CTOS Score Malaysia: What Is It, And The 4 Steps To Improve It!

What Is CTOS Malaysia?

The complex world of credit ratings can sometimes send shivers down peoples’ spines.

Your credit report can seem like a mysterious creature at times, and the key to conquering it is first understanding what CTOS is.

CTOS is a private institution established in 1990, and is Malaysia’s leading credit rating agency.

It's considered a market leader in the country, with its extensive reporting database relied on by most of Malaysia’s major financial organisations.

It’s not the only such organisation in Malaysia, but it’s certainly one of the biggest and most widely known.

That means it’s a great foundation to understand your essential financial history when it comes to checking your credit rating.

As a credit reporting agency, CTOS is bound by the Ministry of Finance’s Registrar Office of Credit Reporting Agencies.

What Is A CTOS Score?

Source: CTOS

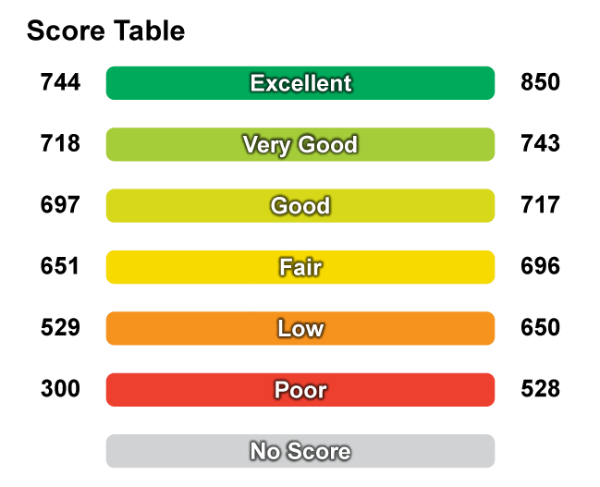

Your CTOS score or credit rating is actually a three-digit number ranging from 300 to 850, calculated by assessing your established credit history.

The higher the score, the better. Just think of it like a test at school! Thus, this article is here to help you study up in advance.

CTOS works using the globally recognised FICO score. The only thing you really need to know about it, is that it's an internationally accepted process for credit score checks.

That means you can be confident that the score is fair, using a widely recognised and understood standard.

Whenever you apply for new credit cards or loans, one of the first things a bank will do is perform a credit check with an organisation like CTOS.

The report generated by CTOS displays your credit history, and indicates your creditworthiness. According to CTOS, here's how it's broken down:

Source: CTOS

45% of your score is based on payment history

20% on outstanding amounts owed

7% on the length of your credit history

14% on your credit mix

14% on new credit

PropertyGuru Tip

<span style="font-weight: 400;">The term 'creditworthiness' simply means a method for lenders to check and see if you're suitable/worthy to receive a loan, largely based on your established credit history.

What Is CTOS, And How Does It Work?

CTOS is responsible for reporting on the financial health of individuals and businesses with its extensive database of information.

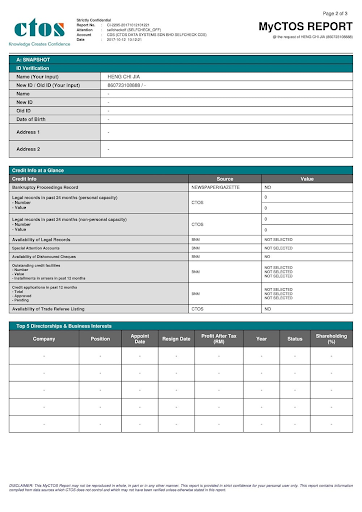

Companies and financial institutions use your CTOS score to determine whether you're able to repay your debts on time. A report provides the following:

CTOS credit score

CCRIS records (BNM)

Dishonoured cheques (BNM)

Directorship and business ownership

Litigation and bankruptcy

Trade referee listings

Missed payments alerts

Change in credit limits

Change of address

Scam alerts

Identity theft alerts

There are a range of ways in which the organisation assesses and analyses your credit history. That includes information from the following channels:

Legal notices in newspapers

Searches at the Companies Commission of Malaysia (CCM) or Suruhanjaya Syarikat Malaysia (SSM)

Government gazettes and publications

Malaysia Department of Insolvency (MDI)

National Registration Department (NRD)

Registrar of Societies (ROS)

Voluntary information from creditors, litigators, trade referees, and individuals

Types Of Information Revealed To CTOS Members

CTOS does NOT reveal any information to other members of the public. Governed by the Credit Reporting Agencies Act 2010, personal consent is required before any agency can release a report to third parties.

Credit reports are only available to members, or individuals requesting their own report. When a report on an individual is requested, the following information will be shared once approval is received:

Personal identity and verification

Directorship and business interests in companies and organisations in Malaysia

Legal proceedings

Trade referees and subject comments

Trade referees: These are CTOS subscribers who may wish to share their business experiences relating to a subject of a report. That’s often things like overdue payments or debts.

Subject comments: This is a provision by CTOS that allows involved parties of a case to provide input on their report.

You shouldn’t leave it just to banks to understand your credit score. Individuals are encouraged to check periodically to ensure oversight of their own CTOS ratings.

That means you’ve got the information you need to work towards a better credit rating.

Remember — the better your credit rating, the more chance you’ve got of having a loan request approved.

The register offers a MyCTOS Score report, so you can understand your credit rating from the perspective of a lender.

How To Improve Your CTOS Score

If your credit score isn't in perfect health, don't worry, because you're not alone. The good news is you can do something about it.

Financial mistakes and challenges happen to everyone, and CTOS scores are not designed to destroy your financial future forever. There are a number of ways you can work to ensure that your future score improves:

1) Pay your bills on time

If there’s one piece of advice that should really be listened to, it’s this! Many people just don’t understand the importance of paying their bills on time.

Lenders are especially keen to know how disciplined a borrower is in repaying their debts. Set up your calendar with reminders, or start using apps that will facilitate the process.

You can also start setting schedules for automatic payments with your bank account, so you don’t have to worry about missing the deadline.

Try to ensure all your bills go out after you get paid. There’s no point scheduling a big bill for two days before your salary comes in, and risk the payment being rejected.

Mistakes like this can show poor financial management. Change up your scheduling to make sure that your income and outgoings align positively.

2) Clearing your name

Be on the lookout for credit reports linked to your name, and if there are errors, bring them up as soon as you can.

CTOS relies on information not just from organisations, companies, and financial institutions, but also individuals.

If you don’t pay attention, you might be caught out by debts or financial problems recorded in error, or due to oversight.

For example, you may have forgotten to pay a small bill to a telecoms company when you recently changed service providers.

Regardless of how small the amount is, companies have the right to file reports against you, thus affecting your overall score.

3) Keep your credit within reasonable limits

Unnecessary credit negatively impacts your credit score. Banks want to see you using your credit allowance smartly. That means not applying for endless credit cards or unnecessary loans.

If you already have unused credit cards, there’s no rush to cancel all of them if the banks aren’t charging you annual fees.

However, it's still good practice to keep only one active credit card if it's sensible. This allows you to keep a better track of your swipes, and reduce the temptation to overspend.

The good news is that responsibly and regularly using a credit card, then paying off the balance on schedule, is a good way to show positive financial management for future credit checks.

4) Hit the reset button on your credit history

If you intend to apply for loans in the future, it's important to address existing issues with your credit score.

To more thoroughly understand the steps you should take, consult with a financial planner or financial service provider.

In the same way it’s smart practice to go for a health check-up every year, you should also perform a financial health check with CTOS regularly.

Where Do I Go To Obtain My CTOS Report?

Want to know how to check your CTOS score? It’s easily done, thanks to CTOS online. To get your MyCTOS report for the first time, you'll need to register here on the official site.

Once you’re registered, simply access your MyCTOS report either online or through the CTOS mobile app.

How Much Does It Cost To Get My Report?

Head on over to the official website and you’ll see three different packages - MyCTOS Basic Report, MyCTOS Score Report, and CTOS SecureID.

All verified users have access to two free MyCTOS Basic Reports per year; once in January and once in July.

For a more detailed and comprehensive report, you can get the MyCTOS Score Report at a cost of RM25.

For an added layer of cyber-security, and a host of other features, you may opt for the CTOS SecureID which is priced at RM99 per year.

What If There Are Inaccuracies In My Score?

If you feel that the information provided in your report is outdated or inaccurate, you can call CTOS at 03-27228833, or send them an email at sarus@ctos.com.my.

After providing the relevant documentation to highlight errors, CTOS will perform the necessary checks and verification, then provide you with a free updated report.

What Are Financial Institutions Looking For In My CTOS Report?

Other than any bankruptcy and legal issues, financial institutions will mainly hone in on your banking payment record and overall credit history in assessing your suitability for credit. That information can include:

Recent credit applications

A history of all your credit applications such as loans and credit cards are displayed here. It’s important to avoid too many credit card applications at any given time, as well as credit application rejections.

CCRIS details

CCRIS details in your CTOS report include your outstanding credit and special attention accounts. Your outstanding payments and repayment behavior will be displayed in the outstanding credit section.

You may also see loans reported under the special attention account. This relates to loans that have fallen into special measures and monitoring by financial institutions due to problems in repayment.

Record of dishonored cheques

Your record of dishonored cheques, or DCHEQS, basically show a history of recently bounced cheques. That’s not a great sign when it comes to good financial management!

If you have three or more bounced cheques within the last 12 months (what were you up to?), your credit score will take a hit, and you may be blacklisted by Bank Negara.

Subject comments

This section provides the option for you to note comments or responses to your financial behaviour. This can help explain any special circumstances relating to a particular element of your report.

My Loan Was Rejected Due To A “CTOS Issue.” What Does This Mean?

CTOS issue is often a way that financial institutions respond to an unfavourable CTOS report, which doesn’t meet their own credit score standards.

Remember that it’s worth checking your CTOS report yourself, to ensure there are no inaccuracies or records that are harming your overall credit check score.

You may need to conduct a CTOS self-check by following the instructions provided here.

How To Check Blacklisted Name?

If you want to get a CTOS report, you have to go directly from CTOS by contacting their service center, or get it through MyCTOS.

If you want to use this CTOS application, you have to register first to get the User ID, then activate the ID and you can continue to access the CTOS report at any time.

If you still have questions about CTOS, you can refer to the frequently asked questions here.

I’ve Settled All Legal Actions Against Me. Why Was My Loan Application Still Rejected?

You need to inform CTOS about any updates with your case at 03-27228833 or sarus@ctos.com.my.

If you’ve already updated CTOS, the issue may be due to the respective bank’s internal credit approval policies.

The internal credit policies of each bank will vary from the next, but as a rule, the more recent the date of legal action taken, the lower your chance of approval.

Will My Bad Debts Still Show Up In My CTOS Report Even After They’ve Been Settled?

Records of your bad debt will still be available up to 24 months from the date of settlement.

After 24 months, the record of these bad debts will be removed, as your report only details your credit history for the past 24 months.

Can I Be Blacklisted By CTOS?

Contrary to popular perception, you can NOT be blacklisted by CTOS!

The company merely compiles information on your credit and legal history from various sources, and provides it to subscribers (with your consent).

Relevant Guides: