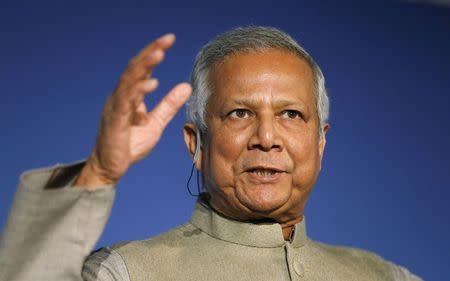

Fight poverty to end modern slavery, Nobel laureate Yunus says

By Astrid Zweynert LONDON (Thomson Reuters Foundation) - The fight against modern slavery can only succeed if poverty is rooted out and sustainable social business models are able to prevent vulnerable people from falling prey to traffickers, Nobel Peace laureate Muhammad Yunus said on Wednesday. "A whole range of issues need to be addressed to fight trafficking: education, legal rights - but poverty is the main cause," the founder of the microcredit movement said. "Unless you focus on poverty, no matter what you do, you can reduce trafficking a bit but it will keep going on because it's the lack of quality of life that makes people vulnerable," he told the Thomson Reuters Foundation on the sidelines of the Trust Women conference in London. Yunus revolutionised finance for the poorest when he started providing tiny loans to Bangladeshi villagers at market interest rates without requiring collateral, helping them to escape what he termed a "slavery" relationship with loan sharks. Modern-day slavery is not exclusive to poor countries but many of the world's estimated 36 million slaves come from countries where average incomes are low. The Walk Free Foundation, an Australian-based human rights organisation, this week listed Mauritania, Uzbekistan, Haiti, Qatar and India as the nations where modern-day slavery is most prevalent. BUSINESS SOLUTION The microcredit concept has been used successfully to extend credit to poor entrepreneurs, and Yunus said that boosting efforts to help women set up social businesses - where they invest profits back into the venture to make it self-sustaining - would also help the fight against trafficking. "When you want to fight trafficking, you've got to ask: How do you improve the quality of women's lives, so that she doesn't have to leave the family, so that she doesn't have to take a risk with her life and opt for the 'glorious future' the trafficker promises her?" Yunus said. Studies have shown that microfinance and social businesses can significantly contribute to women's empowerment by giving them the chance to earn additional income. Once women start making more visible economic contributions to the household, their self-esteem, self-confidence and status grow, both within the household and in the wider community, Yunus said. "Microcredit became popular because it's a self-sustaining business," he said. "The moment you bring a financial model into any movement, then it becomes very powerful." Yunus and Grameen Bank, the microfinance organisation and community development bank he set up in his native Bangladesh, won the Nobel Peace Prize in 2005. (Reporting By Astrid Zweynert, editing by Tim Pearce)