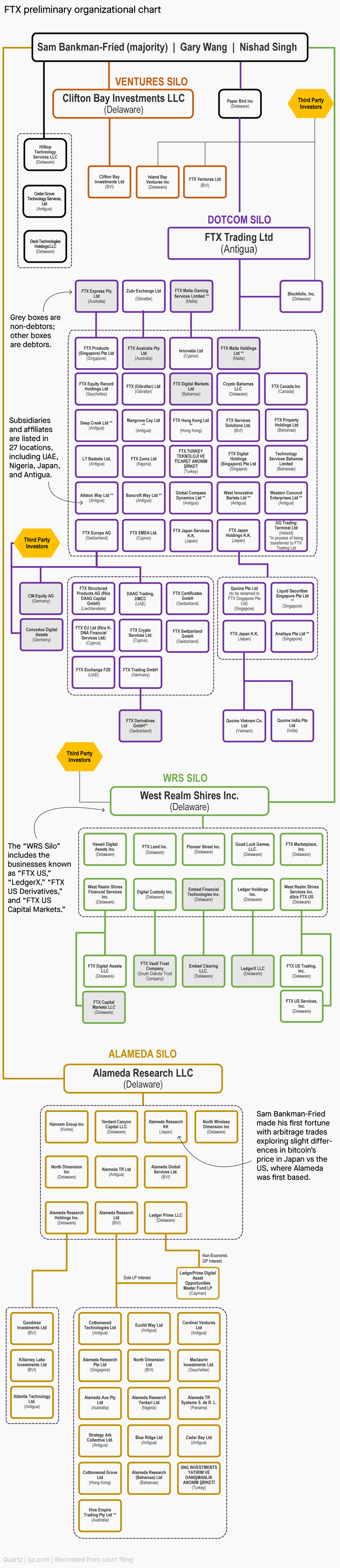

The scrollable, annotated, incredibly complex org chart of FTX and Sam Bankman-Fried’s fallen empire

The cryptocurrency exchange FTX imploded last week, filing for bankruptcy in the aftermath of a massive liquidity crisis. The exchange, and its billionaire co-founder Sam Bankman-Fried, are reportedly under investigation by the US Department of Justice and the Securities and Exchange Commission for mismanaging billions of dollars in client funds. When this activity was called into question and customers started taking out funds, FTX halted withdrawals, and the company filed for bankruptcy days later.

When Bankman-Fried resigned on Nov. 11, he was replaced by a new CEO, John Ray III, who previously oversaw the Enron bankruptcy. Ray is charged with guiding the troubled firm through its liquidation efforts. On Nov. 17, Ray published an organizational chart of FTX’s sprawling empire, offering a glimpse of the web of legal entities Bankman-Fried had created to run his empire, according to a new filing (pdf) in Delaware bankruptcy court.

Read more

The picture was not pretty. The chart lists more than 100 entities, a startling number considering FTX only employed about 300 people among its US and international firms. The convoluted web of interrelated firms, subsidiaries, and affiliates span 27 regions, including the company’s headquarters in the Bahamas.

In many ways, the structure helps explain how FTX collapsed. The lack of transparency allegedly allowed Bankman-Fried to secretly transfer customer deposits to its hedge fund Alameda Research in order to place risky bets on other companies.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,” Ray wrote in the court filing. Under Bankman-Fried, FTX operated without financial audits, liquidity forecasts, or appropriate cash management, Ray wrote. The five appointed directors, he pledged, will provide FTX with “appropriate corporate governance for the first time.”

An “intentionally convoluted” structure

FTX’s complex structure likely aided Bankman-Fried’s mismanagement.

“It’s clear Sam designed the organizational structure to be intentionally convoluted in order to keep various employees and companies in the dark about what was happening outside of their specific walled garden within the greater structure,” said Nick Mancini, director of research for the crypto data firm Trade the Chain. “Reports of fraud, lack of accounting, and special privileges between subsidiaries are examples of reasons that you would create such an intentionally confusing structure.”

Quartz has reoriented the organizational chart from the court filing for easier vertical viewing and added annotations for clarity. The chart, while identifying specific FTX entities and subsidiaries, raises more questions than answers.

More from Quartz

Sign up for Quartz's Newsletter. For the latest news, Facebook, Twitter and Instagram.