Blackwells Capital Urges Nelson Peltz to End ‘Ego-Driven’ Campaign for Disney Board Seats

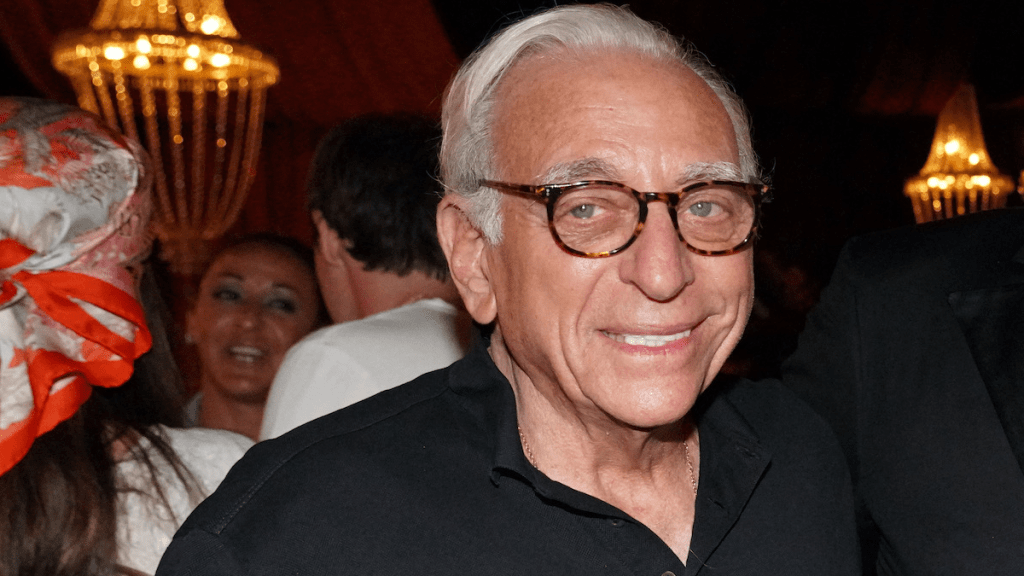

Blackwells Capital is calling on activist investor and Trian Fund Management founder Nelson Peltz to end his renewed push for multiple seats on Disney’s board.

The firm, which has been a Disney shareholder since 2018, expressed concern in a statement on Thursday that Trian’s campaign “prioritizes Mr. Peltz’s ego over what is best for all Disney shareholders,” and that its latest effort “may cost Disney shareholders upwards of $50 million and serve only as a value destructive fog for Disney’s leadership and Board.”

Additionally, Blackwells said it does not believe that Trian’s efforts at Disney or other public companies have served the interests of long-term shareholders. Blackwells cited Peltz’s involvement in The Wendy’s Company as a “cautionary tale for Disney shareholders.”

“In an act of nepotism, Mr. Peltz installed his son, Matthew H. Peltz, as the non-executive Vice Chairman and packed the board with business partners and friends, while presiding over a period of disappointing results for Wendy’s shareholders,” the firm said.

In addition to its criticism of Peltz, Blackwells expressed support for Disney’s “ongoing transformative restructuring” led by CEO Bob Iger and recent decision to appoint Morgan Stanley chairman and CEO James Gorman and former Sky group chief executive Jeremy Darroch to its board of directors.

“Displacing these individuals or other members of the Board with Mr. Peltz and other Trian selected nominees would deprive shareholders of valuable, experienced voices in the boardroom at a critical time in the Company’s history,” the firm said.

Blackwells chief investment officer Jason Aintabi said that Disney has “one of the most attractive portfolios of beloved brands and businesses.”

“The combined stewardship of the refreshed Board and the leadership of Mr. Iger, offer Disney shareholders the best opportunity to surface value. Mr. Peltz and Trian need to withdraw this costly and disruptive effort to displace experienced voices in the boardroom and substitute them with Mr. Peltz and his nominees,” he added.

“Mindless, drum-beating activism is not the right strategy for shareholders. Disney’s Board is acting in the best interests of all shareholders and should be allowed the time to focus on driving value at one of America’s most iconic companies without this fatuous sideshow.”

Peltz and Trian, which called off a proxy fight in February after Disney announced a plan to cut $5.5 billion in costs, beneficially own approximately $3 billion in Disney stock. Their effort is backed by former Marvel Entertainment chairman Ike Perlmutter, who has granted Trian sole voting power over his shares in the entertainment giant.

According to a 13D filed with the U.S. Securities and Exchange Commission, Trian has upped its Disney stake to 7.3 million shares during the third quarter of 2023, compared to 6.42 million shares during the second quarter. The filing also discloses another 25.57 million Disney shares listed as an “other investment discretion.”

On Thursday, Trian said that Disney’s board extended an offer to meet, but turned down its request for board representation, including Peltz.

“Since we gave Disney the opportunity to prove it could ‘right the ship’ last February, up to our re-engagement weeks ago, shareholders lost ~$70 billion of value. Disney’s share price has underperformed proxy peers and the broader market over every relevant period during the last decade and over the tenure of each incumbent director,” Trian’s statement read. “Investor confidence is low, key strategic questions loom, and even Disney’s CEO is acknowledging that the Company’s challenges are greater than previously believed.”

While acknowledging that Gorman and Darroch are “an improvement from the status quo,” Trian argued that their appointments would not “restore investor confidence or address the root cause behind the significant value destruction and missteps that this Board has overseen.”

“Trian intends to take our case for change directly to shareholders,” the statement concluded.

In a response to Trian, Disney noted that Perlmutter owns more than 25 million, or 78%, of the 33 million shares Peltz owns.

“This dynamic is relevant to assessing Mr. Peltz and any other nominees he may put forth as directors, as Mr. Perlmutter was terminated from his employment by Disney earlier this year and has voiced his longstanding personal agenda against Disney’s CEO, Robert A. Iger, which may be different than that of all other shareholders,” the statement continued. “The Disney Board will recommend to shareholders its slate of director nominees in the company’s proxy statement to be filed with the Securities and Exchange Commission and distributed to all shareholders eligible to vote at the annual meeting.”

In addition to its statement, Disney disclosed in an SEC filing on Thursday that it has amended and restated the company’s bylaws, which will take effect immediately.

Under the new bylaws, any person who solicits proxies in support of a director nominee other than the board’s nominees will be required to provide representation that the person will comply with Rule 14a-19 under the Securities Exchange Act of 1934 and deliver “reasonable evidence to the Company that the Rule 14a-19 requirements have been met.”

Additionally, any person directly or indirectly soliciting proxies who use their own proxy card will be required to use a proxy card color other than white.

The change also is designed to “enhance the procedural mechanics and disclosure requirements relating to business proposals submitted and director nominations made by stockholders,” including by requiring “certain additional background information, disclosures and representations regarding any proposing stockholders, any proposed director nominees and business and any other persons related to a stockholder’s solicitation of proxies” and “any notice of director nomination be accompanied by all written questionnaires required of the Company’s directors completed and signed by any proposed director nominees.”

Separately, Disney declared a cash dividend of 30 cents per share for the second half of fiscal year 2023, which will be payable on Jan. 10 to shareholders of record as of the close of business on Dec. 11. The payout marks the first since the dividend was halted three years ago during the COVID-19 pandemic.

“This has been a year of important progress for The Walt Disney Company, defined by a strategic restructuring and a renewed focus on long-term growth,” Disney board chairman Mark Parker said in a statement. “As Disney moves forward with its key strategic objectives, we are pleased to declare a dividend for our shareholders while we continue to invest in the company’s future and prioritize meaningful value creation.”

Disney shares, which closed at $92.69 apiece at the end of Thursday’s trading session, climbed 0.65% in after-hours trading. The stock is up 4.1% year to date, but down 5.98% in the past year.

The post Blackwells Capital Urges Nelson Peltz to End ‘Ego-Driven’ Campaign for Disney Board Seats appeared first on TheWrap.