Here's Why Crocs (CROX) Q4 Earnings are Likely to Improve Y/Y

Crocs, Inc. CROX is scheduled to release fourth-quarter 2019 results on Feb 27. This Colorado-based company has a trailing four-quarter positive earnings surprise of 38%, on average. In the last reported quarter, the company reported positive earnings surprise of 39%.

The Zacks Consensus Estimate for fourth-quarter earnings stands at 10 cents, which has been stable over the past 30 days. This suggests a substantial improvement from a loss of 10 cents reported in the year-ago comparable period. The Zacks Consensus Estimate for revenues is $261.1 million, indicating an improvement of 21.2% from the prior-year reported figure.

Factors to Consider

Crocs’ international collaborations and marketing investments, and favorable response to product categories such as clogs, sandals and visible comfort technology are likely to have contributed to its fourth-quarter results. The company’s e-commerce business has been improving at a double-digit rate for quite some time now. Nevertheless, we cannot ignore the impact of foreign currency fluctuations and store closures on the top line.

Nonetheless, management in a recent release guided fourth-quarter 2019 revenues in the band of $260-$262 million. This shows a sharp rise from the reported figure of $216 million in the prior-year period.

The company at its last earnings call highlighted that gains from higher pricing, increased clog sales and leveraging of fixed supply chain costs would help offset headwind associated with lower purchasing power related to currency and changes in channel mix. Notably, Crocs had forecast an improvement in SG&A expenses as a percentage of revenues for the fourth quarter. This is likely to show on operating margin during the quarter under review.

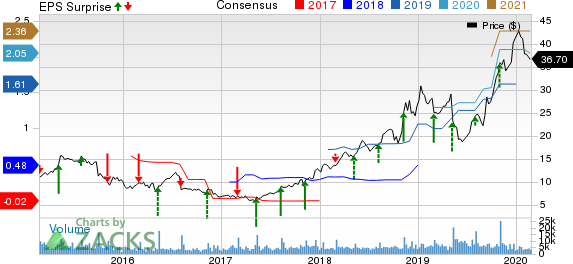

Crocs, Inc. Price, Consensus and EPS Surprise

Crocs, Inc. price-consensus-eps-surprise-chart | Crocs, Inc. Quote

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Crocs this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Crocs has a Zacks Rank #4 (Sell) and an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With Favorable Combination

Here are companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Costco COST has an Earnings ESP of +0.20% and a Zacks Rank of #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Target TGT has an Earnings ESP of +0.78% and a Zacks Rank #3.

Casey's General Stores CASY has an Earnings ESP of +3.45% and a Zacks Rank #3.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research