How China's chemicals industry can profit from Europe's energy crisis

European natural gas prices surged this week following Russia’s indefinite shutdown of Nord Stream flows. The supply cut is ostensibly due to a “maintenance” issue, but as the Kremlin has all but said explicitly, it’s really part of its economic war against the West.

Fragile gas supplies and volatile prices are spelling havoc for businesses across Europe, and in particular for energy-intensive businesses. The chemicals industry, built on years of access to cheap Russian gas, is especially vulnerable.

Read more

World's Largest Cruise Ship to Be Scrapped Before First Voyage

Everything You Need to Know About This Year's Flu Shot<em></em><em></em><em></em><em></em>

<em>The Queen's Gambit </em>Defamation Suit Settled Between Netflix and Chess Grandmaster

In <em>Pinocchio</em>, questionable creative choices clip the strings of Disney's latest adaptation

Awesome Games Done Quick Abandons Live Event Because Florida Is 'Not A Safe Place For Our Community'

This week, the German chemicals giant BASF warned that it may have to further cut production due to the fuel crunch. Covestro, another German chemical behemoth, warned last month of the “collapse of entire supply and production chains” if gas supplies continue to fall.

Boom time for Chinese chemicals?

For China, the world’s biggest producer of chemicals, Europe’s woes present a potentially lucrative business opportunity. As Donghai Securities, a brokerage firm, said in the title of a new report (link in Chinese) on the near future of China’s chemicals industry: “The sun is rising in the East as it rains in the West.”

During Europe’s energy crisis, China stands to make gains in both the immediate and longer terms, according to Huachuang Securities, a brokerage firm. In the short run, Huachuang’s analysts wrote in a note this week (link in Chinese), Chinese chemicals businesses will benefit from lower energy costs.

And even if European natural gas prices fall from current highs, the analysts noted, they are unlikely to return to previous levels, the analysts wrote.

“With Europe and Russia decoupled, Europe must say goodbye to cheap energy” and industrial capacity will shift towards China, noted the Huachuang analysts. “It is an excellent opportunity for China’s chemical industry to upgrade.”

China’s chemicals sector is soaring

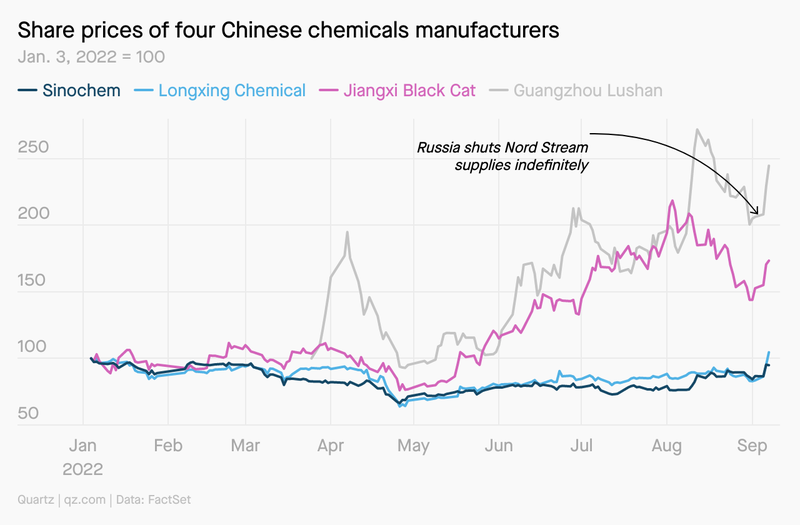

This optimism is driving up the share prices of numerous Chinese chemicals manufacturers. An exchange-traded fund that tracks the sector, for example, jumped over 3.5% earlier this week, while state-owned Sinochem, which produces industrial and agricultural chemicals, saw its stocks surge over 10%.

That compares with a more modest 1.5% and 0.3% increase, respectively, in the Shanghai Composite Index and Shenzhen Composite Index since markets closed last week. The two indices track the stocks traded on the respective cities’ bourses.

Other companies with similar double-digit increases in their share prices include Longxing Chemical, which produces carbon black for tires and rubber products; Jiangxi Black Cat Carbon Black; and Guangzhou Lushan New Materials, which makes functional polymers.

Still, China isn’t without its own challenges

Its zero-covid policy continues to bring uncertainty as factories, businesses, and residential compounds are locked down with little warning. For firms, the unpredictability means disrupted production, which also makes it more difficult to plan new investments. Both Huachuang and Donghai Securities noted the risk of low domestic demand, stemming from continued zero-covid restrictions, affecting chemical companies’ revenue and profits.

Last week, the city of Chengdu, in the province of Sichuan, was locked down after a number of coronavirus cases were detected. It’s unclear when the restrictions will lift: The lockdown, affecting the majority of the city’s 21 million residents, was supposed to end yesterday (Sep. 7) but was instead extended indefinitely today. And it comes mere weeks after a historic heatwave and drought forced many factories in Sichuan—a production hub for raw chemical materials—to temporarily halt operations.

For example, multiple Sichuan-based manufacturers of urea, phosphorous, and titanium dioxide had to curb production last month due to the heat-induced power restrictions, according to Chinese media.