India's LIC and public sector banks are reassessing their Adani stakes

US-based Hindenburg Research’s allegations of fraud against India’s Adani group have sparked panic among investors since Jan. 25. Since the publication of the damning report, the conglomerate’s seven listed companies have lost $68.3 billion, nearly a third of their market value.

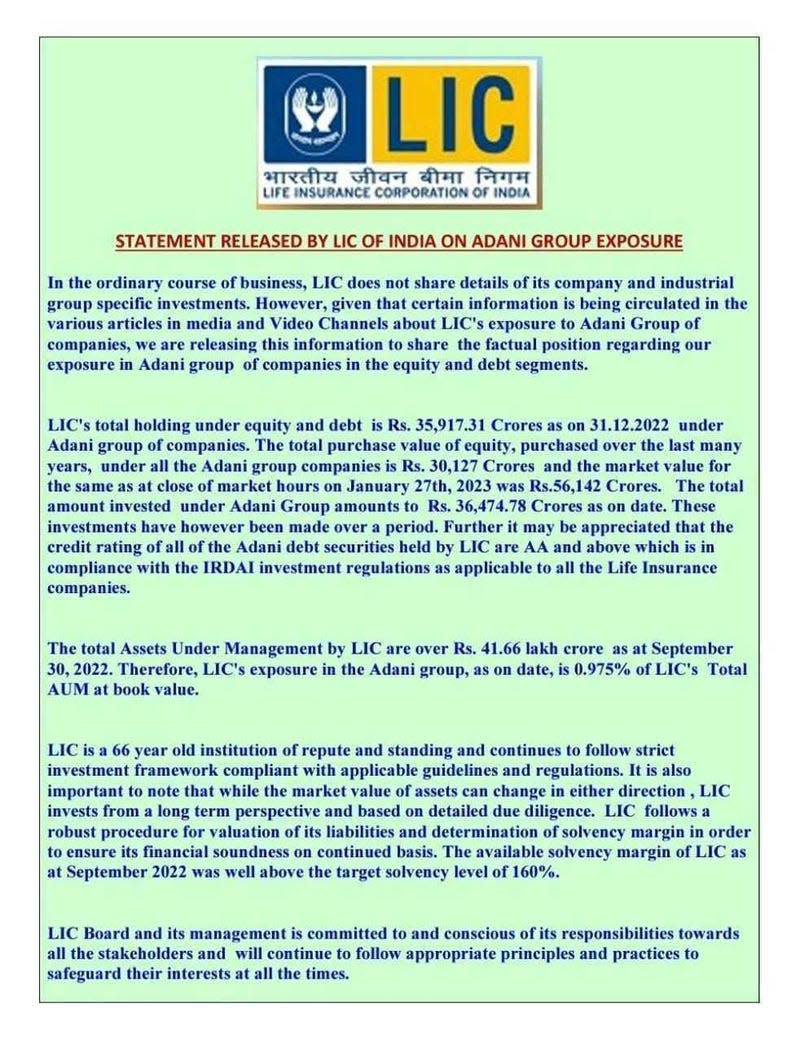

Among Adani’s key investors is the state-run insurance giant Life Insurance Corporation of India (LIC), with close to 1% of its $508 billion assets under management invested in the Gautam Adani-led group. The market bloodbath has, therefore, eroded a little over $2 billion of LIC’s wealth.

Read more

LIC’s management is now “engaging” with Adani to seek clarity on Hindenburg’s allegations, Reuters reported yesterday (Jan. 30).

“We have to gather all the information, clarifications; and a further call will be taken after that. The decision will also be based on an independent risk assessment, internal risk assessment, business profile, and growth trajectory,” Raj Kumar, managing director of LIC, told Reuters.

LIC isn’t the only big investor to turn cautious either.

India’s state-run banks are vulnerable (or not?)

India’s public sector banks, too, have massive exposure to Adani companies.

They had lent more than $9.9 billion to five of them—Adani Enterprises, Adani Ports, Adani Power, Adani Green Energy, and Adani Transmission—as of March 2022, according to last week’s report by global brokerage CLSA.

Questions about the potential default risks related to Indian banks are being raised now. CLSA has noted that India’s public sector banks hold 30% of Adani group’s debt while private lenders have less than 10%. This sent banking stocks reeling.

“It is important to note that during the last three days while Nifty declined by 3.2 %, Bank Nifty declined by 6.3% on concerns of the Adani crisis impacting the banks,” V K Vijayakumar, chief investment strategist at Geojit Financial Services, said in a note.

The lenders have quickly sought to allay fears. The State Bank of India (SBI), for instance, assured that its loan exposure to the Adani group was within limits prescribed by the Reserve Bank of India and secured by cash-generating assets, The Indian Express newspaper reported yesterday (Jan. 30).

While there have been no signs of a loan default by the Adani group so far, analysts believe its future borrowings will be under sharp scrutiny. In recent years, it has increasingly sourced funds from abroad, CLSA said.

Adani’s weightage in global indices is under review

A surge of around 800% in Adani stocks over the past few years had helped them gain a spot in MSCI’s global indices, but it may be time for some correction. Currently, the cumulative weight of eight Adani group firms and associated companies is at 5.75% on the MSCI Indian Standard index.

On Jan. 28, MSCI issued a statement seeking feedback from market participants on Adani stocks post the rout.

Analysts at Nuvama Alternative and Quantitative Research estimate that a foreign fund outflow of $1.5 billion if MSCI halves Adani stocks’ weightage. If the volatility continues, MSCI may even drop them altogether, Nuvama said.

When a stock is included in the index, it attracts money from investors. But when its weightage is reduced, or the stock is excluded from the index, it leads to an outflow of funds.

More from Quartz

Sign up for Quartz's Newsletter. For the latest news, Facebook, Twitter and Instagram.