New data disproves the myth that affordable housing lowers the value of your home

The standard argument against affordable housing is pretty simple: It lowers a neighborhood’s home prices. Here’s the thing, though: The data doesn’t support it.

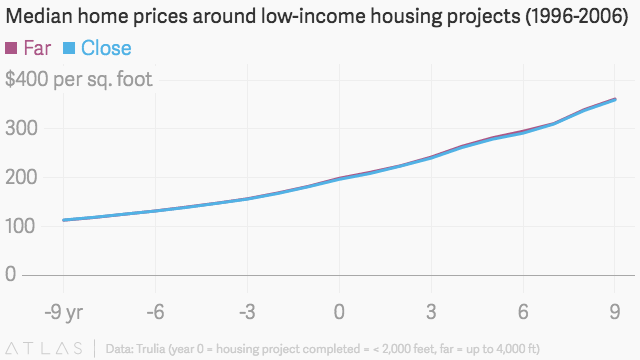

Residential real estate site Trulia tracked housing prices in 20 of the most expensive US markets between 1996 and 2006. The company found that home values within 2,000 feet of low-income housing projects were virtually identical to those for houses between 2,000 and 4,000 feet away from such projects.

Those findings back up decades of research showing that “most new affordable housing does not have a negative impact on home values,” says Kristy Wang, director of community planning policy at urban research group SPUR.

“The bottom line for NIMBYs who fear that property values will take a hit when a low-income housing project locates nearby is that their anxiety is largely unfounded, at least in cities where housing is either expensive or in short supply,” Trulia said in its report.

For its research, Trulia compared home prices around 3,083 new low-income housing sites during the nine years before and after they opened (the Year 0 in the chart). The only exception was a price decline in Boston and Cambridge, Massachusetts, and a slight increase in Denver, Colorado. The findings roughly align with affordable-housing data collected by the National Housing Conference (pdf), the Association of Bay Area Governments, and realtor associations.

The age-old NIMBY (not-in-my-background) argument has halted new housing for decades, pushing home ownership out of reach for millions of young, working-class families. But affordability is actually a scarcity problem, writes Andrew Price for nonprofit Strong Towns.

Restrictive zoning laws prevent housing supply from responding to demand, which drives up prices. Governments respond with price controls, which then drive up prices for housing on the open market. This is particularly true in California, where more than two-thirds of coastal metropolitan areas limit growth. In the San Francisco Bay area, only one unit of housing is being built for every eight jobs created.

Something may have to give. Across the US, young, poor, and working-class denizens are being driven out of urban centers, and further away from jobs and services. President Barack Obama’s most recent housing report weighed in with a clear directive: “We need to break down the rules that stand in the way of building new housing.”

That could start with changing attitudes about affordability. “Sometimes we talk about property values as if they exist on their own and are somehow naturally occurring, but they are driven by people’s choices and desires setting demand,” says Wang. “Often neighbors have only their own fear to blame. That fear of property values going down can be a self-fulfilling prophecy. Hence the need for studies like this to help combat those fears.”

Sign up for the Quartz Daily Brief, our free daily newsletter with the world’s most important and interesting news.

More stories from Quartz: