FAST Is on the Rise, but What Are Consumers Watching? | Charts

Free Ad-Supported Television is increasing in both popularity and awareness among consumers, a new survey from content performance tracking platform Whip Media reveals. Public awareness of FAST platforms like Tubi, Roku Channel, Pluto and Freevee collectively saw a 43% average increase since 2021, while nearly half of respondents said they watched FAST channels at least a “few times” per month.

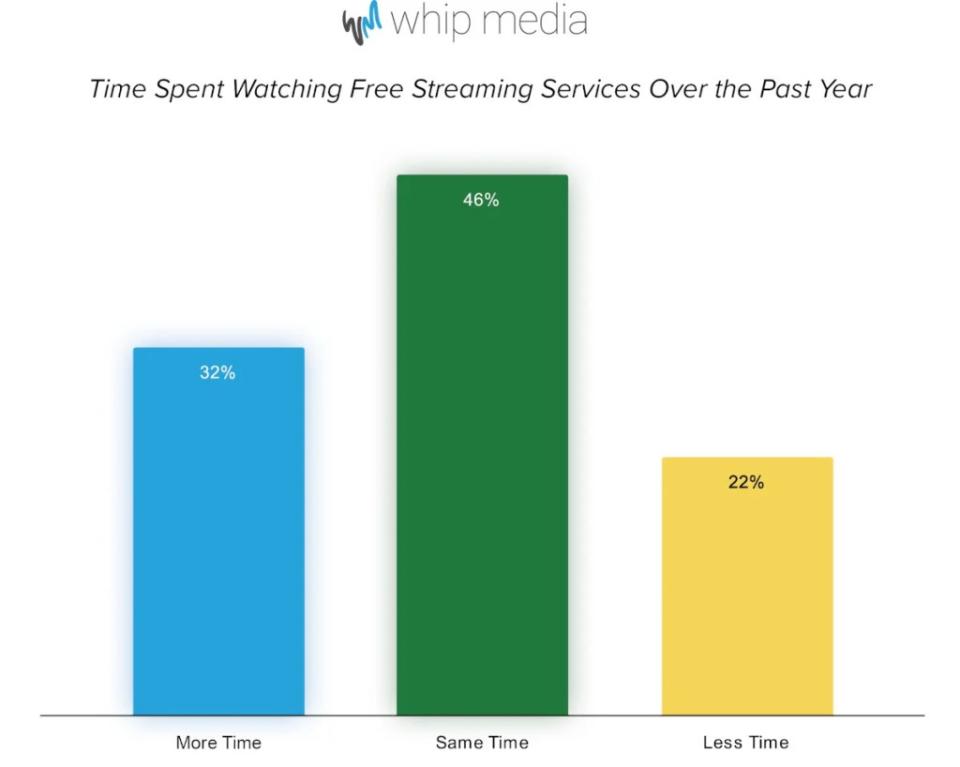

Whip Media’s fifth annual SVOD study is based on the responses of 2,000 U.S. TV Time users. A whopping 78% of FAST viewers said they’re watching the same amount or more FAST content this year compared to last year, underlining a lack of decline as companies (and by extension advertisers) attempt to chase consumers.

FAST has grown in popularity as more consumers cut the cord and untether from traditional cable subscriptions. As SVOD platforms like Netflix and Disney+ raise prices, the allure of FAST — which offers ad-supported programming for free — is becoming increasingly attractive.

But what do people watch on FAST? While Freevee had arguably the first major original FAST hit with the James Marsden-fronted “Jury Duty” — which not only broke into the zeitgeist but racked up four Emmy nominations including Outstanding Comedy Series — the majority of FAST consumers are watching library content.

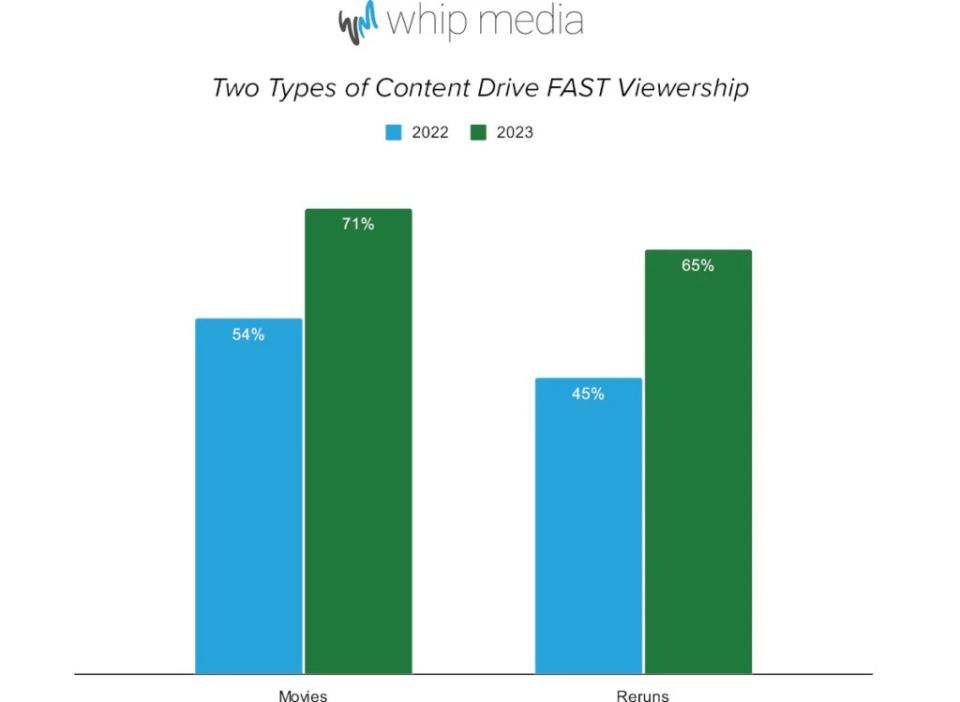

In Whip Media’s survey, 71% of respondents said they watch movies, up from 54% last year; while 65% of respondents said they watch “reruns of older comedies and dramas,” which is up from 45% last year. While some FAST platforms have increased original programming, the bulk of content on platforms like Pluto TV continues to be films and older TV shows — just what the consumers are sparking to.

But while FAST programming is driven by an abundance of channels that cater to very specific interests (Pluto has channels for Kung Fu Movies, Yoga and Minecraft, for example), Whip Media’s survey reveals that viewers are more drawn to specific channel content than the channel itself. Seventy-two percent of respondents said they watch “for a specific program” while only 23% said they watch “for a specific themed channel.”

While FAST still represents a fraction of the total market — over $4 billion in ad revenue to the overall $660 billion US Media and Entertainment Ecosystem — its increasing popularity is driving companies to think about innovations in ad strategy.

Jerry Inman, Whip Media’s chief marketing officer, said the opportunity in FAST lies in niche audiences.

“Major media companies encroaching on the FAST space often have deep pockets and large resources to produce high-quality content, and to acquire exclusive rights to popular shows,” Inman said. “Our research suggests that small and medium creators can focus on providing niche content that is low-cost, high-efficiency, and higher quality compared to big-budget programming. Catering to niche audiences that may have been overlooked in traditional broadcasting or premium streaming platforms may provide a foothold into new value areas.”

Speaking at TheWrap’s TheGrill conference in October on a panel about innovations in FAST strategies, Patrick Courtney, Fuse Media’s head of digital and business development, said there’s “a lot of room for innovation as to how advertising looks and feels” in an environment like FAST.

During the same discussion, Pluto TV’s global SVP and head of consumer marketing Valerie Kaplan underlined that FAST isn’t a replacement for linear TV but a companion to SVOD services. “It’s a perfect supplement and complement to those two or three core services that audiences are paying for.”

As of 2023, Tubi alone has 74 million monthly active users — that’s more subscribers than premium SVOD platforms like Hulu, Peacock and Paramount+.

That’s a lot of eyeballs … and a lot of ad revenue potential.

The post FAST Is on the Rise, but What Are Consumers Watching? | Charts appeared first on TheWrap.