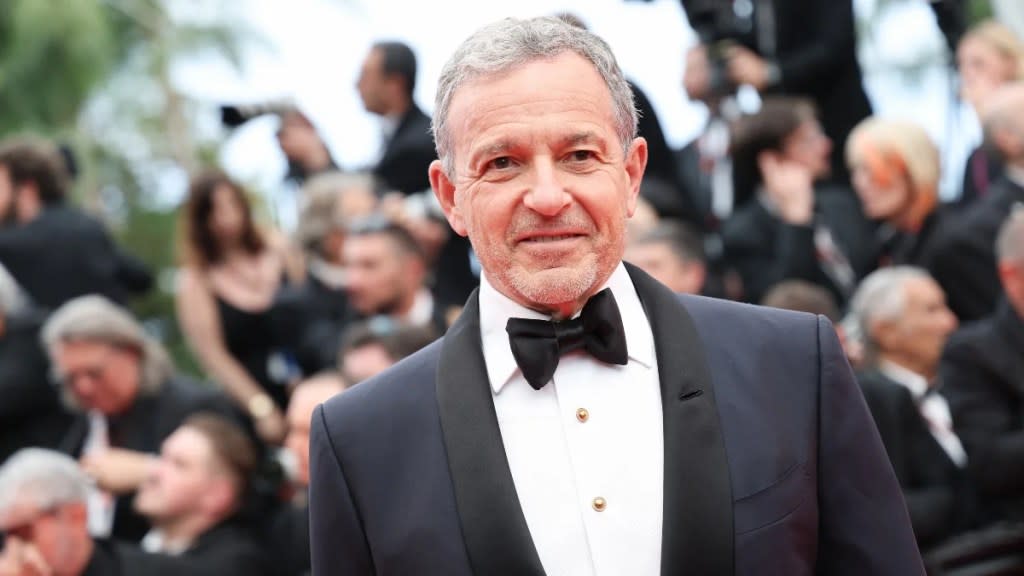

Bob Iger and Disney Backed in Board Battle by Glass Lewis Recommendation

Disney and Bob Iger have received the support of the independent proxy advisory company Glass Lewis in its ongoing proxy battle. Glass Lewis recommended that Disney shareholders vote for the 12 Disney-selected director nominees in a report released on Monday.

The company’s report also recommended rejecting the nominees put forward by Nelson Peltz’s Trian Partners and another firm, Blackwells Capital, ahead of Disney’s annual meeting on April 3. In its reasoning, Glass Lewis emphasized The Walt Disney Company’s clear strategy, its strong additions to the board and “measurable shifts” in the business since the return of Iger.

“We are pleased that Glass Lewis recognizes the strength of our highly qualified nominees and supports our plans to return this iconic company to a period of sustained growth and shareholder value creation,” Mark Parker, chairman of The Walt Disney Company Board of Directors, said in a statement to press. “In its recommendation, Glass Lewis clearly identifies the strength of the diverse skillsets across our Board nominees, the credibility of our succession planning process and the recent changes to the Board and compensation program and the promise of our recent efforts to bolster growth and value creation to position Disney for the future.”

The Glass Lewis report specifically noted that Disney is undertaking a “credible effort” to rearrange “key operational priorities” under Iger’s leadership and pointed to the last 15 months of Iger’s return as an “adequate” opportunity to establish a “more credible succession program.”

“While it remains too early to say with certainty that each of those programs will prove successful, we believe it is similarly too early to suggest there exists adequate cause for investors to support alternate solicitations which may prove significantly less accretive to Disney’s trajectory, by comparison,” the report reads.

The proxy fight against Disney is currently being spearheaded by Trian Fund Management founder Nelson Peltz. The activist investor has also sought reinforcements from shareholders at ValueAct Capital and Blackwells Capital. Essentially, what Peltz wants from this fight is for Disney to develop a succession plan after Iger. He also wants the company to attribute compensation with performance, cut costs and reinstate Disney’s dividend by fiscal year 2025. Iger has been vocal about wanting to retire in 2026.

The post Bob Iger and Disney Backed in Board Battle by Glass Lewis Recommendation appeared first on TheWrap.