Grab targeting over 1,000 merchants with app's mobile wallet

Grab users may soon be able to use its in-app mobile wallet, GrabPay, to make purchases with over 1,000 merchants.

The company plans to partner with merchants that are “currently more heavily dependent on cash” in a move to expand beyond its current ride-hailing service, it said in a press release on Wednesday (30 August). The move is in line with the Singapore government’s push to encourage more consumers and merchants to switch to cashless payments.

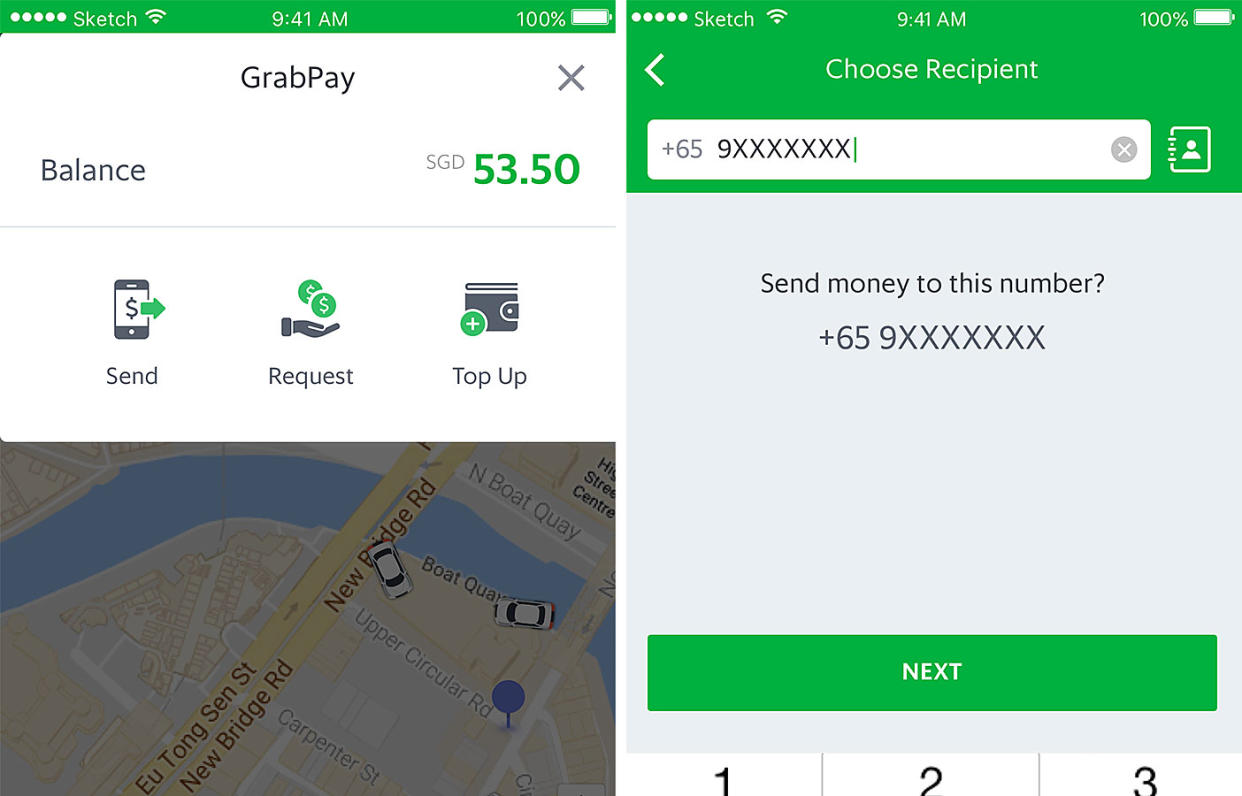

Grab also announced the launch of a fund transfer feature, which enables users to transfer GrabPay credits to one other. Over the coming months, Grab will develop this technology to facilitate payments via GrabPay to merchants, such as those in the food and beverage, retail and entertainment industries.

Singapore will be the first country where this expanded payment service will be tested. In a recently concluded initial trial, consumers frequently used the fund transfer feature to top up transport allowances for their loved ones, split the cost of meals and entertainment, as well as to transfer credits as gifts.

“Fund transfer is the first step to expand the use of GrabPay as a mobile wallet. Today, users can transfer money to one another; in the coming months, they can look forward to use GrabPay to buy food or other goods and services from physical shops,” said Jason Thompson, head of GrabPay.

To make GrabPay more secure, Grab also introduced this week a new six-digit GrabPay PIN as a form of second-factor authentication. Users with over $150 worth of credits in their GrabPay account are required to activate the PIN and the app will prompt them if it detects any unusual activities, such as if the app is used in a different country.

The low adoption of cashless payments in Singapore was raised in Prime Minister Lee Hsien Loong’s National Day Rally speech on 20 August, in which he called for Singaporeans to harness the potential of information technology towards the goal of a Smart Nation.

Thompson said, “(As) one of the most frequently used consumer apps, we believe Grab can drive mass adoption of mobile payments in Singapore and across South-east Asia. We have a stake in educating and bringing local communities into the cashless future, and are open to working with public and private sector organisations to enable this.”

Related stories: