Are Dual-Key Condos a Good Investment Strategy?

Dual-key condos are not a recent concept in Malaysia. In this article, we answer some key questions such as: ‘Who should own a dual key condo?’ and “Are they a good investment?

Long existed in developed countries such as the United States, Sweden and Australia, dual key concept condos have only started picking up momentum among property investors in Malaysia in recent years.

Originally, the dual key concept was introduced as a solution to multigenerational living in big cities. Since its introduction to the market, owners and investors have started realizing its potential in solving multiple home ownership and property investment-related issues.

So, what is a dual-key apartment?

In simpler terms, a dual-key apartment comprises two adjoining units held under one legal title. Generally, there are two types of dual-key condos: –

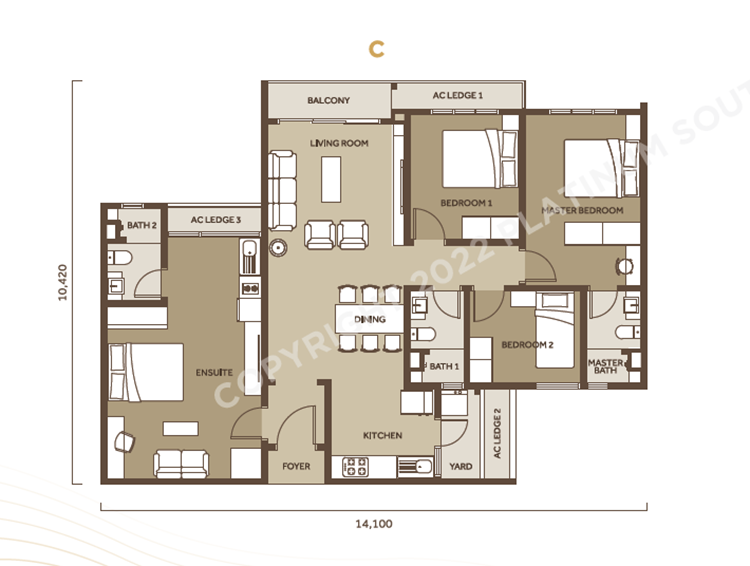

Type one, which is the more commonly offered version, comprises a shared foyer area or a main entrance that leads to the main door. A studio unit is built into the primary apartment, which comes with a larger floor area of either a 2-bedroom or 3-bedroom layout. Depending on the size, the studio unit may come with its own bedroom, living area, bathroom and kitchen.

The second type of dual-key condo is made up of two units, which may or may not be the same size and a shared foyer. Both units would typically have individual lockable entrances or access points, or both. Each unit comes with its own bathroom(s) and kitchenette.

Now that we have a basic understanding of the concept of a dual-key condo. Let’s look at how it solves certain home ownership problems and its potential as an investment property.

The age-old privacy issue of multi-generational living

The concept of multi-generational living, in which several generations of a family cohabit under one roof, is common practice in Malaysia. No matter the makeup of the household, everyone needs privacy, be it the grandparents, young adult children, teenage children or the married couple themselves.

With the growing cost of living, elderly care and childcare, multi-generational living also saves time and cost.

There are several configurations for dual key arrangements:

Type | Configurations |

Multi-generational 1 | Studio: Adult Child |

Multi-generational 2 | Studio: Aging parents |

Multi-generational 3 | Studio: Adult Child |

Young Couple | Studio: Single tenant |

Potentially better return on investment

Other than multi-generation families, dual-key properties also appeal to prospective property buyers, such as a young couple looking to rent out part of their property, especially those who do not have the means to purchase a second property for investment purposes (Refer to the table above).

The property owner can choose to live in the main unit and rent out the sub-unit. The rental earned from the sub-unit should be able to subsidize part of the monthly instalment of the whole condo and boost cash flow.

If the affordability of a second property is not an issue, the buyer can also choose to rent out the unit to two different tenants and receive two streams of rental income.

Here’s an example of the rental income you can fetch:

Long Term Rent | |

Price | RM513,000.00 |

Monthly Instalment (Assume 90% Loan, 30 Years, 4.5% interest) | RM 2,339.37 |

Tenant 1 (Studio) – rental per month | RM1,500* |

Tenant 2 (1-Bedroom) – rental per month | RM2,000* |

Total Rental | RM3,500 |

Rental Yield | 49.6% |

Here’s how you calculate your rental yield:

Total Rental Yield – Monthly Instalment x 100% = Rental Yield

Monthly Instalment

Lower overall cost

Starting from the potential saving to your overall cost of living if you live with your family members i.e. childcare cost, elderly care cost, and rental cost for your young adult child.

On top of that, when it comes to the initial purchase cost, dual key condos are legally a single property, therefore, it does not incur any additional stamp duty. You will be paying the water and electricity deposit for a single property.

Since both the main and sub-units are using the same facilities, you don’t have to worry about paying two maintenance fees that come with owning two separate properties.

As a landlord, it is easier for you to keep an eye on your rented unit and you’ll be maintaining repairs for a single property instead of two. You’ll also be paying one quit rent, one assessment rate and one fire insurance.

Alternatively, if you’re a small business owner or a freelancer who now works in a hybrid work environment and work from home frequently, you can choose to utilize the sub-unit as a home office setup, you can save money on a commute and still have a conducive working space.

Ultimately, should you buy a dual-key condo unit?

Depending on your financial situation, current priority, family’s living arrangements and location, dual key properties can be the ideal solution. There are plenty of high-quality options in the market, such as PSV 1 Residences @ Platinum South Valley in Sungai Besi.

Want to know more about PSV 1 Residences? Check out their website here or call 0111-722 6555.