Council pushes to boost City of Edmonton's lagging industrial tax base

The City of Edmonton is getting a smaller portion of industrial development while other communities in the metropolitan region continue to grow their industrial base, a new city report shows.

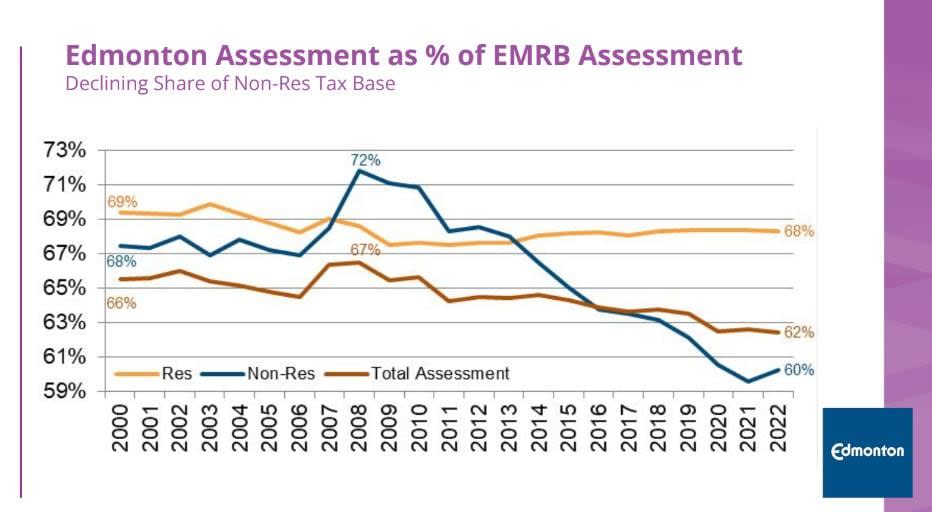

Edmonton's share of the region's non-residential properties has dropped from 72 per cent in 2008 to 60 per cent in 2022, the report says.

Non-residential properties include industrial, office, retail, hotel and land.

The City of Edmonton's tax base was made up of 78 per cent residential and 22 per cent non-residential properties in 2022, said Milap Petigara, a principal adviser in the budget, planning and development department.

The region's 12 other municipalities, as a whole, had 60 per cent residential and 40 per cent non-residential.

"In metropolitan Edmonton, non-residential properties are disproportionately located in the doughnut , whereas residential structures are disproportionately located in the centre," Petigara said.

"This presents a significant fiscal problem for the city."

Most municipalities generate more tax revenue from industrial and commercial properties than from houses and apartments, he said..

The Edmonton Metropolitan Region includes the cities of Beaumont, Fort Saskatchewan, Leduc, St. Albert and Spruce Grove; the towns of Devon, Morinville and Stony Plain; and Leduc, Parkland, Strathcona and Sturgeon counties.

They comprise 27 per cent of the region's population, compared to Edmonton's 73 per cent.

Mayor Amarjeet Sohi said he's tried to make it a point to reduce dependency on residential property taxes.

"We need to get ahead of it. We have lost too much ground on this," Sohi said.

The report notes that the non-residential tax base is essential to the city, as it pays significantly higher taxes than the residential sector, while consuming fewer services.

Key challenges

Edmonton has lost its competitive edge because of complex administrative processes, high design standards, high utility costs and higher tax rates, the report says.

Edmonton's mill rate for non-residential properties is 21.07860, more than two times higher than the average of all municipalities surrounding Edmonton at 9.36282, according to the Government of Alberta Municipal Affairs data from 2022.

Mill rates are the taxes paid per $1,000 of assessment.

City administration presented an industrial investment action plan, outlining nine areas to work on.

Councillors agreed on Wednesday that administration should report back early next year with progress on the action plan and a budget estimate on the cost to deliver parts of it within three years.

"I fear that it could take decades to recover this kind of industrial development," Ward sipiwiyiniwak Coun. Sarah Hamilton said.

Action areas in the city's plan include collaborating with regional partners, Indigenous communities, investment groups and regional economic development agencies; creating more efficient administrative processes and flexible city's design standards.

Lack of shovel-ready land

Another key action area is creating a shovel-ready land supply by establishing a vacant land inventory and determining development timelines with industry, the report says.

Only 0.1 per cent, or 133 hectares, of the city's raw industrial land is considered shovel-ready for industrial development, the report shows.

Kim Petrin, deputy city manager of urban planning and economy, said Edmonton's industrial base such as petroleum, fertilizers and natural gas remain dependent on natural resources.

In recent years, this has branched out to research, manufacturing and innovative, high-tech fields.

While industry is often thought to be heavy machinery and oil and gas, industrial needs have shifted, Hamilton said in an interview.

"We're seeing a lot of warehousing, for instance, and that's not something Edmonton has necessarily leaned into, warehousing and logistics," Hamilton noted.

Edmonton could be a global industrial hub, she suggested.

"You have a potential in, especially near the airport, to have the ability to store large amounts of food to do agricultural production, like industrial agricultural production," Hamilton said.

Shipments can then be made from Edmonton to places around North America and Asia.