should have obtained asset transfer amount from the chief actuary before spending millions on engagement and advertising for something Albertans don't want.

"Albertans have overwhelmingly said we don't want to leave the CPP," Ip said Friday.

"We want to focus on the priorities of Albertans. And right now it's affordability and health care."

The province said Alberta won't leave the CPP unless the majority of residents vote in favour of an APP in a referendum.

Dinning's final report is expected to include his recommendation about whether a referendum should take place.