Get the Guru View: Swinging home ownership for singles

For many singles, home ownership provides independence and privacy

With the vast majority of housing policies focused on marriage and families, singles often feel left out. At the same time, price levels in the private market have prevented many with single incomes from entering it, or limited options towards the smaller units.

By Chang Hui Chew

In the final days before this article went to print, Finance Minister Heng Swee Keat announced the increase of CPF Housing Grants for first-time home buyers purchasing HDB resale flats. While the announcement largely focused on young couples, the state also increased the grant for singles from $15,000 to $25,000, when purchasing four-room flats or smaller units.

Singles in Singapore often feel left out of the state’s policies on public housing. With the prospect of applying for flats before one hits the ripe, but not so old age of 35, reserved only for married or soon-to-be married couples, singles often either have to wait to own a home, or make a more expensive foray into private property.

The government has stated that it has implemented such policies because it wants to encourage Singaporeans to enter a state of matrimony. In fact, some policy analysts have suggested that the revised CPF grants for resale flats are to encourage newlyweds to move into their matrimonial homes quickly, and start family planning earlier.

Despite the state’s best efforts, more Singaporeans are choosing to stay single.

According to SingStats’ 2016 Population Trends report, the proportion of singles in each age group rose between 2005 and 2015. For instance, over 20 percent of males and 17 percent of females aged between 30 and 35 reported being single in the latest report.

In this edition of the Guru View, we examine housing options for single Singaporeans.

Smaller space living for single people

In space-constrained cities like New York and Tokyo, micro-apartments, often smaller than 350 sq ft, are often occupied by younger professionals looking to save costs on rent and utilities.

The same principles apply to singles in Singapore as well.

For many Singaporeans, if they are looking to enter the private market at a younger age, they often have to opt for smaller units, often below 50 sq m (538 sq ft), due to affordability issues. Furthermore, with a single income and fewer years of employment, the amount of CPF funds that can be used as a deposit for a condo are often lower, which means more cash needs to be paid upfront as well.

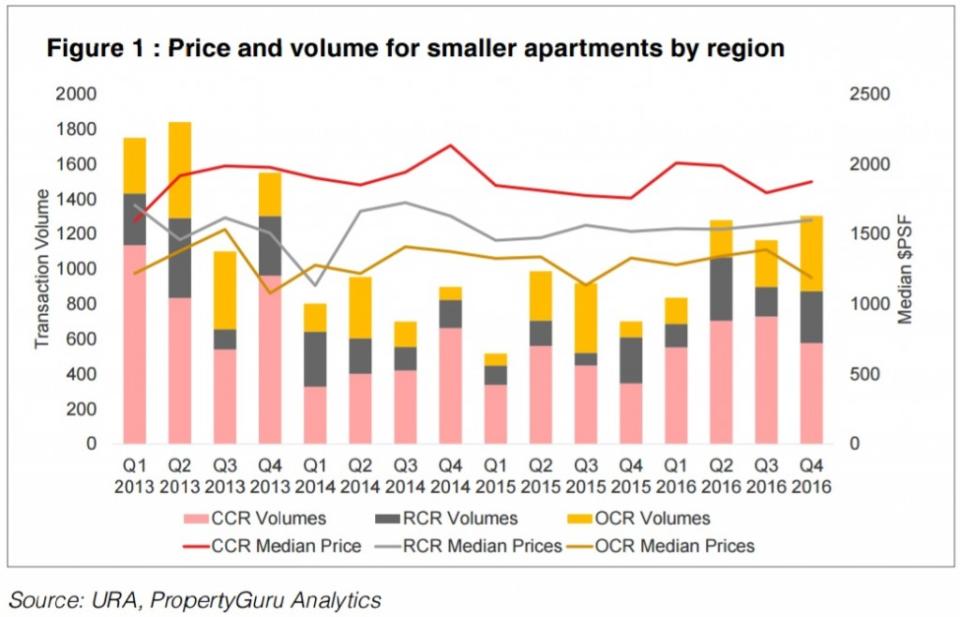

Figure 1 shows the transaction prices and volumes of units over the past 16 quarters. Interestingly, volumes for smaller units see the greatest proportion in the Core Central Region (CCR), where they are an investor favourite, for rental to expatriates. However, in the Outside of Central Region (OCR), we see an increasing proportion of smaller units being sold.

This is likely due to increased supply. With cooling measures, developers have shifted their unit mixes towards smaller units, while keeping their psf prices up. This allows them to reduce quantums to increase affordability for buyers, without impacting their margins too seriously.

Median prices of smaller units in the OCR have hovered around the $1,300 psf mark over the period of analysis. Taking into consideration a unit size of about 480 sq ft, a single looking to buy a one-bedroom condominium unit would be looking at a quantum of approximately $624,000.

This would work out to a down payment of about $125,000, and a monthly instalment of about $1,800, according to PropertyGuru’s mortgage calculator.

Interestingly, what Figure 1 also demonstrates is that prices for smaller units have started to recover somewhat, with a mild upward trajectory over 2016. Singles who are still trying to time the market to purchase smaller units might have missed their opportunity to buy at a trough, unless a pessimistic economy applies downward pressure on prices.

Public housing

Singles in Singapore can purchase Housing and Development Board (HDB) flats under the Single Singaporean Citizen Scheme. The scheme also stipulates that one has to be 35 and above to apply for either a resale or Build-To-Order (BTO) flat.

Introduced in 1991, the Single Singaporean Citizen scheme initially prevented single individuals from purchasing HDB flats in estates such as Bukit Merah, Whampoa, Outram Park, and other more densely populated areas, and limited sizes to three-room and smaller flats. Gradually relaxed over the years, single Singaporeans are no longer restricted to certain sizes and locations.

It was only in 2013 however, that the state allowed single Singaporeans to apply for BTO flats. But singles are still unable to purchase executive condominium units, a property class we covered in the previous edition of the Guru View.

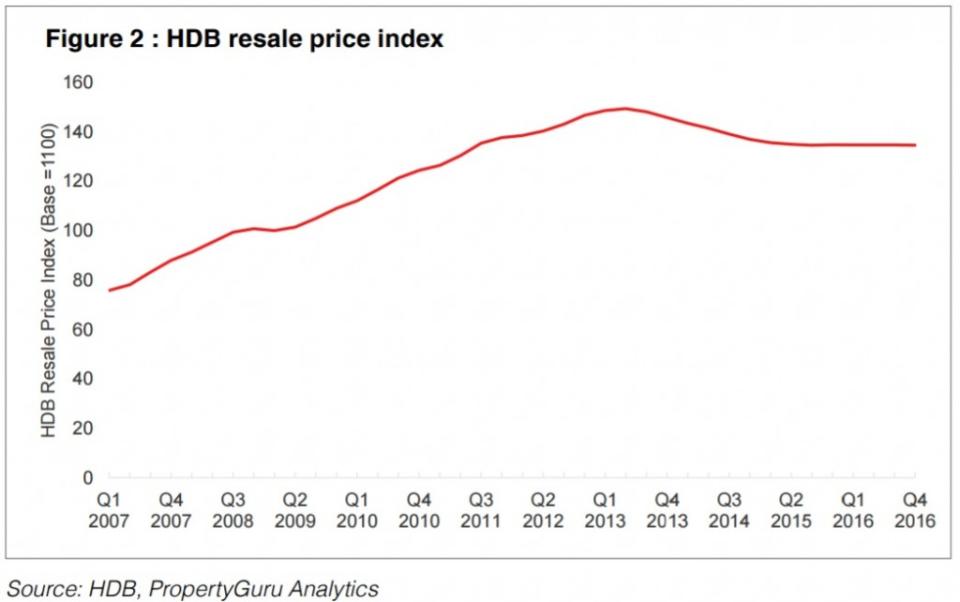

Figure 2 shows the movement of HDB resale prices since the first quarter of 2007. HDB resale prices climbed sharply in the past decade, before a slew of cooling measures halted the upward momentum and led prices to decline.

Since the first quarter of 2015 however, resale flat prices have hovered around the 135 mark, indicating a degree of resilience in pricing. Barring external shocks or further cooling measures, it is unlikely that prices will correct much further.

While the upwardly revised grants are definitely a great gesture on the part of the government to help singles own their own home, the increase of $10,000 works out to be about three percent of the cost of a $350,000 resale flat.

To provide some context on this, the median gross monthly income from work in 2016 was $4,056. For singles looking to take a bank loan, this income level would work out to a maximum loan of about $240,000, and a monthly mortgage of about $1,000 a month.

For those with a single source of income, home ownership can be an expensive enterprise.

Looking long term

Despite the state’s insistence that public housing should not be seen as an investment, it remains an important asset for the accumulation of wealth, and building one’s nest egg in old age.

As such, owning a home should still remain an important goal for single Singaporeans. It is an immovable asset and source of security. Furthermore, it could provide passive income, if one chooses to rent out rooms, for instance. Psychologically, it provides a sense of independence when one lives away from the family home.

Still left out

A particular group of singles in Singapore – single parents – continue to be left out when it comes to housing policies.

Single parents below the age of 35 do qualify for two-room Flexi BTOs in non-mature estates, but have to be previously married. For now, there is no official policy for single parents who have never been married to own HDB flats until they turn 35. Their only recourse, if they wish to own a home, is to enter the private market, if they are able to afford it.

It is a policy gap that voluntary welfare organisations have called out, and the state has responded that it does assess this on a case-by-case basis.

This article was first published in the print version PropertyGuru News & Views. Download PDFs of full print issues or read more stories now! | |||