Carousell transactions account for 70% of e-commerce scams in Singapore in 2018: police

About 70 per cent of e-commerce scams that were reported in Singapore last year took place on online marketplace Carousell, according to statistics released by the police on Wednesday (20 February).

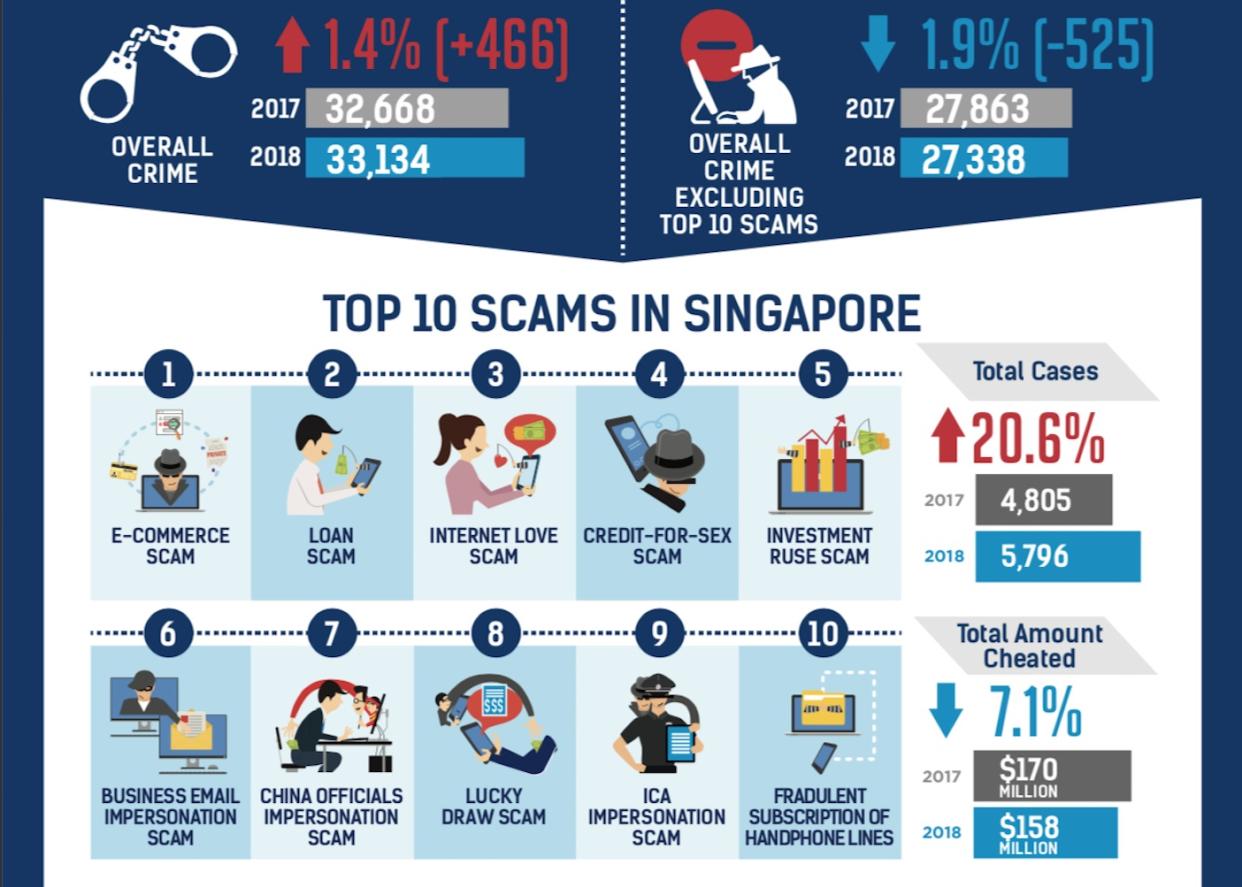

E-commerce scams were also identified as the top scam in Singapore with more than 2,000 cases reported in 2018, the police revealed at their annual media briefing.

The data release comes two days after Carousell announced that its fraud rate fell by 44 per cent over the past 12 months. In a press release on Monday, Carousell said it had a fraud rate of 0.031 per cent by the fourth quarter of last year, or three in 10,000 transactions on its platform were fraudulent.

According to the police, the common scams on Carousell involved transactions of electronic products, and tickets to events and attractions.

E-commerce scams, which typically happen when buyers fail to receive items that have been purchased online, increased by 11.4 per cent to 2,125 cases last year from 1,907 cases in 2017. The total amount cheated rose to $1.9 million from $1.4 million over the period.

Other forms of fraud, including loan scams, credit-for-sex schemes, and China officials impersonation scams, were also on the rise.

The number of loan scams more than doubled to 994 cases from 396 cases. In a typical loan scam, an SMS or WhatsApp message offering loans, purportedly from a licensed moneylender, is sent to random persons. A person who is keen would be instructed to transfer money as a deposit before the loan can be disbursed, but the scammer would be uncontactable after the transfer.

The number of credit-for-sex scams increased by 28.7 per cent to 533 cases while the number of China officials impersonation scams surged by 60.6 per cent to 302 cases.

But the number of internet love scams decreased by 20 per cent to 660 cases from 826 cases while the total amount cheated fell to $27.5 million from $37 million.

The police attribute the decline to the efforts of the Transnational Commercial Crime Task Force (TCTF), which was set up in October 2017 under the Commercial Affairs Department.

The TCTF has since closed over 600 bank accounts and recovered more than $1.4 million, said the police, adding that they have worked with foreign law enforcement agencies to combat such scams.

Overall, there was a 1.4 per cent increase in the number of reported crimes to 33,134 cases last year from 32,668 cases in 2017, due mainly to a rise in scam cases.

The high internet penetration and prevalent use of smartphones in Singapore have contributed to the increase in online crimes, said the police, adding that a significant proportion of them were perpetrated by foreign syndicates.

Another area of concern is the rise in computer misuse offences such as unauthorised access of an individual’s online account, unauthorised purchases using credit cards, or using phishing emails to obtain personal data.

Such offences under the Computer Misuse Act increased by 40.3 per cent to 1,204 cases.

The police pointed out that the community’s involvement remains crucial to fighting crime, ranging from providing information to i-Witness, on the Police@SG mobile app or the police website, to making calls to the anti-scam helpline.

“With strong support from the community and stakeholders, Singapore will continue to remain one of the safest countries in the world,” said the police.

Other Singapore stories

Man admits to using fake documents to apply for Singapore citizenship for surrogate twin boys

Man arrested for paying private hire car driver with fake S$50 note

TOTO Hong Bao Draw 2019’s jackpot snowballs to $13.6 million